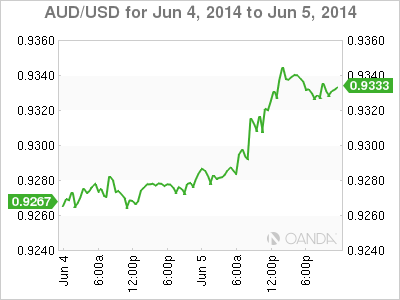

AUD/USD was firm on Thursday, as the pair trades above the 0.93 line in the North American session. The Australian dollar continues to ride on the strong GDP reading a day earlier. Taking a look at Thursday's releases, Australian Trade Balance posted a slight deficit, missing the estimate. Over in the US, Unemployment Claims increased to 312 thousand, slightly above the estimate.

Australian GDP looked sharp in Q2, posting an excellent gain of 1.1%. This beat the estimate of 0.9%. The GDP reading points to strong growth in the economy, but surprisingly, other key releases failed to keep pace this week. Building Permits, Retail Sales and Trade Balance all missed their estimates in May. Meanwhile, there were no surprises from the RBA earlier this week, as it maintained the benchmark interest rate at 2.50%, where it has been pegged since last July. The RBA noted that present monetary policy would "foster sustainable growth in demand and inflation", and the Aussie reacted with slight gains.

US manufacturing and services sectors are pointed in the right direction, according the ISM Business Survey Committee. The ISM Manufacturing and Non-Manufacturing PMIs both improved in May. There was some confusion earlier in the week, as the Manufacturing PMI was based on faulty data, with the original report stating that the manufacturing index had softened in May. This was later corrected, as the index actually improved to 55.4 points in May, up from 54.9 points a month earlier. Meanwhile, the Non-Manufacturing PMI hit a nine-month high last month, climbing to 56.3 points, ahead of the estimate of 55.6 points.

AUD/USD June 5 at 14:25 GMT

AUD/USD 0.9317 H: 0.9326 L: 0.9258

AUD/USD Technical

- AUD has posted gains on Thursday. The pair pushed above the 0.93 line earlier in the European session.

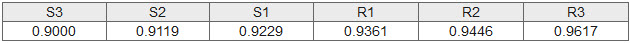

- 0.9229 has some breathing room as the pair trades at higher levels. This is followed by support at 0.9119.

- 0.9361 is the next line of resistance.

Further levels in both directions:

- Below: 0.9229, 0.9119, 0.9000, 0.8893 and 0.8757

- Above: 0.9361, 0.9446 and 0.9617 and 0.9757

OANDA's Open Positions RatioAUD/USD ratio currently has a majority of long positions, indicative of a trader bias towards the Australian dollar continuing to move upwards.AUD/USD has posted gains on Thursday. The pair is steady in the North American session.AUD/USD Fundamentals

- 1:30 Australian Trade Balance. Estimate +0.40B. Actual -0.12B.

- 12:30 US Unemployment Claims. Estimate 309K. Actual 312K.

- 11:30 US Challenger Job Cuts. Actual 45.5%.

- 14:30 US Natural Gas Storage. Estimate 116B.

- 17:30 US FOMC Member Narayana Kocherlakota Speaks.