AUD/USD

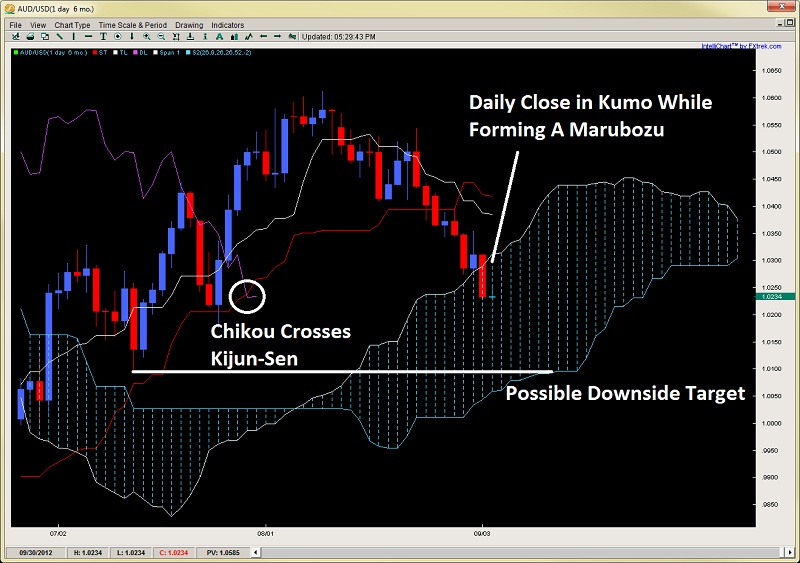

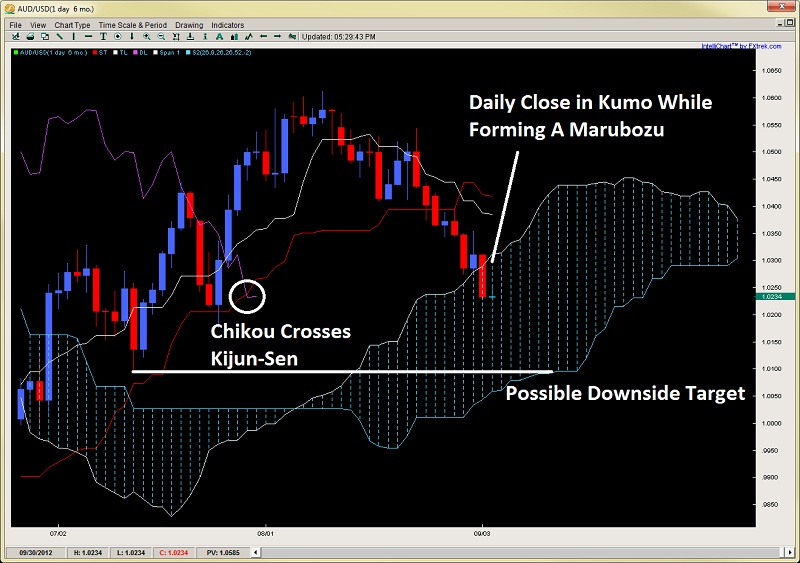

After forming an inverted pin bar last Friday, the aussie sold off heavily today forming a marubozu candle closing inside the daily kumo for the first time since June. In the process, the chikou span has also crossed the kijun line today which further adds to the bearish Ichimoku picture.

With price action now sitting at the 1.0230 key support level, I think this is the last interim support level before further losses. Below this, I’m suspecting losses to 1.0175 in a jiffy, and then 1.0100 which is where the Kumo bottom comes in, but short-term bearish pressure should continue.

AUD/USD" title="AUD/USD" width="728" height="563">

AUD/USD" title="AUD/USD" width="728" height="563">

Global Market Commentary:

With volumes muted yesterday due to the Labor Day holiday in the US, a mix of market news came out with Bulgaria refusing to join the EZ for fear it would be (ahem) not the most prudent decision. That along with Moody’s shifting the EZ’s outlook to negative while curiously maintaining the AAA rating.

Yet markets were relatively stable with potential monetary easing from Draghi this week to support bond purchases along with the Fed in their upcoming FOMC meeting.

The main loser on the day was the AUD/USD which got hammered from market open losing almost 70pips during low volumes.

The main winners on the day were precious metals which have started to break out of their flag consolidation patterns to break higher.

Original post

After forming an inverted pin bar last Friday, the aussie sold off heavily today forming a marubozu candle closing inside the daily kumo for the first time since June. In the process, the chikou span has also crossed the kijun line today which further adds to the bearish Ichimoku picture.

With price action now sitting at the 1.0230 key support level, I think this is the last interim support level before further losses. Below this, I’m suspecting losses to 1.0175 in a jiffy, and then 1.0100 which is where the Kumo bottom comes in, but short-term bearish pressure should continue.

AUD/USD" title="AUD/USD" width="728" height="563">

AUD/USD" title="AUD/USD" width="728" height="563">Global Market Commentary:

With volumes muted yesterday due to the Labor Day holiday in the US, a mix of market news came out with Bulgaria refusing to join the EZ for fear it would be (ahem) not the most prudent decision. That along with Moody’s shifting the EZ’s outlook to negative while curiously maintaining the AAA rating.

Yet markets were relatively stable with potential monetary easing from Draghi this week to support bond purchases along with the Fed in their upcoming FOMC meeting.

The main loser on the day was the AUD/USD which got hammered from market open losing almost 70pips during low volumes.

The main winners on the day were precious metals which have started to break out of their flag consolidation patterns to break higher.

Original post