GROWTHACES.COM Forex Trading Strategies

Taken Positions:

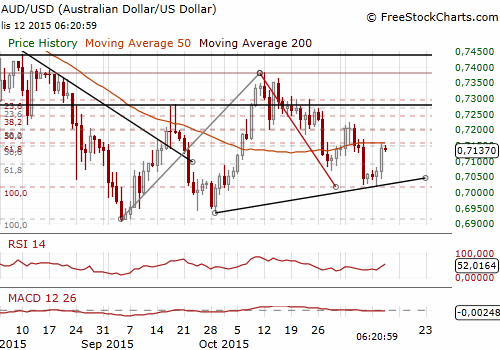

AUD/USD: long at 0.7030, target 0.7190, profit locked in at 0.7120, risk factor **

Pending Orders:

CHF/JPY: sell at 123.00, target 120.50, stop-loss 124.00, risk factor **

More Strategies - GrowthAces.com

AUD/USD: Profit Locked In At 0.7120 After Strong Jobs Report

(long for 0.7190)

- Australian employment surged 58.6k in October, much above the market forecast of 15k. This increase was made up of a rise of 40k in full-time employment,while part-time employment rose 18.6k. Unemployment rate dropped to 5.9% from 6.2% in September. The market expected a reading of 6.2%.

- Interbank futures slid after strong jobs report as the market greatly lengthened the odds on another cut in interest rates. However, investors still expect a cut next year. In our opinion the monetary easing cycle has ended and the next rate change will be a hike.

- The AUD/USD jumped to 0.7153 after the employment data. We stay long for 0.7190, but have locked in our profit at 0.7120.

Significant technical analysis' levels:

Resistance: 0.7153 (session high Nov 12), 0.7169 (high Nov 6), 0.7222 (high Nov 4)

Support: 0.7061 (low Nov 12), 0.7026 (low Nov 11), 0.7017 (low Nov 10)

Source: Growth Aces Forex Trading Strategies