We continue to see strong volatility from AUD/USD. The pair has lost close to one cent in Friday trading, following a string of weak US releases on Thursday. The pair was trading in the high-95 range in Friday’s European session. Taking a look at Friday’s releases, Australian Private Sector Credit posted a gain of 0.3%, matching the forecast. In the US, there are plenty of releases for the market to scrutinize as we wrap up the trading week. Today’s highlights include inflation and consumer confidence releases.

US releases looked unimpressive on Thursday, with three key releases missing their estimates. Preliminary GDP improved to 2.4%, but missed the estimate of 2.5% Unemployment Claims shot up to 350 thousand, well above the estimate of 342 thousand. Pending Home Sales was another disappointment, as the key housing indicator rose just 0.3%, well below the forecast of a 1.3% gain. These numbers point to weakness in the US economy, and raises questions about the extent of the US recovery.

The Aussie has suffered a horrendous month of May, with spectacular declines against thee US dollar. The Australian dollar has plunged more than seven cents against the US dollar this month. The greenback has taken advantage of the RBA interest rate cut, lukewarm Australian data and the government’s budget which pointed to the high value of the Australian dollar as an impediment to economic growth. These factors have resulted in nervous investors shifting their funds to US assets, resulting in the Aussie plunging in value. We are seeing this on Friday as well, as weak US releases have resulted in sharp losses for AUD/USD.

In the US, the Federal Reserve hasn’t made any changes to the current round of quantitative easing, which stands at $85 billion in asset purchases each month. Fed policymakers, including Fed Chair Bernanke, have not been shy about dropping clues that QE could be altered or even terminated in the next few months. The currency markets have reacted sharply to such talk, and much of the volatility we are seeing in the currency markets is a reflection of market uncertainty as to what the Fed plans to do. Talk of an end to QE has given a boost to the dollar, and we can expect the currency markets to continue to be very sensitive to further talk of tapering QE.

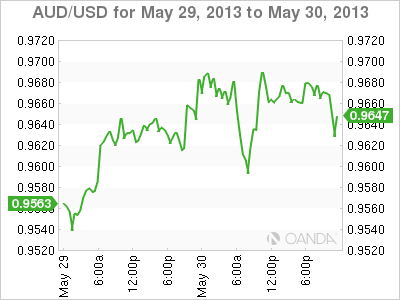

AUD/USD May 31 at 10:55 GMT

AUD/USD 0.9593 H: 0.9681 L: 0.9566

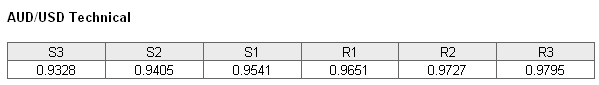

AUD/USD has posted sharp losses on Friday, wiping out most of the gains accumulated over the past two days. The pair continues to receive support at 0.9541. This is followed by support at 0.9405, protecting the 94 line. On the upside, there is resistance at 0.9651. The next line of resistance is at 97.27.

- Current range: 0.9541 to 0.9651

Further levels in both directions:

- Below: 0.9541, 0.9405, 93.28 and 92.21

- Above: 0.9651, 0.9727, 0.9795, 0.9907 and 1.00

AUD/USD ratio is pointing to movement towards long positions, after the lull on Thursday. This is reflected in the pair’s current movement, as the Aussie is having another bad day and has dropped sharply against the US dollar. The ratio is dominated by long positions, as trader sentiment is strongly biased towards the US dollar continuing to post gains against the struggling Aussie.

AUD/USD Fundamentals

- 0:30 Australian Private Sector Credit. Estimate 0.3%. Actual 0.3%.

- 12:30 US Core PCE Price Index. Estimate 0.1%.

- 12:30 US Personal Spending. Estimate 0.2%.

- 12:30 US Personal Income. Estimate 0.2%.

- 13:45 US Chicago PMI. Estimate 50.3 points.

- 13:55 US Revised UoM Consumer Sentiment. Estimate 84.1 points.

- 13:55 US Revised UoM Inflation Expectations.

- 15:00 US Crude Oil Inventories. Estimate -0.8M.