Hourly Chart AUD/USD Hourly" title="AUD/USD Hourly" height="614" width="979">

AUD/USD Hourly" title="AUD/USD Hourly" height="614" width="979">

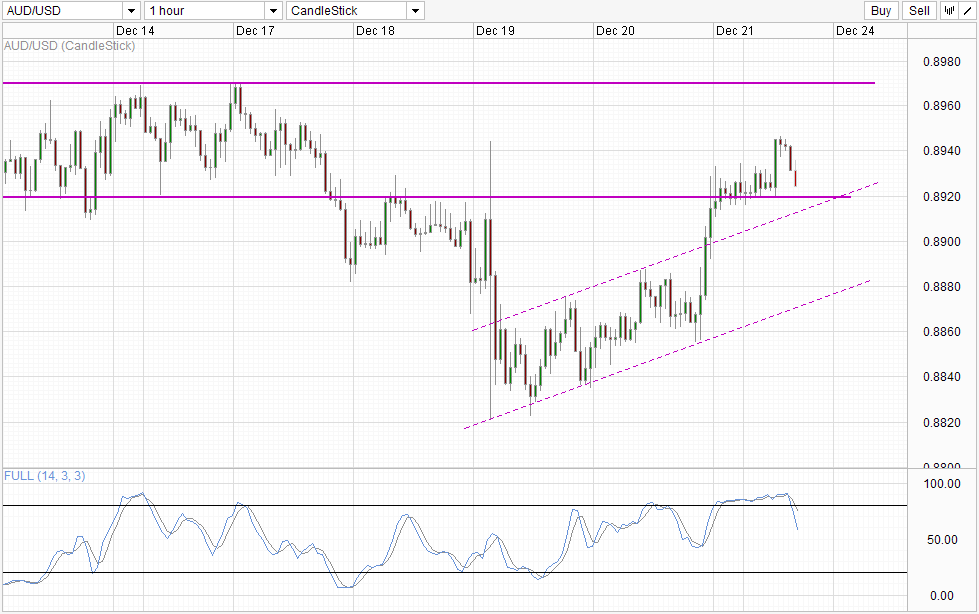

Despite the strong bearishness seen in AUD/USD in 2013, bulls have actually fared much better compared to other major pairs counterpart such as EUR/USD and GBP/USD. Prices have retraced a much larger portion of post tapering decline compared to the rest, with today's rally even managing to push above the highs that occurred after the wild swings post FOMC announcement. Prices have since traded lower towards 0.892, but even then we are above the pre FOMC announcement highs, underlining the strong bullish bias that is currently in play. Not only that, it seems that bears may not be able to push much more beyond 0.892, with additional support coming in the form of rising Channel Top, making a push towards 0.897 a possibility.

However, it's not all rosy for the bulls. Stochastic readings actually favor further bearish pullback with a fresh bearish cycle signal being formed in the past couple of hours. Then again, Stochastic curve may likely rebound from various "support levels" between 40.0 - 60.0, which is in line with prices finding support from Channel Top right now or from consolidation between 0.889 - 0.892 seen on Wednesday before FOMC announcement should Channel Top is breached. Hence, overall bullish outlook remain intact, and declines in the near term should be shallow.

Weekly Chart AUD/USD Weekly" title="AUD/USD Weekly" height="614" width="979">

AUD/USD Weekly" title="AUD/USD Weekly" height="614" width="979">

The strong bullish response seen in the short-term perhaps is a reflection of the long-term bullish pullback. Prices managed to carve out a new 2013 low last week, but 0.89 support remain strong. Together with Stochastic which reflects Oversold momentum, a long-term pullback to 0.93 or at the very least tagging the descending trendline should not be ruled out.

That being said, long term fundamentals remain bearish for AUD/USD. Unlike it's neighboring counterpart NZD/USD, AUD does not have rate hikes expectations to buffer against the incoming USD strength. On the contrary, Central Bank RBA may need to cut rates down even more in order to keep the economy afloat given that the country will be undergoing a mild form of austerity in 2014 even as mining sector stalls. To put it simply, economic growth in Australia is not looking good, and that in itself would already be pulling Aussie lower without the threat of lower interest rates - a proven recipe that will chase carry traders and hot money flow away from Australia and bring AUD even lower. Hence, overall long-term bearish outlook remains, and traders should not expect current pullback to change sentiment.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

AUD/USD: Back Within 0.892 – 0.897 Consolidation

Published 12/23/2013, 05:34 AM

Updated 07/09/2023, 06:31 AM

AUD/USD: Back Within 0.892 – 0.897 Consolidation

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.