GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/CHF: long at 1.0380, target 1.0580, stop-loss moved to 1.0380, risk factor **

AUD/NZD: long at 1.1220, target 1.1470, stop-loss 1.1120, risk factor *

Pending Orders

EUR/USD: sell at 1.0930, target 1.0750, stop-loss 1.1015, risk factor *

USD/JPY: buy at 123.40, target 125.80, stop-loss 122.60, risk factor *

USD/CHF: buy at 0.9540, target 0.9700, stop-loss 0.9485, risk factor *

USD/CAD: buy at 1.2860, target 1.3055, stop-loss 1.2790, risk factor *

AUD/USD: sell at 0.7450, target 0.7250, stop-loss 0.7530, risk factor *

NZD/USD: sell at 0.6620, target 0.6400, stop-loss 0.6710, risk factor *

EUR/GBP: sell at 0.7025, target 0.6905, stop-loss 0.7070, risk factor **

GBP/JPY: buy at 192.20, target 195.00, stop-loss 191.30, risk factor **

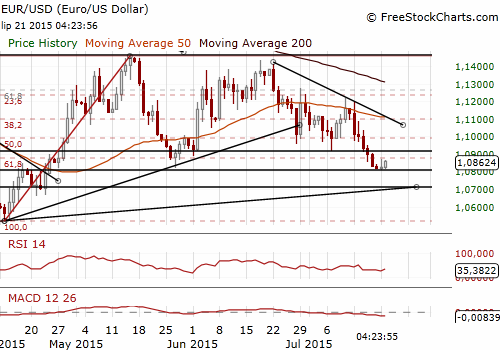

EUR/USD Under Pressure Of Hawkish Fed Comments

(sell at 1.0930)

- St. Louis Fed President James Bullard, a policy hawk who is not a voting member on the Fed's policy-setting committee this year, said it was unlikely the Fed would decide to hike rates at its July 28-29 meeting, with September a stronger possibility. “I'd see September having more than a 50% probability right now.”

- On Monday, Greece received EUR 7.2-billion in bridge financing from the European Union, its main international creditor, and immediately spent most of the borrowed money to pay two other creditors - the European Central Bank and the International Monetary Fund. The central bank got EUR 3.5 billion to redeem Greek sovereign bonds, while the IMF received EUR 2 billion to cover a 1.6-billion payment that had gone missing on June 30, plus a smaller payment that was due last week.

- Greece reopened its banks on Monday morning in an attempt to show citizens the worst of the crisis is over. The move was considered largely symbolic because most of the banking restrictions remain. The daily withdrawal limit of EUR 60 has been replaced by a weekly limit of EUR 420, meaning that Greeks can get no more money out of their accounts over a seven-day period. The ban on international money transfers remains.

- The EUR/USD reached new lows at 1.0808 today. We keep our sell offer at 1.0930. If the orders is filled the target will be at 1.0750, above 1.0744 (76.4% of the 1.0521-1.1468 rise).

Significant technical analysis' levels:

Resistance: 1.0870 (high Jul 20), 1.0907 (high Jul 17), 1.0916 (low Jul 7)

Support: 1.0808 (low Jul 20), 1.0785 (low Apr 24), 1.0744 (76.4% of 1.0521-1.1468)

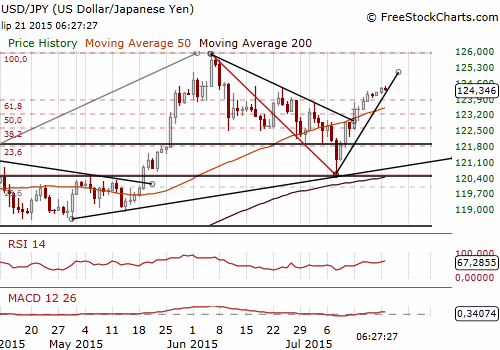

USD/JPY: Buy At 123.40 For 125.80

(buy at 123.40)

- Minutes of Bank of Japan’s June meeting showed that several Bank of Japan board members had said the impact of the bank's massive stimulus might be fading and that not all had shared Governor Haruhiko Kuroda's optimism on achieving 2% inflation target. The nine-member board agreed underlying inflation, which excludes volatile food and energy prices, would continue to improve in the long term. The BOJ has kept monetary policy steady since expanding stimulus in October last year.

