In the last few days the AUD/USD has finally shown some positive signs as it has rallied from three year lows to move back above the key level of 90 cents. Over the last week or so, it has fallen very strongly and appeared to resume the medium term down trend as it moved to a new three year low near 0.8850. It was only a few weeks ago the AUD/USD moved up towards the 0.93 level again as it continued to place buying pressure on that level. It was during this time it did very well to maintain its price level well above 0.92 as place upward buying pressure on the resistance level at 0.93 however a couple of weeks ago, it fell sharply to back under 0.92 and started to place pressure on the short term support level of 0.9150. After finding solid support at 0.90 a few weeks ago, it did well to rally moving up above 0.92 for the first time in nearly a week and getting to within a whisker of 0.93 again.

Over the course of the last month the 0.93 level has provided reasonable resistance to any movement higher and this level will likely play a role again should the AUD/USD continues its rally up above 0.90. To finish a few weeks ago, it dropped sharply again to resume its medium term down trend as it moved down towards the key long term level of 90 cents, however it then surged higher to within a whisker of the 93 cents level before falling away to close out the week. The 0.9150 level had become a key level over the short term providing both some resistance and more recently support, and this was called upon again a couple of weeks ago providing some much needed support however it was completely ignored last week as the AUD/USD fell heavily through it. It was only a month or so ago that many were waiting for the AUD/USD to break below the 90 cents level and then it would have been a matter of how far can it drop. It had continued to drift lower and move towards the 90 cents level, a level not seen for three years. Considering the speed of its decline over the last few months, the last month or so had seen a significant slowing down and almost some consolidation as it has rested well on the support at 0.90 and made its way back to 0.93 on a few occasions.

The last few months have seen the AUD/USD establish a strong medium term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to near 0.90 in that time. In doing so, it has completely ignored any likely support at either 1.04 or 1.0360, and more recently the long term support level at 0.97. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. After making a solid run higher in the middle of June back towards the key level of 0.97, the AUD/USD has since continued its strong and steady decline moving to below 0.90 and levels not seen since near the middle of 2010. This has seen it experience a significant strong trend that would have caught many people on the wrong side of.

Australia’s mining tax was upheld as legal earlier this week by the country’s highest court in a defeat for Fortescue Metals Group Ltd. (FMG) and state governments that challenged its validity. The High Court of Australia’s full bench unanimously dismissed the challenge, ruling the tax “did not discriminate between states and that the acts did not give preference to one state over another,” according to a summary of the ruling posted on the court’s website. Fortescue, Australia’s third-biggest iron-ore producer, sued in the nation’s highest court in June 2012 to nullify the Minerals Resource Rent Tax, with the backing of the governments of Queensland and Western Australia, claiming the levy was discriminatory. The tax on iron-ore and coal profits, introduced by former Prime Minister Julia Gillard’s government, will raise A$600 million ($538 million) in the current fiscal year, according to Treasury forecasts released last week. That’s down from the A$4 billion projected by Treasury in May 2011, as slumping commodity prices on weaker Chinese demand curb mining profits

AUD/USD August 7 at 23:30 GMT 0.8994 H: 0.9025 L: 0.8920

During the early hours of the Asian trading session on Thursday, the AUD/USD is just consolidating in a narrow range right below 0.9000 after surging higher to break through the 90 cents level. Despite its slowing down the last few weeks, the Australian dollar has been in the middle of a free-fall, as the currency has lost around 15 cents since the beginning of May. In moving through to 1.0580 only a few months ago, it moved to its highest level since January. Current range: trading just below 0.8980.

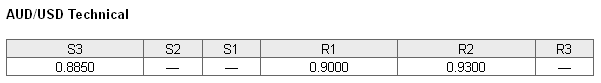

Further levels in both directions:

• Below: 0.8850

• Above: 0.9000 and 0.9300

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has eased back under 70% as the Australian dollar has rallied back towards 90 cents. The trader sentiment remains in favour of long positions.

Economic Releases

- 01:30 AU Employment (Jul)

- 01:30 AU Unemployment (Jul)

- 05:45 CH Unemployment (Jul)

- 12:30 CA House Price Index (Jun)

- 12:30 US Initial Claims (02/08/2013)

- JP Economy Watchers Survey (Jul)

- JP BoJ MPC – Overnight Rate (Aug)