The Australian dollar has had a very tough time over the past few weeks, but showed some strength last week, gaining about 140 points against the US dollar. The Aussie continued to move higher on Monday, barreling past the 0.96 level in Monday’s Asian session. There are just a handful of releases on Monday. In Australia, New Motor Vehicles improved to 0.0%. The markets are waiting for the release of the RBA’s Monetary Policy Meeting Minutes early on Tuesday. In the US, today’s highlight is the Empire State Manufacturing Index. After a sharp drop last month, the markets are expecting the indicator to push above the zero line, which indicates improving conditions.

After dropping close to 3-year lows, the Australian dollar rebounded last week, thanks to some positive key domestic releases this week. Westpac Consumer Sentiment recorded a four-month high, with a strong gain of 4.7%. On Thursday, Employment Change posted a modest gain of 1.1 thousand, blowing past the estimate of -9.8 thousand. The Unemployment Rate remained unchanged at 5.5%, slightly better than the forecast of 5.6%.

Taking a look at the US, the highlight of the week could be the US Federal Reserve, which will release a statement on Wednesday. What the Fed might do with QE has become a hot issue for the markets and there is growing speculation that the Fed could tighten QE in the near future. Currently the Fed purchases $85 billion in assets every month. The Fed has said that it won’t make a move until the US economy improves, so every strong US release seems to result in more speculation that the Fed will press the trigger. A tightening to QE is dollar positive, so any action or even hints from the Fed in this regard could boost the dollar. AUD/USD" width="400" height="300">

AUD/USD" width="400" height="300">

AUD/USD June 17 at 12:10 GMT

AUD/USD 0.9612 H: 0.9642 L: 0.9565

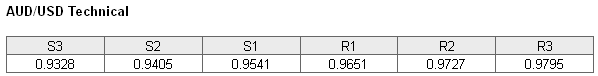

AUD/USD has started the week with modest gains, as the proximate support and resistance levels remain intact (S1 and R1 above). On the upside, the pair continues to face resistance at 0.9651. This is not a strong line, and could face pressure if the pair continues to move higher. This is followed by resistance at 0.9727. On the downside, the pair is receiving support at 0.9541. The next support line is at 0.9405, protecting the 0.94 level.

Current range: 0.9541 to 0.9651

Further levels in both directions:

- Below: 0.9541, 0.9405, 0.9328, 0.9221, 0.9135 and 0.9071

- Above: 0.9651, 0.9727, 0.9795 and 0.9842

AUD/USD ratio is showing little change in the Monday session. This is not currently reflected in the movement of the pair, as the Aussie has started the week with slight gains. Long positions continue to make up most of the ratio, indicating that trader sentiment is strongly biased towards the Australian dollar continuing to push higher.

The Australian dollar looked good last week, thanks to some solid employment numbers and a broadly weak US dollar. Will the upward trend continue? With no major releases until Tuesday, we could see the pair continue to trade in the mid-95 level.

AUD/USD Fundamentals

- 1:30 Australian New Motor Vehicle Sales. Estimate 0.2%. Actual 0.0%.

- 12:30 US Empire State Manufacturing Index. Estimate 0.4 points.

- 14:00 US NAHB Housing Market Index. Estimate 45 points.

- Day 1 of G8 Meetings.