The AUD rushes higher after crazy-strong payrolls overnight – but don’t expect a repeat next month. The EUR/CHF may be set for further gains in this environment despite today’s relatively quiet SNB.

RBNZ nixes the kiwi

The RBNZ was out with some rhetorical intervention on NZD strength - saying that it could cut rates if the kiwi remained too strong to help it cope with the threat of drought - catching the market off guard, and unleashing a new bout of kiwi selling. Selling was perhaps particularly enthusiastic as we also saw a wildly strong Aussie payrolls reading that saw a frenzy of AUD/NZD buying after the pair recently broke through resistance.

Wildly strong Aussie payrolls

Aussie rushed higher across the board overnight after a crazy-strong payrolls report showing payrolls jumping the most in over 10 years. Keep in mind that we have seen three similar spikes (of lesser magnitude) in recent years as the numbers aren’t as statistically manipulated as, for example, the US numbers. In nearly all of those cases, the subsequent months saw a good portion of the gains mean- reverted – so we will probably see a negative number next month. Still – a reading of -20k next month still averages to a healthy +25k clip for the two months – so Aussie strength could continue as long as new China fears, asset market weakness or commodity sell-offs don’t materialize... big ifs beyond the nearest term….

It’s also humorous if we take a big-picture view of thing,s and see that the market is beginning to favour the idea that this marks the end of the RBA rate easing cycle. This is vastly too premature.

A glance back at the US predictions of future rates shows how egregiously the market can underestimate cycles. As recently as early 2011, for example, the market was predicting that the December 2012 Fed Funds rate would be 1.5% - instead it was still 0%, AND we saw Operation Twist, QE3 and then open-ended QE in December.

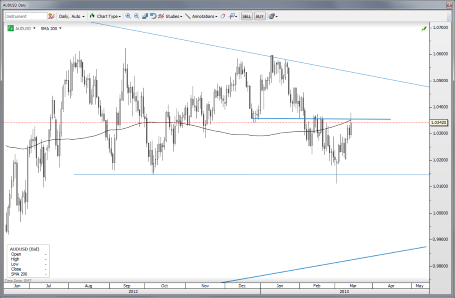

Chart: AUD/USD

From a technical perspective – this is an importan swing area for AUD/USD – the bearish view has come under major threat from the last rally, and 1.0350/75 is perhaps the final line in the sand for the bears – so whether we pivot through here is key for the ongoing technical outlook . A chunky reversal would be a nice “hook” for the bears to latch onto, while a strong close up through 1.0375 could mean an extension of the eternal ranging purgatory for the pair.

US Retail Sales – still a bit sceptical…

The US retail sales figures were celebrated as very strong, but if we look at ex Auto and Gas figures, the rise was merely +0.4% MoM vs. +0.2% expected. I have a cheeky theory that some of the profit taking on larger capital gains ahead of the New Year that many took to avoid paying capital gains at a higher rate after Jan 1 might be feeding into near-term strength in consumption. February sales were apparently rather weak at the likes of Walmart, Target and Kohls, where many US citizens do their basic shopping. At least a couple more months of solid data are needed to get the positive story to gain steam.

SNB

The SNB meeting today came and went without much fanfare – the bank left the Libor target unchanged as expected, and said the currency remained overvalued. Inflation forecasts were lowered slightly – to 0.2% for 2013 vs. 0.4% previously. Some were expecting the SNB might move with an indication that it would allow negative rates with the hope of “scaring” capital away from Switzerland, so the more dovish outcome expectations were not met. Still, the current environment is very supportive of the EUR/CHF continuing to rally, with yesterday’s reversal providing a nice technical setup. Let’s see if the 1.2400 level can fall again and set up a test of those 1.2550+ highs in the coming days.

Norges Bank

Norges Bank was out keeping rates unchanged as expected, and took the opportunity to guide expectations for the policy rate lower for longer than expected. The expectation was for 2014 rate to be 1.75% (vs. 1.50% now) rather than the 2.25% previous estimate. Inflation is expected to remain low for longer. Some of the dovish stance here could be in response to the recent EURNOK fall to grazing the 20+ year lows late last year and early this year and the desire to ensure that safe haven seeking doesn’t see the currency any stronger. As of this writing, just a few minutes after the Norges Bank meeting, EURNOK was pushing above the key 7.50 level in EURNOK – a key technical and psychological level for the market.

Looking ahead

Otherwise, we have a break to new lows in EUR/USD – so as long as we hold below 1.3000, it’s on to the next targets, starting with the 200-day moving average below 1.2900, but eventually possibly the flat-line area around 1.2665 and the psychologically interesting 1.2500. There is some uncertainty over Greece’s next payment from the Troika, but the EU PR department is busy making it sound like everything is great – though at issue is a plan for how to fire 150k public sector workers over the next couple of years. How long before social tensions trigger a break-point?

The US calendar today features PPI data for Feb. and the latest weekly initial jobless claims figures.

The JPY is sharply weaker today after an advisor to Abe said USD/JPY at 98-100 would be nice even after specific instructions to keep his mouth shut.

Stay careful out there.

Economic Data Highlights

- New Zealand RBNZ left official cash target at 2.50% as expected

- Australia Feb. Employment Change out at +71.5k vs. +10k expected and +13.1k in Jan.

- Australia Feb. Unemployment Rate out at 5.4% vs. 5.5% expected and 5.4% in Jan.

- Spain Jan. Adjusted Real Retail Sales out at -10.2% YoY vs. -11.1% expected and vs. -11.4% in Dec.

- Switzerland SNB left Libor Target Rate unchanged at 0.00% as expected

- Sweden Feb. Unemployment Rate out at 8.2% vs. 8.1% expected and 8.0% in Jan.

- Norway Norges Bank left rates unchanged at 1.50% as expected

- Canada Jan. New Housing Price Index (1230)

- US Feb. Producer Price Index (1230)

- US Weekly Initial Jobless Claims (1230)

- US Q4 Current Account Balance (1230)

- US Weekly Bloomberg Consumer Comfort Index (1345)

- New Zealand Feb. Business NZ PMI (2130)

- New Zealand Mar. ANZ Consumer Confidence (0000)

- Japan Upper House to Vote on BoJ Nominees (0100)