GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: long at 1.1150, target 1.1350, stop-loss 1.1040, risk factor **

USD/CAD: short at 1.2110, target 1.1930, stop-loss 1.2205, risk factor ***

AUD/USD: long at 0.7870, target 0.8230, stop-loss 0.7790, risk factor ***

NZD/USD: long at 0.7560, target 0.7800, stop-loss 0.7450, risk factor ***

GBP/JPY: long at 182.50, target 184.90, stop-loss 181.50, risk factor **

AUD/JPY: long at 93.80, target 97.00, stop-loss 92.80, risk factor ***

Pending Orders

GBP/USD: buy at 1.5060, if filled - target 1.5540, stop-loss 1.4940, risk factor **

EUR/GBP: buy at 0.7310, if filled – target 0.7590, stop-loss 0.7210, risk factor **

EUR/JPY: buy at 133.00, if filled – target 135.60, stop-loss 131.90, risk factor **

EUR/CAD: buy at 1.3460, if filled – target 1.3730, stop-loss 1.3340, risk factor **

AUD/NZD: buy at 1.0320, if filled – target 1.0530, stop-loss 1.0220, risk factor ***

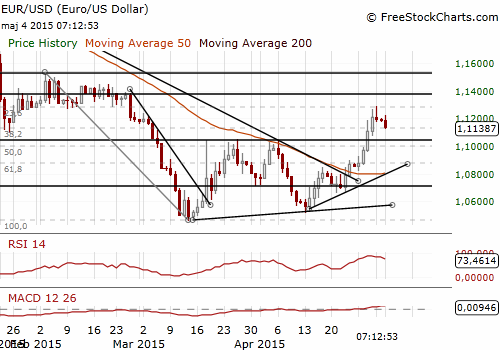

EUR/USD: USD Gained After Hawkish Mester And Williams

(long for 1.1350)

- Final April Eurozone manufacturing PMI stood at 52.0, revised up from a flash reading of 51.9 but below March's 10-month high of 52.2.

- Official figures last week showed the Eurozone ended four months of deflation in March with consumer prices unchanged from year-ago levels. The survey's output price index nudged above 50 for the first time in eight months, suggesting inflation may turn positive.

- Ireland and Spain remained the top performers in April, according to the latest PMI readings, although accelerations in the Netherlands and Italy saw these nations narrow the gap. Germany reported further expansion, but its overall rate of improvement slowed slightly over the month.

- Eurozone PMI showed that although domestic market conditions remained subdued in a number of nations, most benefitted from increases in new export orders.

- The U.S. economy's weak winter performance, including near-zero growth in HFP, has pushed back market expectations for a policy tightening to September or December, when key Fed meetings are also scheduled. However, the hawkish-leaning chief of the Cleveland Fed Loretta Mester (voting this year) said the Fed could well raise interest rates as soon as June. She said: “There are a whole bunch of data releases that will come out between now and June. But to me the employment reports will be indicative of a lot.” John Williams, president of the San Francisco Fed (voting this year), is also the opinion that a hike in June is still “on the table”. He said the Fed would get two months of data, including jobs reports for April and May as well as retail sales data, inflation data and other key metrics.

- European Central Bank Vice President Vitor Constancio expressed his confidence that Athens and its creditors will agree a deal to avoid Greece leaving the Eurozone.

- Constancio said that the ECB had no intention of prematurely ending its quantitative easing programme aimed at pumping around EUR 1 trillion into the financial system by September 2016.

- The combination of relatively hawkish comments from the Fed and ECB’s Constancio providing a rationale for not wanting to halt QE supported the USD against the EUR. We have used today’s correction to buy EUR/USD at 1.1150, in line with our strategy. The next target is 1.1350.

Significant technical analysis' levels:

Resistance: 1.1282 (100-dma), 1.1290 (high May 1), 1.1380 (high Feb 26)

Support: 1.1125 (100-hma), 1.1116 (hourly low Apr 30), 1.1072 (low Apr 30)

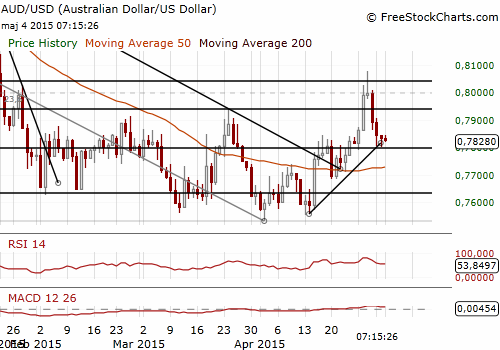

AUD/USD: All Eyes On RBA

(stay long)

- China's PMI fell to 48.9 in April, the lowest level since April 2014, from 49.6 in March, as demand faltered and deflationary pressures persisted. Renewed concerns about growth in China, Australia's top export market, weighed on the AUD today.

- A survey by Australia and New Zealand Banking Group showed total job advertisements rose 2.3% to 144,559 per week on average in April. Annual growth in ads picked up to 7.3%, from 6.6% the month before. Government figures on employment out last month showed a surprisingly strong rise of 37k in March and a large upward revision to February as well. The official employment report for April is due on Thursday and is expected to show an increase of around 5k with the jobless rate ticking up to 6.2%. In our opinion the increase in employment may be slightly stronger.

- Australian approvals to build new homes in March jumped 2.8% mom vs. median forecast for a 2.0% mom fall. Annual change in total approvals to build new homes amounted to 23.6%.

- Investors are focused on RBA rate decision tomorrow (04:30 GMT). The market expects a rate cut by 25 bps. In our opinion the RBA will keep rates unchanged which should give a strong boost to the AUD. We stay AUD/USD long.

Significant technical analysis' levels:

Resistance: 0.7844 (session high May 4), 0.7919 (high May 1), 0.7938 (hourly high Apr 30)

Support: 0.7804 (session low May4), 0.7792 (low Apr 27), 0.7750 (55-dma)

Source: Growth Aces Forex Trading Strategies