The Australian dollar remains under pressure, as AUD/USD is trading in the mid-0.92 range in Tuesday trading. The Aussie took a hit last week from the US dollar, but has stabilized this week. We could see some activity from the pair later in the day, as the US releases three key events - Core Durable Goods Orders, CB Consumer Confidence and New Home Sales. There are no Australian releases on Tuesday.

The US dollar was broadly stronger last week, courtesy of comments by Federal Reserve chair Bernard Bernanke, who said that QE would likely be scaled down in 2013, and could be terminated in 2014, if the economy continues to improve. The Fed expects stronger economic growth and a drop in the unemployment rate, which would allow the Fed to reduce QE. Currently the Fed is purchasing $85 billion in assets each month, and has left these purchases open-ended. Bernanke’s comments boosted the dollar against the major currencies, since winding up QE is dollar-positive.

The Australian dollar also lost ground last week after the RBA released the minutes of its previous policy meeting. Policymakers left the door open for further rate cuts down the road, which would make the Australian dollar less attractive to investors. The RBA also stated that the Australian dollar could fall further due to weak demand for Australian exports. AUD/USD responded by shedding more than one cent after the RBA release. With the Aussie taking hits from developments in Australia and abroad, we could see the currency drop even lower.

With national elections in Australia only a few months away, Prime Minister Julia Gillard faces a steep uphill battle to win re-election. The economy continues to sputter, and Gillard could pay the price of a disgruntled electorate .According to a recent poll, Gillard’s Labor Party could get crushed in the September vote and lose more than half of its 71 seats in parliament. As well, there is speculation that Kevin Rudd may challenge Prime Minister Julia Gillard for leadership of the Labor Party. The markets are sure to keep a close eye on the upcoming election, as political uncertainty could weigh on the Australian dollar. AUD/USD">

AUD/USD">

AUD/USD June 25 at 11:15 GMT

AUD/USD 0.9264 H: 0.9297 L: 0.9197

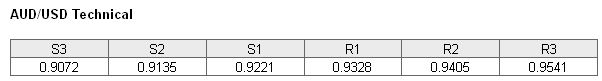

The Australian dollar remains under pressure from the US dollar, as the pair trades in the mid-0.92 range. On the upside, the pair is currently facing resistance at 0.9328. This is followed by a resistance line at 0.9405. On the downside, there is a support level at 0.9221. This is not a strong line, and could see pressure if the Aussie loses more ground. The next support line is at 0.9135. This line has remained intact since September 2010.

- Current range: 0.92221 to 0.9328

- Below: 0.9221, 0.9135, 0.9071, 0.9000, 0.8916 and 0.8747

- Above: 0.9328, 0.9405, 0.9541 and 0.9651

AUD/USD ratio is almost unchanged in the Tuesday session. This is consistent with what we are currently seeing from AUD/USD, as the pair is showing little movement. The ratio continues to be dominated by long positions, indicative of a strong bias towards the Aussie moving higher.

AUD/USD is steady, but certainly vulnerable to losing further ground. With the US posting three key releases later today, we could see some volatility from the pair if the readings are not in line with market expectations.

AUD/USD Fundamentals

- 12:30 US Core Durable Goods Orders. Estimate 0.0%.

- 12:30 US Durable Goods Orders. Estimate 3.0%.

- 13:00 US S&P/CS Composite-20 HPI. Estimate 10.6%.

- 13:00 US HPI. Estimate 1.2%.

- 14:00 US CB Consumer Confidence. Estimate 75.2 points.

- 14:00 US New Home Sales. Estimate 462K.

- 14:00 US Richmond Manufacturing Index. Estimate 0 points.

- 21:00 US Treasury Secretary Jack Lew Speaks.