- At the June policy meeting, the BOJ also decided to reduce the number of policy-setting meetings it holds each year to 8 from 14, starting next year.

- The monthly Tankan sentiment index for manufacturers , which closely tracks the central bank's quarterly survey, held steady at 14 in July. The service-sector index tumbled from a record high of 36 in June to 24, the biggest decline since May 2014 when a sales tax hike dealt a blow to consumers.

- The downturn in China's economy – a major market for Japanese exporters, which is on course to grow at its slowest pace in over two decades this year, has continued to hurt exports and manufacturing across much of Asia. In Japan, data in the past few weeks showed shipments and output weakening, but capital expenditure climbing solidly.

- The USD/JPY continues to edge higher to focus on 124.57 (76.4% retrace of the 125.86-120.41 fall). A break and daily close above this level will add to the overall bullish market structure. Our trading strategy is to buy at 123.40 for 125.80.

Significant technical analysis' levels:

Resistance: 124.63 (high Jun 10), 124.74 (high Jun 9), 125.00 (psychological level)

Support: 123.96 (low Jul 20), 123.92 (low Jul 17), 123.74 (low Jul 16)

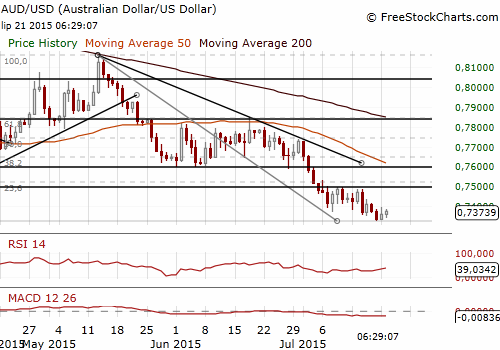

AUD/USD: Eyes On CPI Data

(sell at 0.7450)

- Minutes of the July 7 meeting of the Reserve Bank of Australia showed that the RBA reiterated that a lower currency was needed to help achieve balanced growth. “Members noted that the exchange rate had thus far offered less assistance than would normally be expected in achieving balanced growth in the economy and that further depreciation seemed both likely and necessary.”

- The RBA said in its minutes key forces shaping the economy haven’t changed with record low interest rates and booming resource exports helping to offset falling mining investment and still subdued spending elsewhere.

- RBA policymaker noted that volatility in Chinese equity markets and potential spillovers from developments in Greece would require close monitoring. Conditions in both have subsequently improved since the July 7 meeting.

- The AUD/USD was hurt by comments from the RBA. We should note The RBA's line differed from that in New Zealand, where Prime Minister John Key offered the currency some verbal support on Monday. The AUD/NZD fell below 1.1200 and our long AUD/NZD position is under threat. However, we expect rather dovish statement from the Reserve Bank of New Zealand tomorrow that should support our long AUD/NZD position.

- Investors are waiting for Australian CPI reading now (tomorrow, 1:30 GMT). The consensus is at 0.8% qoq and 1.7% yoy vs. 0.2% qoq and 1.3% yoy in the first quarter. The market does not currently expect any further rate cuts by the RBA. Should this perception change on the back of a much weaker-than-expected inflation release, this would likely result in downside pressure on the AUD. We are looking to sell the AUD/USD at 0.7450. After the CPI release, the AUD traders will shift its focus to the Reserve Bank of New Zealand’s statement (tomorrow 21:00 GMT).

Significant technical analysis' levels:

Resistance: 0.7397 (high Jul 20), 0.7407 (10-dma), 0.7438 (high Jul 16)

Support: 0.7328 (low Jul 20), 0.7241 (low May 2009), 0.7204 (76.4% of 0.6007-1.1081)

Source: Growth Aces Forex Trading Strategies