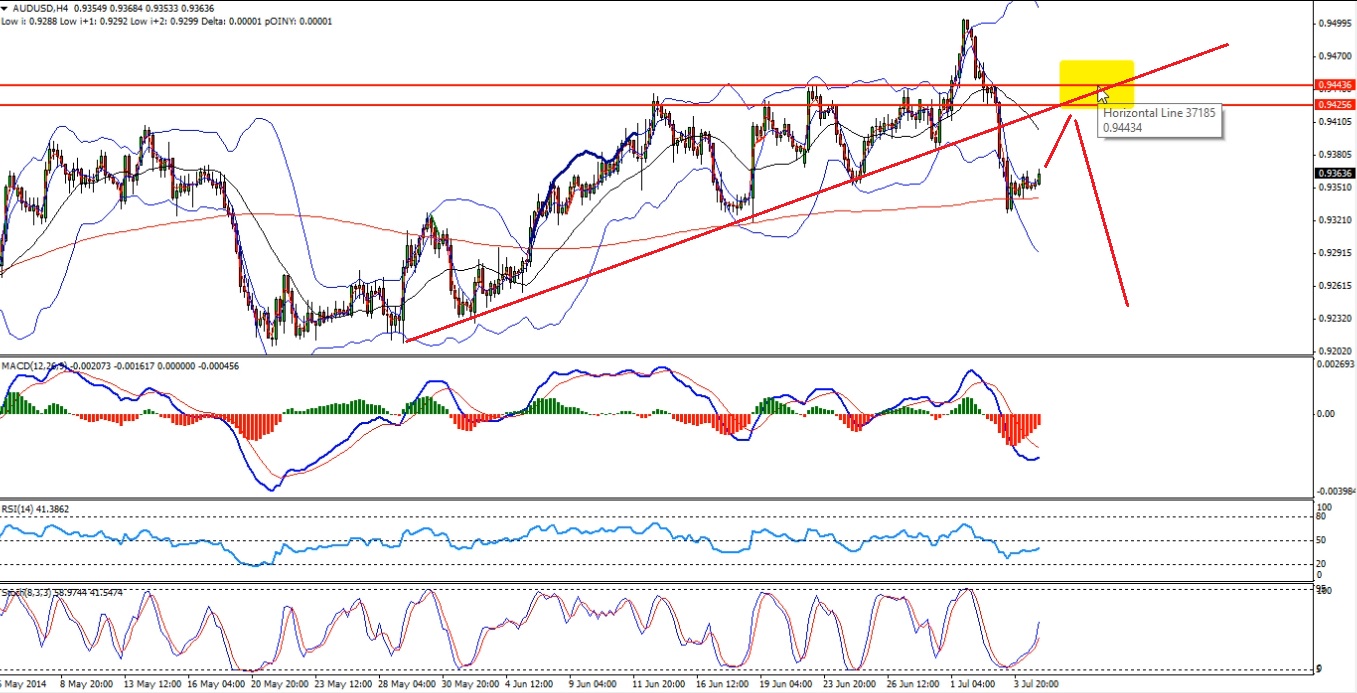

The Australian dollar is trading lower against the US dollar. The AUD/USD pair managed to break an important bullish trend line and support area to trade lower. I think that particular break was a critical one, and the pair might continue trading lower in the coming days. So, we should be looking for short-term sell opportunities in the AUD/USD pair.

As mentioned there was a trend line on the 4-hour chart and there were support levels at around the 0.9420 area. This mentioned area could now act as a resistance for the pair. If the pair manages to climb or correct higher from the current levels and trades closer to the mentioned resistance zone, then we can enter into a sell trade. Remember, the pair has to respect the 0.9420-40 resistance area for this trade setup to be valid.

Initial target should be around the 0.9280 level, and final target could be around the 0.9220 level. Stop should be placed above the 0.9450 level.

Major events scheduled in the upcoming week

The US Dollar was seen trading higher this past week, as the economic data which was released in the US was very encouraging. The US ADP nonfarm employment change, the US NFP data and the unemployment rate managed to register impressive readings with the US unemployment rate falling to 6.1%. The US dollar traded higher against the Euro and the Australian dollar, but failed to hold the gains against the British pound and the USD/JPY. The ECB interest rate decision was also lined up during this past week, which failed to help the Euro, as the EUR/USD pair continued its decline.

Let us look at all major events lined up in the upcoming week.

Sunday – Australia’s AIG construction index.

Monday – German industrial production data, Canadian building permits, Canadian Ivey PMI and New Zealand’s NZIER business confidence.

Tuesday – German trade balance data, UK industrial and manufacturing production data and Chinese CPI data.

Wednesday –Canadian housing starts, FOMC meeting minutes, Australia’s employment data and Chinese trade balance data.

Thursday – French CPI, ECB Monthly Report, UK trade balance data, BOE interest rate decision, US initial jobless claims and Australia’s home loans data.

Friday –German CPI, Spanish CPI, Canadian employment data and US federal budget balance data.

This analysis is taken from Weekly Market Forecast, which also includes trade opportunities on: EUR/USD, GBP/USD, EUR/GBP, EUR/JPY, USD/CAD, EUR/CAD, AUD/CAD, NZD/USD, USD/TRY, Crude Oil and Wheat.