AUD/USD is under pressure, as the pair struggles to remain above the 0.96 line in Thursday’s European session. In economic news, key Australian data was mixed, as Building Approvals sparkled, while Private Capital Expenditure recorded a sharp drop. It’s a busy Thursday in the US, with the release of three key events – Preliminary GDP, Unemployment Claims and Pending Home Sales.

The Aussie will want to delete the month of May and move on, as the currency has plunged more than seven cents against the US dollar this month. The greenback has taken advantage of the RBA interest rate cut, lukewarm Australian data and the government’s budget which pointed to the high value of the Australian dollar as an impediment to economic growth. These factors have resulted in nervous investors shifting their funds to US assets, resulting in the Aussie plunging in value. On Thursday, Building Approvals jumped to 9.1%, blowing past the estimate of 4.1%. However, Private Capital Expenditure posted its sharpest drop in four years, declining by -4.7%. The estimate stood at 0.7%.

Over in Japan, a major trading partner of Australia, the government and the BOJ have declared deflation as Public Enemy Number One. The BOJ has embarked on an aggressive monetary easing program, as it seeks to double the monetary base within two years. However, inflation indicators continue to point to deflation, despite these herculean efforts. Corporate Services Price Index, which measures corporate inflation, actually worsened, as the indicator fell from -0.2% to -0.4%. Critics of the government’s agenda say economic growth cannot be created by monetary policy alone, and deflation continues to hobble the Japanese economy. With more inflation indicators being released later on Thursday, highlighted by Tokyo Core CPI, we’ll get a better idea if the government’s war on deflation is working.

In the US, the Federal Reserve hasn’t made any changes to the current round of quantitative easing, which stands at $85 billion in asset purchases each month. Fed policymakers, including Fed Chair Bernanke, have not been shy about dropping clues that QE could be altered or even terminated in the next few months. The currency markets have reacted sharply to such talk, and much of the volatility we are seeing in the currency markets is a reflection of market uncertainty as to what the Fed plans to do. Talk of an end to QE has given a boost to the dollar, and we can expect the currency markets to continue to be very sensitive to further talk of tapering QE.

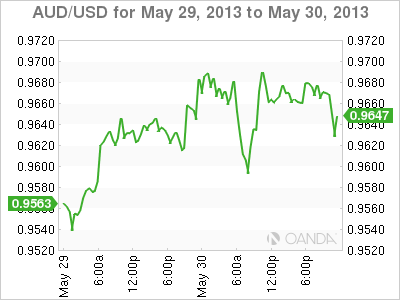

AUD/USD May 30 at 11:55 GMT

AUD/USD 0.9608 H: 0.9697 L: 0.9584

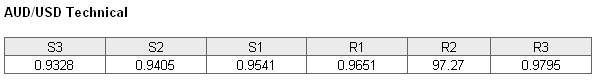

AUD/USD is currently testing the 0.96 level. The pair continues to receive support at 0.9541. Given the strong movement we are seeing from the pair, this line cannot be considered safe. This is followed by support at 0.9405, protecting the 94 line. On the upside, there is resistance at 0.9651. This line could face pressure if the Aussie can recover. The next line of resistance is at 97.27.

- Current range: 0.9541 to 0.9651

Further levels in both directions:

- Below: 0.9541, 0.9405, 93.28 and 92.21

- Above: 0.9651, 0.9727, 0.9795, 0.9907 and 1.00

AUD/USD ratio is unchanged in Thursday trading. This is reflected in what we are seeing from the pair, which has shown no net movement, although it has made some temporary moves in both directions. Traders should continue to monitor the ratio, as any movement could be an early sign that the pair will move in a similar direction.

AUD/USD Fundamentals

- 1:30 Australian Building Approvals. Estimate 4.1%. Actual 9.1%.

- 1:30 Australian Private Capital Expenditure. Estimate 0.7%. Actual -4.7%.

- 12:30 US Preliminary GDP. Estimate 2.5%.

- 12:30 US Unemployment Claims. Estimate 342K.

- 12:30 US Preliminary GDP Price Index. Estimate 1.2%.

- 14:00 US Pending Home Sales. Estimate 1.3%.

- 14:30 US Natural Gas Storage. Estimate 85B.

- 15:00 US Crude Oil Inventories. Estimate -0.8M.