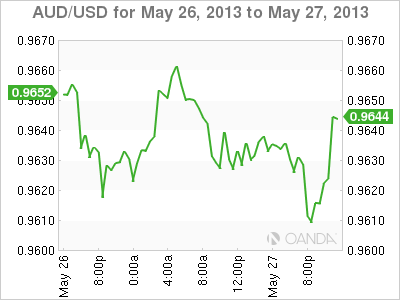

AUD/USD continues to struggle, as the pair dropped close to the 0.96 line on Monday, before moving up to the mid-0.96 range. The US markets were closed for the Memorial Day holiday, and there are no Australian releases.

The Aussie’s misery continues, as the currency has crashed, losing over seven cents against the US dollar since the beginning of May. The surprise interest rate cut by the RBA hurt the currency, as did a bleak budget which pointed a finger at the high value of the Australian dollar as hurting the economy – hardly a vote of confidence in the Aussie.

The Australian dollar was also hit hard following remarks by Bernard Bernanke, who was testifying before a Congressional committee. Bernanke initially stated that tightening monetary policy could hurt the US recovery. However, he later said that a decision to scale back QE could be taken in the “next few meetings” if the US economy improves. The bottom line? Bernanke’s comments still leave the markets guessing as to the Fed’s plans regarding the current quantitative easing (QE) program. The Fed is not making any changes to its monetary policy, but that could change if the US economy improves and unemployment falls.

Almost overshadowed by Bernanke’s remarks in Congress was the release of the minutes from the FOMC’s last policy meeting. The minutes indicate that the US recovery will have to gain more traction before the Fed winds down QE. Policy members were split, as some suggested scaling back QE in June (at the next policy meeting), while others wanted to increase QE, given the weak inflation readings we are seeing. It should be noted that the FOMC minutes relate to a meeting which took place at the beginning of May, in contrast to the fresh testimony of Bernanke on Wednesday.

AUD/USD May 27 at 13:20 GMT

AUD/USD 0.9633 H: 0.9666 L: 0.9616

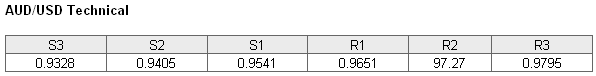

AUD/USD is showing very little movement as we begin the new trading week. The pair is receiving support at 0.9541. This is followed by a support level at 0.405. On the upside, there is weak resistance at 0.9651. This line could face pressure if the Aussie can show any improvement. The next line of resistance is at 0.9651.

- Current range: 0.9541 to 0.9651

- Below: 0.9541, 0.9405, 93.28 and 92.21

- Above: 0.9651, 0.9727, 0.9795, 0.9907 and 1.00

AUD/USD ratio has showed some movement towards long positions. The pair has covered a large number of short positions as it slides lower, leaving a large majority of long positions.

The Australian dollar has nosedived for most of May. Will we see a correction or will the strong downward trend continue? With the US markets closed on Monday and no Australian releases today, we could see the pair settle down in the mid-0.96 range.

AUD/USD Fundamentals

- There are no Australian or US releases on Monday.