Street Calls of the Week

AUD/USD Daily" title="AUD/USD Daily" height="464" width="959" />

AUD/USD Daily" title="AUD/USD Daily" height="464" width="959" />

Last week, the Blackwell Global Research team published an article regarding the importance of fundamental factors collaborating with technical analysis, in order to fully take advantage of a heads and shoulders trading opportunity. The article I am referring to, looked at the NZD/USD, specifically how the current New Zealand economic optimism should defuse the consensus that when we see a heads and shoulders pattern, the currency pair will edge lower.

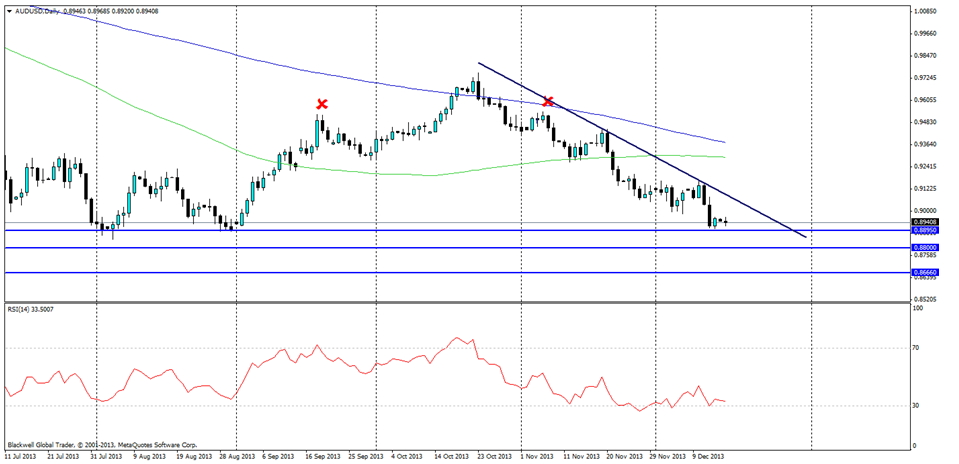

Currently, the AUD/USD has also formed a heads and shoulders pattern. However, I see this as still an attractive trading opportunity to short the Aussie. In contradiction to the NZD/USD, the current economic fundamentals point towards the belief that the AUDUSD currency pair, is set to decline in valuation.

The reasons to suspect an Aussie decline:

For starters, the United States economy is showing improvement and the continual threat of an inevitable QE taper will weaken riskier currency pairs. Nonetheless, domestically within Australia, there are heightened concerns that their currency is overvalued, coupled with recent disappointing economic performances.

To begin with, a dovish RBA recently mentioned introducing currency intervention techniques, in order to deflate the value of their currency. More specifically, RBA governor Glenn Stevens indicated that the AUD/USD, would be be ideally valued at 0.85. It remains to be seen which currency intervention techniques the RBA are considering introducing, but in the meantime, the threat of this approach will encourage currency devaluation.

Moreover, the latest GDP reading missed expectations, confirming worries that a slowdown in the mining industry will destabilise Australian economic growth. Mining previously contributed towards up to 50% of Australian GDP. However, it was also the countries largest employment sector. The IMF feels that the Australian unemployment rates will hit a record 6.0% in 2014. Unemployment within Australia has not yet reached its peak.

In terms of technical observations for this currency pair, I see future support levels at 0.8898, 0.8800 and0.86660.Additionally, when looking at the RSI, the currency pair has not yet reached the oversold boundaries, suggesting the AUD/USD can still drift lower.

Overall, there is a variety of fundamental factors to support the technical observation that a currency pair is about to turn bearish.The threat of currency intervention techniques will provide currency volatility. Personally, I don’t feel decreasing interest rates is a feasible option, based upon the potential damage it could do to a housing sector which has already increased by 9% in value, this year. However, there are other methods that the RBA can turn towards.

Alongside the threat of currency intervention, there are other factors which encourage my bearish sentiment in regards to the Australian currency. For example, The latest GDP disappointment emphasised the importance of the mining industry for the Australian economy. The mining slowdown is still in its preliminary stages. We are yet to witness the full correlation this will have on Australian unemployment.

To conclude, there are substantial current economic factors to validate that the attractive heads and shoulders pattern is likely to extend lower in the near term. In fact, it would not surprise me if a dovish RBA minutes tonight pushes this currency pair below the 0.8898 support level.