The Australian dollar is having a quiet week, and the lack of activity is continuing on Thursday as AUD/USD trades just below the key 0.9000 line. The Aussie has had a miserable December, coughing up about 250 points since the start of the month. In economic news, there are no Australian releases this week. Over in the US, Thursday's only event is Unemployment Claims.

There was some holiday cheer from US releases on Tuesday, as manufacturing and housing numbers pointed upwards. Core Durable Goods Orders posted a strong gain of 1.2%, its best showing since April. The key manufacturing indicator had posted four consecutive declines, so the sharp gain was welcome news. Durable Goods Orders bounced back from a sharp decline in October with a gain of 3.5%, well above the estimate of 1.7%. New Homes Sales also impressed with a five-month high, climbing to 464 thousand. The estimate stood at 449 thousand.

The year ended on a dramatic note as the US Federal Reserve announced last week that it would begin tapering its $85 billion QE program by $10 billion, commencing in January. This will reduce the Fed's asset purchases to $75 billion every month, comprised of $40 billion in Treasuries and $35 billion in mortgage bonds. The announcement came as somewhat of a surprise, as most analysts had expected the Fed to hold off on any QE reductions until early next year. The Australian dollar lost close to one cent against the greenback following the news.

In its tapering announcement, the Federal Reserve was careful to separate tapering from rate hike expectations. Fed chairman Bernard Bernanke stated that interest rates are likely to remain low even after the unemployment rate drops below 6.5%. Previously, the Fed had stated that it would start to consider rate increases when unemployment fell below this level. With the US unemployment rate at 7.0%, it appears a safe bet that we won't see any change in US rates for quite some time.

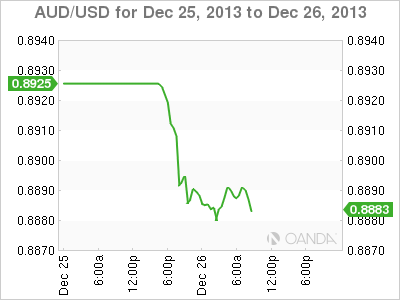

AUD/USD for Thursday, December 26, 2013

AUD/USD Daily Chart" title="AUD/USD Daily Chart" width="400" height="300" align="bottom" border="0">

AUD/USD Daily Chart" title="AUD/USD Daily Chart" width="400" height="300" align="bottom" border="0">

AUD/USD December 26 at 13:25 GMT

AUD/USD 0.8890 H: 0.8916 L: 0.8879

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.8505 | 0.8658 | 0.8735 | 0.8893 | 0.9000 | 0.9119 |

- AUD/USD is showing little movement in Thursday trading. The pair dropped below the 0.89 line during the Asian session.

- The pair is testing resistance at 0.8893. This line was beached earlier in the day and it could continue to see action. This is followed by the key round number of 0.9000.

- On the downside, 0.8735 is providing support. The next support level is 0.8658, which has remained intact since July 2010.

- Current range: 0.8735 to 0.8893

Further levels in both directions:

- Below: 0.8735, 0.8658, 0.8505 and 0.8411

- Above: 0.8893, 0.9000, 0.9119, 0.9229 and 0.9305

OANDA's Open Positions Ratio

The AUD/USD ratio has showed little movement this week, reflecting the lack of activity from the AUD/USD. This is consistent with what we are seeing from the pair, which is not showing much movement. The ratio is made up of a substantial majority of long positions, reflecting a trader bias towards the Australian dollar moving higher against the US currency.

The Australian dollar continues to trade close to the 0.89 line. We could see AUD/USD show some movement in the North American session, as the US releases the all-important Unemployment Claims.

AUD/USD Fundamentals

- 13:30 US Unemployment Claims. Estimate 346K.