After breaking out above the key 0.97 level and reaching a two week high the AUD/USD has since reversed and moved below. For the last couple of weeks the Australian dollar established and traded within a range between two key levels at 0.9550 and 0.97 which it has now returned to. The trading range established has been able to halt the strong decline it experienced through May. A few weeks ago the 0.97 level provided some support and in recent weeks has provided stiff resistance to any rally efforts, which is why it was significant that the AUD/USD broke through that level, despite its recent reversal. It had attempted on a few occasions to rally however the Australian dollar had run into a brick wall of resistance at this level.

A couple of weeks ago the AUD/USD enjoyed a relatively solid few days which saw it halt the falls and rally back up towards 0.9850 before a sharp which saw it drop two cents. The week prior it experienced its worst week in a long time which saw it continue to move to new lows near 0.98, from highs not so long ago above 1.0250, although it did settle a little and find some support at the long term support level at 97 cents.

Although presently appearing unlikely in the short term, should it recover and move back, it is likely the 1.00 level may now provide some resistance to higher prices. The AUD/USD has now experienced an ordinary last few weeks as it wasn’t so long ago it was moving up above 1.03 and threatening the key level at 1.0360, and before that it was approaching 1.06. Up until earlier in May, the 1.02 level was one of significance and presented as a long term support level however this has now clearly been broken. It had been showing some bearish as it continued to place selling pressure on the 1.0220 and 1.02 levels and the RBA rate cut last month was the catalyst for a strong push lower, seeing it just fall very heavily as if all support gave way.

The last couple of months have seen the AUD/USD establish a strong medium term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to near 0.95 in that time. In doing so, it has completely ignored any likely support at either 1.04 or 1.0360, and more recently the long term support level at 0.97. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. Up until a month ago, the AUD/USD spent the best part of a month trading between the two key levels of 1.0220 and 1.0360 and it will take some effort to return it to this range, with the resistance being offered at the 1.02 level and now likely at 1 too.

The RBA did not have any surprises up its sleeve this time, and maintained the key interest rate at 2.75%. This was widely expected by the markets, but the Aussie still took a hit. The reason? The RBA was very clear in stating that there is room for further cuts. RBA Governor Glenn Stevens noted that the “inflation outlook, as currently assessed, may provide some scope for further easing, should that be required.” The central bank has kept an easing bias in place, and we could see another cut in August, following the release of inflation numbers in late July. The Australian dollar was more than happy to wave goodbye to the month of May. The Aussie suffered a horrendous month of May, plunging more than seven cents against the US dollar. The surging US dollar took advantage of the RBA rate cut earlier this month, lukewarm Australian data and the government’s budget which pointed to the high value of the Australian dollar as an impediment to economic growth. Weak US numbers also weighed on the risky Aussie. These factors have resulted in nervous investors shifting their funds to the safe-haven US dollar, resulting in the Australian dollar plunging in value.

AUD/USD June 5 at 01:10 GMT 0.9642 H: 0.9738 L: 0.9610

During the early hours of the Asian trading session on Wednesday, the AUD/USD is just easing away a little from a short term resistance level around 0.9650 after it has recently fallen back below the 97 cents level. Only a month ago the AUD/USD was spending a fair amount of time trading roughly between 1.02 and 1.0550, however that range seems a distant memory as it has fallen down to near a 12 month low below 0.95500 last week. In moving through to 1.0580 only a month ago, it moved to its highest level since January. Current range: trading right around 0.9640.

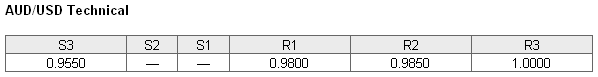

Further levels in both directions:

• Below: 0.9550.

• Above: 0.9800, 0.9850 and 1.0000.

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has moved back above 75% again as the Australian dollar has dropped back below 97 cents. The trader sentiment remains strongly in favour of long positions.

Economic Releases

- 01:30 AU GDP (Q1)

- 07:58 EU Services & Composite PMI (May)

- 08:28 UK CIPS/Markit Services PMI (May)

- 09:00 EU GDP (2nd Est.) (Q1)

- 09:00 EU Retail Trade (Apr)

- 12:15 US ADP Employment Survey (May)

- 12:30 CA Building permits (Apr)

- 12:30 US Non Farm Productivity (Final) (Q1)

- 12:30 US Unit Labour Costs (Final) (Q1)

- 14:00 US Factory Orders (Apr)

- 14:00 US ISM Non-Manufacturing (May)

- 18:00 US Beige Book released