GROWTHACES.COM Forex Trading Strategies

Taken Positions

USD/JPY: long at 120.60, target 123.50, stop-loss 119.80, risk factor *

EUR/CHF: long at 1.0380, target 1.0580, stop-loss moved to 1.0380, risk factor **

AUD/JPY: long at 89.20, target 92.00, stop-loss moved to 89.20, risk factor *

Pending Orders

AUD/USD: sell at 0.7560, target 0.7250, stop-loss 0.7640, risk factor **

NZD/USD: sell at 0.6830, target 0.6530, stop-loss 0.6900, risk factor **

AUD/NZD: buy at 1.1010, target 1.1400, stop-loss 1.0910, risk factor *

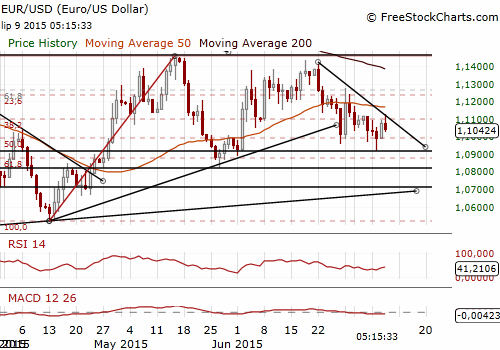

EUR/USD: Fed’s Hikes Are Coming, Eyes On Yellen Tomorrow

(stay sideways)

- The minutes from the June 16-17 FOMC meeting show how the central bank continues to grapple with its plan to raise interest rates later this year. At the time of the Fed's two-day meeting in June, Greece had not yet defaulted on its debt, and China's stock market was not yet in free-fall.

- The minutes said: “Many participants emphasized that, in order to determine that the criteria for beginning policy normalization had been met, they would need additional information indicating that economic growth was strengthening, that labor market conditions were continuing to improve, and that inflation was moving back toward the Committee’s objective.”

- San Francisco Fed President John Williams said the US Federal Reserve would likely raise interest rates this year adding that his personal preference continues to be for two rate hikes before the end of the year. By September, he said, there should be enough new data to make a better judgment on a potential policy change.

- The government of Greece has extended bank closures and the EUR 60 daily limit on ATM withdrawals till July 13. The European Central Bank will not increase support for Greek banks until the debt crisis is resolved.

- The Greek newspaper Naftemporiki said Greece is preparing a reform package worth EUR 10-12 billion. The package includes an increase in corporate tax to 28% from 26%, a rise in VAT on luxury goods to 13% from 10%, a rise in VAT on processed foods, restaurants, transport and some health services offered by the private sector to 23% from 13%, a VAT hike on hotels to 13% from 6.5%. Greek islands would continue to enjoy tax breaks that creditors had sought to scrap. The government spokesman Gabriel Sakellaridis said Greece is confident it can clinch a deal with international creditors.

- The short-term view is unclear. Although the EUR/USD peaked at 1.1125 today in the morning of the European session, in our opinion the rate is likely to fall near 1.0920 at the end of this week. The market is choppy and we stay sideways. The outcome of Sunday’s Eurozone summit is uncertain and the market reaction on Monday is hard to predict, so it is better to stay flat on this pair over the weekend.

- The EUR/USD may be under pressure next weeks due to approaching Fed hikes. Yesterday’s comments from Fed’s John Williams suggested that a hike in September is a likely scenario. The market's focus will shift now to Fed’s chair Janet Yellen’s speech tomorrow.

Significant technical analysis' levels:

Resistance: 1.1125 (hourly high Jul 9), 1.1172 (high Jul 1), 1.1189 (30-dma)

Support: 1.0975 (low Jul 8), 1.0916 (low Jul 7), 1.0915 (low Jun 2)

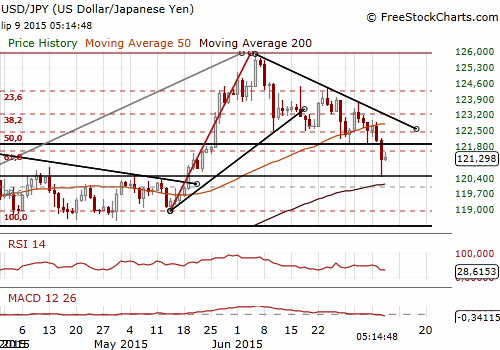

USD/JPY: The JPY Weakened On Stabilizing Chinese Stock Market

(stay long)

- China's stock markets have plunged roughly 30% over the last three weeks. But the sharp selloff abated today, as investors took heart that measures taken by Beijing may have stemmed the savage correction. The USD/JPY recovered from its yesterday’s low at 120.41. We used yesterday’s surprising JPY strength to get long on the USD/JPY (at 120.60) and AUD/JPY (at 89.20). However, the risk on these positions is still high, because the Chinese and Japanese stocks are still fragile.

