AUD/USD for Tuesday, October 29, 2013

To finish out last week the AUD/USD eased back away from resistance near 0.97 to finish at a one week low right around 0.96. This decline has continued into this week as it has moved down to a two week low right around 0.9550. It experienced a rollercoaster ride in the middle of last week which saw it surge higher to reach a new 4 1/2 month high above 0.9750 before collapsing back to near 0.9600. In the last month or so it has enjoyed a solid and steady move higher from the support level at 0.93 up to the recent resistance level at 0.95 and beyond a couple of weeks ago to above 0.97. Throughout the first half of September the AUD/USD enjoyed a solid run which was punctuated by a strong surge higher sending it to a then three month high just above 0.95. Since that time it has generally traded within a range between 0.93 and 0.95 finding support at the former level and more recently resistance at 0.95. A couple of months ago the AUD/USD had been trying valiantly to stay above the support level at 0.89 as all week it placed downward pressure but was unable to sustain any break lower. At the beginning of August it moved very well from three year lows to move back above the key level of 90 cents and beyond to a two week high just above 0.92 to finish out that week.

At the end of July the AUD/USD fell very strongly and appeared to resume the medium term down trend as it moved to a new three year low near 0.8850 but it reversed very well and looked poised to continue back towards the longer term resistance level at 0.93. For the most part of the last week, it moved very little and was quite subdued staying above the support level at 0.94. Throughout July the AUD/USD placed constant pressure on the 0.93 level again as it continued to place buying pressure on that level however the resistance there was able to stand firm. It was during this time it did very well to maintain its price level well above 0.92 as place upward buying pressure on the resistance level at 0.93. Over the course of the last couple of months the 0.93 level has provided reasonable resistance to any movement higher and now that this level has been broken, it is providing a measure of support. Throughout July, the AUD/USD spent most of its time trading between 0.90 and 0.93 threatening to break through either level at multiple stages. The 0.9150 level also became a key level during that time providing both some resistance and more recently support, and this was called upon again a few weeks ago providing some much needed support however it was completely ignored a couple of weeks ago as the AUD/USD fell heavily through it.

It was only a few months ago that many were waiting for the AUD/USD to break below the 90 cents level and then it would have been a matter of how far can it drop. It had continued to drift lower and move towards the 90 cents level, a level not seen for three years. Considering the speed of its decline throughout several months this year, the last couple of months has seen a significant slowing down and almost some consolidation as it has rested well on the support at 0.90 and now made its way back to 0.95. Throughout April to August, the AUD/USD established a strong medium term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to near 0.90 in that time. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. After making a solid run higher in the middle of June back towards the key level of 0.97, the AUD/USD has since continued its strong and steady decline moving to below 0.90 and levels not seen since near the middle of 2010.

The new government in Australia, which swept into power last month, has plenty of economic challenges on its plate. Finance Minister Mathias Cormaan acknowledged as much on the weekend when he said that the fiscal situation "continues to deteriorate". The mining investment boom has run out of steam, unemployment is rising while growth has fallen. The Australian dollar remains high, and this is hurting the manufacturing and exporting sectors. The RBA continues to state that it wants to see a lower Australian dollar, so a rate cut remains a possibility in the near future if the currency remains well above the 0.90 level. AUD/USD Daily Chart" title="AUD/USD Daily Chart" height="231" width="550">

AUD/USD Daily Chart" title="AUD/USD Daily Chart" height="231" width="550"> AUD/USD 4 Hourly Chart" title="AUD/USD 4 Hourly Chart" height="231" width="550">

AUD/USD 4 Hourly Chart" title="AUD/USD 4 Hourly Chart" height="231" width="550">

AUD/USD October 28 at 22:00 GMT 0.9572 H: 0.9622 L: 0.9555 AUD/USD Technical" title="AUD/USD Technical" height="231" width="550">

AUD/USD Technical" title="AUD/USD Technical" height="231" width="550">

During the early hours of the Asian trading session on Tuesday, the AUD/USD is trading within a narrow range between 0.9565 and 0.9585 after receiving some support around 0.9570 over the last few days. Despite its strong recovery the last few months, the Australian dollar has been in a free-fall for a lot of this year. In moving through to 1.0580 only a few months ago, it moved to its highest level since January. Current range: trading between 0.9565 and 0.9585.

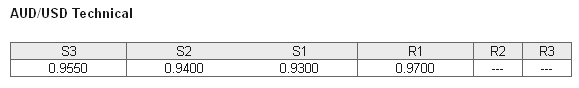

Further levels in both directions:

• Below: 0.9550, 0.9400 and 0.9300.

• Above: 0.9700.

OANDA’s Open Position Ratios AUD/USD Open Position Ratios" title="AUD/USD Open Position Ratios" height="53" width="387">

AUD/USD Open Position Ratios" title="AUD/USD Open Position Ratios" height="53" width="387">

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has moved back to below 60% as the Australian dollar has eased back towards 0.9550. The trader sentiment remains in favour of long positions.

Economic Releases

- 23:30 (Mon) JP Unemployment (Sep)

- 23:50 (Mon) JP Retail Sales (Sep)

- 09:30 UK M4 Money Supply (Sep)

- 09:30 UK BoE - Mortgage Approvals (Sep)

- 09:30 UK BoE - Net Consumer Credit (Sep)

- 09:30 UK BoE - Secured Lending (Sep)

- 12:30 CA Industrial product price index (Sep)

- 12:30 CA Raw Materials Price Index (Sep)

- 13:00 US S&P Case-Shiller Home Price (Aug)

- 14:00 US Consumer Confidence (Oct)