The Aussie is back to its old losing ways, shedding more than a cent against the US dollar in Tuesday trading. AUD/USD is trading in the mid-94 level in the European session. The pair took a hit after the release of RBA minutes. In the US, there are two major releases – Building Permits and Core CPI. The G8 (Australia is not a member of the club) wraps up a summit in Northern Ireland, and has held preliminary discussion about an EU-US free trade pact.

After showing some strength late last week, the Australian dollar has weakened against the US currency. The Aussie got no help from the RBA, which released the minutes of its previous policy meeting. Policymakers left the door open for further cuts down the road. The RBA also stated that the Australian dollar could fall further due to weak demand for Australian exports. AUD/USD responded by shedding more than one cent, and we could see the pair drop even further.

All eyes will be glued to the US Federal Reserve on Wednesday, as the FOMC releases a highly anticipated policy statement. The markets will be particularly interested in what the Fed has to say with regard to its quantitative easing program. Speculation has been growing that the Fed could scale back QE later in the year, and this has had a very strong impact on stocks, commodities and the US dollar. The Federal Reserve has repeatedly stated that it will stick with the current program until it sees an improvement in the US economy, especially in the employment market. Currently the Fed purchases $85 billion in assets every month. If the Fed does take action or even hint at a move to tighten QE, we can expect the dollar to move higher against the major currencies.

G8 summits are often photo-ops with little substance, as confident world leaders reiterate their commitment to take steps to improve the global economy. However, this year’s G8 meeting in Northern Ireland served more than the usual fare, as the G8 leaders used the occasion to announce the start of negotiations on a free trade agreement between the European Union and the United States. The stakes are very high – the EU and US produce 50% of the global output, and a third of world trade. The deal would be the largest bilateral trade deal ever, and could add up to $100 billion to the economies of each partner. Negotiations will get underway in Washington next month, with a deal expected to be signed by the end of 2014. AUD/USD" width="400" height="300">

AUD/USD" width="400" height="300">

AUD/USD June 18 at 12:20 GMT

AUD/USD 0.9454 H: 0.9574 L: 0.9440

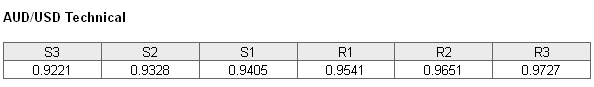

AUD/USD is in retreat in Tuesday trading, and has dropped to the mid-94 range. On the upside, the pair is facing resistance at 0.9541. This line has strengthened as the pair trades at lower levels. This is followed by resistance at 0.9627. On the downside, the pair is receiving weak support at 0.9405, which is protecting the 94 line. There is a stronger support level at 0.9328.

Current range: 0.9405 0.9541

Further levels in both directions:

- Below: 0.9405, 0.9328, 0.9221, 0.9135 and 0.9071

- Above: 0.9541, 0.9651, 0.9795 and 0.9842

AUD/USD ratio is showing slight movement towards long positions on Tuesday. This is not currently reflected in the movement of the pair, as the Aussie has lost ground against the US dollar. Long positions continue to make up most of the ratio, indicating that trader sentiment is strongly biased towards the pair undergoing a correction and moving upwards.

The Australian dollar looked sharp last week, but that seems in the distant past, as AUD/USD has been dropping this week. Will the pair continue to fall? We could see some further activity from the pair, as the US releases two key events later today.

The week started with some gains by the US dollar, and this trend has continued on Tuesday. Will the dollar continue to move higher? We could see more movement from USD/JPY during the day, as the US releases two key events later in the day.

USD/JPY Fundamentals

- 9:30 RBA Monetary Policy Meeting Minutes.

- 12:30 US Building Permits. Estimate 0.98M.

- 12:30 US Core CPI. Estimate 0.2%.

- 12:30 US CPI. Estimate 0.1%.

- 12:30 US Housing Starts. Estimate 0.95M.

- Day 2 of G8 Meetings.

Original post