- Data released early in the session were JPY-positive, suggesting the Bank of Japan might have less reason to expand its ultra-loose monetary policy. Core machinery orders rose by 0.6% mom and 19.3% yoy to a 7-year high in May, up for the third-straight month, adding to recent evidence of a steady pick-up in spending by firms and raising hopes of a more durable economic recovery.

- Japanese firms had long been hesitant to boost capital spending despite low borrowing costs made possible by years of loose money policies from the Bank of Japan. Policymakers are eager for firms to invest their earnings in plant and equipment, hoping for a virtuous cycle of investment, higher wages and consumption to revitalise the economy. Recent signs suggest that firms may be changing their cautious investment approach. Last week's BOJ quarterly tankan survey showed big companies plan to boost capital expenditure at the fastest pace in a decade in the current fiscal year to March 2016.

- Japanese Economics Minister Akira Amari said economic and monetary policy are not aimed at triggering a decline in the JPY.

- Many market analysts still expect further BOJ easing later this year, but in our opinion the likelihood of such a move is low.

Significant technical analysis' levels:

Resistance: 121.53 (session high Jul 9), 122.55 (high Jul 8), 122.88 (high Jul 7)

Support: 120.70 (hourly low Jul 9), 120.41 (low Jul 8), 119.83 (low May 19)

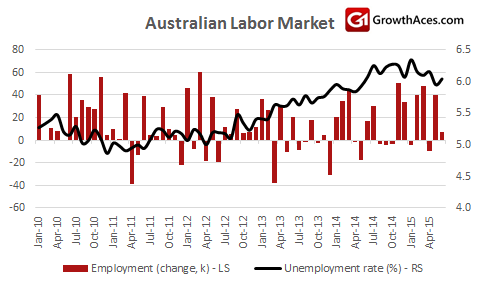

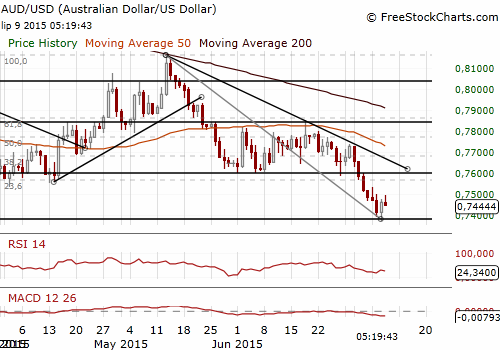

AUD/USD: Jobs Data In Line With Our Forecasts, Sell On Upticks

(sell at 0.7560)

- Today's data from the Australian Bureau of Statistics showed 7.3k new jobs were added in June vs. median expectations for a drop of 5.0k. The reading was very close to our forecast of 8.0k gain.

- The jobless rate ticked up to 6.0% from a one-year low of 5.9%. The reading was below the market consensus of 6.1%, but in line with our forecast. The detail was also upbeat with a solid 24.5k gain in full-time jobs and an increase in hours worked.

- Market analysts have a very pessimistic picture of Australia’s labor market. Job gains have beaten market forecasts for six of the past eight months. In our opinion the economic outlook for Australia is underestimated by the market and we can see further upside surprises soon. Investors see also a quite significant chance for another RBA rate cut. Interbank futures imply a 50% chance of a further easing by September, rising to 88% in December. Our baseline scenario is no rate cuts in 2015.

- The AUD/USD rose slightly after better employment data. In our opinion higher AUD/USD levels should be used to get short on this pair. We still expect the USD to be stronger in the coming weeks as we expect more hawkish comment from the Fed suggesting a rate hike as soon as in September. In our opinion stronger AUD/USD recovery is possible in the fourth quarter this year.

Significant technical analysis' levels:

Resistance: 0.7491 (session high Jul 9), 0.7502 (high Jul 7), 0.7533 (high Jul 6)

Support: 0.7372 (low Jul 8), 0.7335 (low May 6, 2009), 0.7302 (low May 4, 2009)

Source: Growth Aces Forex Trading Strategies