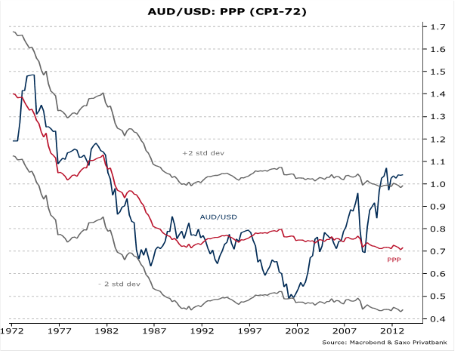

The Australian dollar is perhaps the most extremely overvalued currency of all the majors. Measured on relative prices (purchasing power parity or PPP), AUD/USD fair value is 0.70, or more than 40 percent below the current spot price of 0.958. PPP cycles are by nature very long, and should not be used as short-term trading signals. The current cycle began with an extreme undervaluation in 2002. Nonetheless, the present valuation mismatch indicates the potential for a continued drop in AUD. AUD/USD" title="AUD/USD" width="455" height="351">

AUD/USD" title="AUD/USD" width="455" height="351">

Over the past decade, the AUD has been buoyed by a strong rise in commodity prices, resulting in a significant improvement in Australia’s terms-of-trade (export prices versus import prices). However, the continued decline in commodity prices since the peak in 2011 is undermining support to AUD even against this metric.

The Reserve Bank of Australia (RBA) has cut its cash rate from 4.75 percent in 2011 to 2.75 percent. Further rate cuts are expected this year. In contrast, the Federal Reserve is on hold, contemplating how and when to shift to a less accommodative monetary policy stance. The two-year swap spread has already fallen from 4.85 percent in 2011 to 2.5 percent now, but a further erosion in the relative interest rate differential can be expected going into 2014.

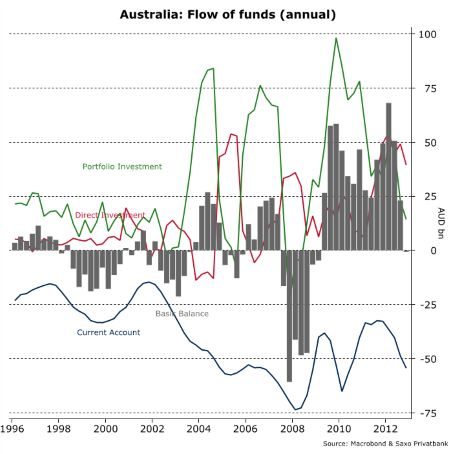

A main driver behind AUD strength has been a substantial inflow of portfolio investment, particularly in debt instruments. Australia runs a significant current account deficit, but direct investment and portfolio flows have more than compensated for this, leaving the country with a substantial surplus on the basic balance (current account + direct investments + portfolio investments). Recently, however, the net inflow from debt instruments has more or less disappeared, leaving AUD vulnerable to underlying fundamentals.

During the past decade, the AUD has been buoyed by a strong rise in commodity prices, resulting in a significant improvement in Australia’s terms-of-trade (export prices versus import prices). However, the continued decline in commodity prices since the peak in 2011 is undermining support to AUD even against this metric.

The Reserve Bank of Australia (RBA) has cut its cash rate from 4.75 percent in 2011 to 2.75 percent. Further rate cuts are expected this year. In contrast, the Federal Reserve is on hold, contemplating how and when to shift to a less accommodative monetary policy stance. The two-year swap spread has already fallen from 4.85 percent in 2011 to 2.5 percent now, but a further erosion in the relative interest rate differential can be expected going into 2014.

A main driver behind AUD strength has been a substantial inflow of portfolio investment, particularly in debt instruments. Australia runs a significant current account deficit, but direct investment and portfolio flows have more than compensated for this, leaving the country with a substantial surplus on the basic balance (current account + direct investments + portfolio investments). Recently, however, the net inflow from debt instruments has more or less disappeared, leaving AUD vulnerable to underlying fundamentals.

The overall conclusion is that AUD is extremely overvalued and fast losing support from relative rates, commodity prices and financial flows. Relative to the USD, the outlook is bearish in the medium to long term, and we may well have begun a multi-year decline.

Technically, the AUD/USD may look oversold after a drop of some 9 percent. The area around 0.95 has provided significant support in the past three years, and may yet again lend support to a short-term bounce higher. However, with the 2012 low taken out yesterday, the immediate outlook is for a further decline, targeting 0.9330 and 0.9160 before a break below 0.90.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

AUD/USD: The Inevitable Correction Has Begun

Published 05/29/2013, 08:25 AM

Updated 03/19/2019, 04:00 AM

AUD/USD: The Inevitable Correction Has Begun

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.