The Australian dollar took a nasty tumble last week, and the toll was a huge drop of 350 points against the surging US dollar. The Aussie will try to put last week’s fiasco behind it, as it starts the week just above the 0.89 line. The new week has not started out very well, as Australian Retail Sales fell short of the estimate. There is only one release out of the US on Monday - ISM Non-Manufacturing PMI.

It was a week to forget for the Australian dollar, as the Aussie dived under the 0.89 line. On Monday, the news was not positive as Australian Retail Sales dropped from 0.1% to a flat 0.0%. This missed the estimate of 0.4%. This poor reading points to weak consumer spending, which is bad news for the struggling Australian economy. AIG Services Index continues to look very weak and dropped below the 40 line. MI inflation gauge, which helps analysts track quarterly CPI on a monthly basis, posted a rise of 0.5%, its sharpest gain since April 2012.

Last week, RBA Governor Glenn Stevens was in the news, stating that there was further room for an interest rate reduction next week. Stevens complained about low business confidence, the end of the mining boom and even criticized the government for not providing a specific date for the election. This is not the first time that Stevens has made comments which have impacted on the currency markets, and his comments about a possible rate reduction resulted in more pressure on the struggling Australian dollar. Most analysts feel that the rate will remain at 2.75%, although the RBA has surprised the markets before, and traders should be prepared for a scenario in which the central bank shaves the rate to 2.50%.

Over in the US, the week ended with disappointing employment numbers. With excellent numbers from ADP Non-Farm Payrolls and US Unemployment Claims last week, there were high hopes that the all-important Non-Farm Payrolls would keep pace, but this did not occur. Non-Farm Payrolls dropped sharply from 195 thousand to 162 thousand, well of the estimate of 184 thousand. The US Unemployment Rate edged down to 7.4%, its lowest level in over three years. However, this is not as important as it may seem at first glance. The reason? The participation rate in the US employment market actually dropped and is hovering just over 63%. This is a weak figure, and points to trouble in the labor market, even with a lower unemployment rate. AUD/CAD" width="400" height="300">

AUD/CAD" width="400" height="300">

AUD/USD August 4 at 10:05 GMT

AUD/USD 0.8912 H: 0.8914 L: 0.8848

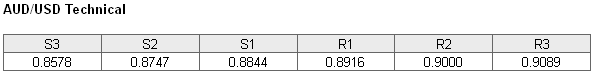

AUD/USD is struggling to stay above the 0.89 line in Monday trading. The pair dropped as low as 0.8848 in the Asian session, as support at 0.8444 held firm. In European trade, AUD/USD is receiving support at 0.8844. This line could again face pressure if the Aussie weakens. 0.8747 is the next support level.

On the upside, the pair is testing resistance at 0.8916. This is followed by resistance at the round number of 0.9000. This line has strengthened as the pair trades at lower levels.

- Current range: 0.8844 to 0.8916

- Below: 0.8844, 0.8747, 0.8578 and 0.8467.

- Above:0.8916, 0.9000, 0.9089, 0.9135, 0.9221 and 0.9328

AUD/USD ratio has started the new trading week almost unchanged. This is consistent with what we are seeing from the pair, which is trading quietly in Monday trading. The ratio has a strong majority of long positions, indicating that trader sentiment is strongly biased towards the Aussie reversing direction and moving upwards.

The Aussie under strong pressure from the surging US dollar as it struggles to stay in 0.89 territory. With a key US release later in the day, we could see some movement from the pair. A well, Australia will release Trade Balance early on Tuesday, and a reading not in line with market expectations could lead to some volatility from AUD/USD.

AUD/USD Fundamentals

- 00:30 Australian MI Inflation Gauge. Actual 0.5%.

- 1:30 Australian Retail Sales. Estimate 0.5%. Actual 0.0%.

- 14:00 US ISM Non-Manufacturing PMI. exp. 53.2 points.