The AUD/USD has done very little in quiet trading over the last 24 hours and has remained sitting just above the 0.9600 level. It is still facing an uphill battle trying to rally higher after it finished last week under 97 cents and appears to be placing a lot of selling pressure on the 96 cents level. Last week it enjoyed a relatively solid few days which saw it halt the falls and rally back up towards 0.9850 before a sharp which saw it drop two cents. The week prior it experienced its worst week in a long time which saw it continue to move to new lows near 0.98, from highs not so long ago above 1.0250, although last week it did settle a little and find some support at the long term support level at 97 cents. Although presently appearing unlikely in the short term, should it recover and move back, it is likely the 1.00 level may now provide some resistance to higher prices.

The AUD/USD has now experienced an ordinary last few weeks as it wasn’t so long ago it was moving up above 1.03 and threatening the key level at 1.0360. Up until earlier in May, the 1.02 level was one of significance and presented as a long term support level however this has now clearly been broken. It had been showing some bearish as it continued to place selling pressure on the 1.0220 and 1.02 levels and the RBA rate cut a few weeks ago was the catalyst for a strong push lower, seeing it just fall very heavily as if all support gave way. The last month or so have seen the AUD/USD establish a strong medium term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to below 0.96 in that time.

Over the course of the last month, the Australian dollar has fallen very sharply from near 1.06 to its lows just below 0.9600, and in doing so, it also completely ignored any likely support at either 1.04 or 1.0360. In contrast, the week prior, it enjoyed a solid week moving strongly off the key level of 1.0360 towards 1.06 and to its highest levels since January. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. Up until a few weeks ago, the AUD/USD spent the best part of a month trading between the two key levels of 1.0220 and 1.0360 and it will take some effort to return it to this range, with the resistance being offered at the 1.02 level and now likely at 1 too.

The Aussie’s misery continues, as the currency has crashed, losing over seven cents against the US dollar since the beginning of May. The surprise interest rate cut by the RBA hurt the currency, as did a bleak budget which pointed a finger at the high value of the Australian dollar as hurting the economy – hardly a vote of confidence in the Aussie. The Australian dollar was also hit hard following remarks by Bernard Bernanke, who was testifying before a Congressional committee. Bernanke initially stated that tightening monetary policy could hurt the US recovery. However, he later said that a decision to scale back QE could be taken in the “next few meetings” if the US economy improves. The bottom line? Bernanke’s comments still leave the markets guessing as to the Fed’s plans regarding the current quantitative easing (QE) program. The Fed is not making any changes to its monetary policy, but that could change if the US economy improves and unemployment falls.

AUD/USD May 28 at 01:45 GMT 0.9605 H: 0.9665 L: 0.9597

During the early hours of the Asian trading session on Tuesday, the AUD/USD is continuing to trade within a narrow range right around 0.9630. A month ago the AUD/USD was spending a fair amount of time trading roughly between 1.02 and 1.0550, however that range seems a distant memory as it has fallen down to near a 12 month low below 0.9600 late last week. In moving through to 1.0580 only a month ago, it moved to its highest level since January. Current range: trading right around 0.9630.

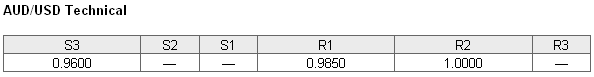

Further levels in both directions:

• Below: 0.9600.

• Above: 0.9850 and 1.0000.

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has just pushed even higher to 75% as the Australian dollar has fallen lower and now rests just above 96 cents. The trader sentiment remains strongly in favour of long positions.

Economic Releases

- 06:00 CH Trade Balance (Apr)

- 06:00 UK Nationwide House Prices (28th-31st) (May)

- 13:00 US S&P Case-Shiller Home Price (Mar)

- 14:00 US Consumer Confidence (May)