The AUD/USD has experienced its worst week in a long time which has seen it continue to move to new lows below 0.99, from highs above 1.0250, although in the last 24 hours it has settled a little and consolidated right around the 99 cents level. It has slowed its decline a little however it has in the last 24 hours moved to a new 11 month low below 0.9850. It is likely the 1.00 level may now provide some resistance to higher prices as the AUD/USD tried to claw back some lost ground. At the end of last week, it experienced its largest 24 hour drop in a long time falling strongly down through 1.02 and 1.01 and this week has seen this form continue falling sharply back down below parity. It had an ordinary week last week as it wasn’t so long ago it was moving up above 1.03. Up until recently, the 1.02 level was one of significance and presented as a long term support level however this has now clearly been broken.

It had been showing some bearish signs over the last few weeks as it continued to place selling pressure on the 1.0220 and 1.02 levels and the RBA rate cut earlier last week was the catalyst for a strong push lower. The last couple of weeks have seen the AUD/USD establish a strong medium term down trend with lower peaks and lower troughs, as it has moved from near 1.04 down to below 1 in that time. In the previous few weeks, the AUD/USD spent most of its time trading between 1.02 and 1.0360. During that time, it moved up to a two week high and back towards 1.04 however it has quickly handed back all of those gains and then some. A couple of times in that same period it received solid support around 1.0220, just above the key long term level at 1.02. All of this just gave way last week as the AUD/USD was heavily sold down, and now the 1.02 level is poised to provide resistance and thwart attempts to push higher, although it seems some distance away presently.

Over the course of the last month, the Australian dollar has fallen very sharply from near 1.06 to its lows around 0.9850, and in doing so, it also completely ignored any likely support at either 1.04 or 1.0360. In contrast, the week prior, it enjoyed a solid week moving strongly off the key level of 1.0360 towards 1.06 and to its highest levels since January. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. Up until earlier this week, the AUD/USD spent the best part of a month trading between the two key levels of 1.0220 and 1.0360 and it will take some effort to return it to this range, with the resistance being offered at the 1.02 level. A couple of months ago, it did well to push back up off the support level at 1.02 and start the move that it was enjoying getting close to 1.06.

A higher than expected deficit figure revealed in Australia’s budget on Tuesday has raised concerns that the country could follow in the same path as the highly indebted euro zone, said one expert. Australian Treasurer Wayne Swan reported a A$19.4 billion (US$19.18 billion) deficit for the current fiscal year ending on June 30 and A$18 billion for the following fiscal year, and said he would not be able to balance the budget for another two years. The figure was above expectations of around A$17 billion for this financial year, and $10 billion for the next fiscal year, according to a Reuters poll. According to John Daley, CEO of the Australian think tank the Grattan Institute, Australia’s economy is facing a “very real danger” of following down the same path as Europe and words like austerity have come into the vocabulary of economic commentators.

AUD/USD May 16 at 01:10 GMT 0.9904 H: 0.9919 L: 0.9852 AUD/USD Technical" title="AUD/USD Technical" width="599" height="74">

AUD/USD Technical" title="AUD/USD Technical" width="599" height="74">

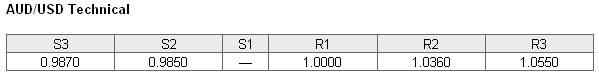

During the early hours of the Asian trading session on Thursday, the AUD/USD is rallying a little to back above 0.9900 after having recently dropped back down to 0.9870 again. Up until a few weeks ago, the AUD/USD was spending a fair amount of time within a trading range roughly between the key levels of 1.04 and 1.05, however that range seems a distant memory as it has fallen down to a 11 month low near 0.9850. In moving through to 1.0580 only a few weeks ago, it moved to its highest level since January. Current range: trading right around 0.9900.

Further levels in both directions:

• Below: 0.9870 and 0.9850.

• Above: 1.0000, 1.0360 and 1.0550.

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD remains above 70% which is it highest level in a long time, as the Australian dollar has moved back down below parity. The trader sentiment remains strongly in favour of long positions.

Economic Releases

- 04:30 JP Capacity Utilisation (Mar)

- 04:30 JP Industrial Production (Final) (Mar)

- 09:00 EU HICP (Final) (Apr)

- 09:00 EU Trade Balance (Mar)

- 12:30 US Building Permits (Apr)

- 12:30 US CPI (Apr)

- 12:30 US Housing Starts (Apr)

- 12:30 US Initial Claims (10/05/2013)

- 14:00 US Philadelphia Fed Survey (May)

- EU ECB Governing Council Meeting hold non-rate setting meeting