Investing.com’s stocks of the week

AUD/USD

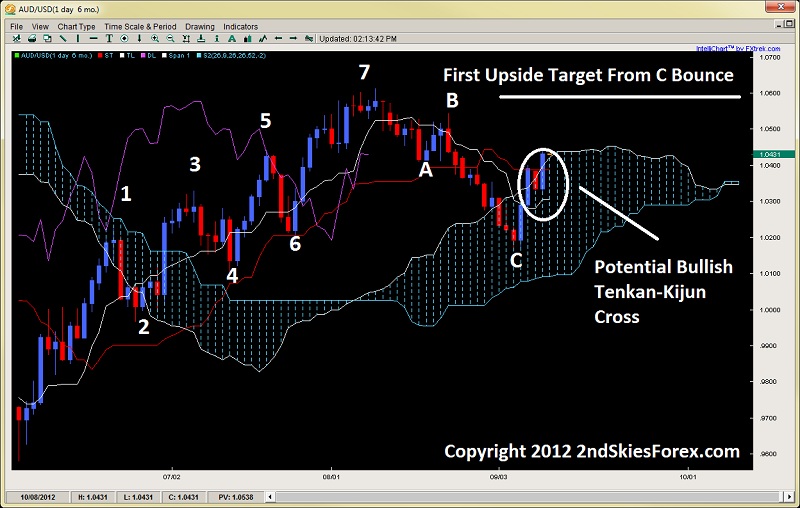

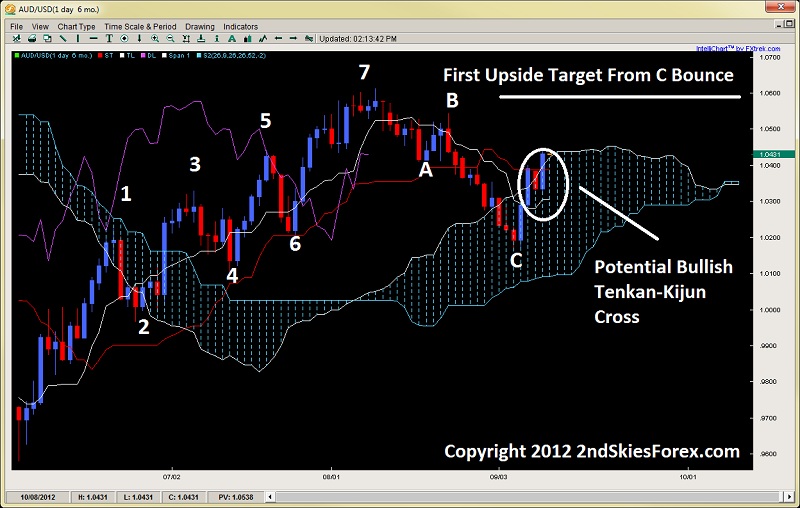

After closing below the Kijun back in late August, the sell-off after the daily kijun break stopped midway into the kumo. It has since then become extremely impulsive in its bullish price action, with 4 days taking out the last 9 days of selling pressure. This is communicating the bulls have retaken control of the pair and will likely attempt to take out the 1.0600 highs.

From an ichimoku perspective, generally when a dominant trend pulls back but only gets partially into the kumo, it usually leads to another up leg and likely tenkan-kijun cross signal (in this case, likely medium). These usually minimally hit the prior SH (swing high) which is around 1.0600.

The chikou has already crossed back above the kijun and may take out the tenkan and price line in one shot should the bullish momentum continue. Using Ichimoku Wave Theory, the pair formed a 7 wave series of N-waves up, and a one-leg N wave down. But this leg down did not take out point 6 in the wave count, so it has not reversed the trend. Therefore, a test of 1.0600 becomes more likely. Should this fail to take out 1.0600, then it should re-attempt to go back down to the 1.0175 swing longs and try to break below the kumo.

AUD/USD" title="AUD/USD" width="600" height="336">

AUD/USD" title="AUD/USD" width="600" height="336">

Global Market Commentary:

Two days now before the potential QEx announcement from Bernanke, and indices rallied in the US and Europe with the combo potential new easing by the Fed along with the German Court not saying ‘9‘ to the EZ rescue plan.

However all of this could be setting up the market for a massive sell-off should the Fed disappoint this FOMC meeting.

The Dow gained almost 70pts while gold added about $3 and the EURO closed above the 2800 barrier at 1.2851 today, its highest close in over two months.

Original post

After closing below the Kijun back in late August, the sell-off after the daily kijun break stopped midway into the kumo. It has since then become extremely impulsive in its bullish price action, with 4 days taking out the last 9 days of selling pressure. This is communicating the bulls have retaken control of the pair and will likely attempt to take out the 1.0600 highs.

From an ichimoku perspective, generally when a dominant trend pulls back but only gets partially into the kumo, it usually leads to another up leg and likely tenkan-kijun cross signal (in this case, likely medium). These usually minimally hit the prior SH (swing high) which is around 1.0600.

The chikou has already crossed back above the kijun and may take out the tenkan and price line in one shot should the bullish momentum continue. Using Ichimoku Wave Theory, the pair formed a 7 wave series of N-waves up, and a one-leg N wave down. But this leg down did not take out point 6 in the wave count, so it has not reversed the trend. Therefore, a test of 1.0600 becomes more likely. Should this fail to take out 1.0600, then it should re-attempt to go back down to the 1.0175 swing longs and try to break below the kumo.

AUD/USD" title="AUD/USD" width="600" height="336">

AUD/USD" title="AUD/USD" width="600" height="336">Global Market Commentary:

Two days now before the potential QEx announcement from Bernanke, and indices rallied in the US and Europe with the combo potential new easing by the Fed along with the German Court not saying ‘9‘ to the EZ rescue plan.

However all of this could be setting up the market for a massive sell-off should the Fed disappoint this FOMC meeting.

The Dow gained almost 70pts while gold added about $3 and the EURO closed above the 2800 barrier at 1.2851 today, its highest close in over two months.

Original post