Key Points:

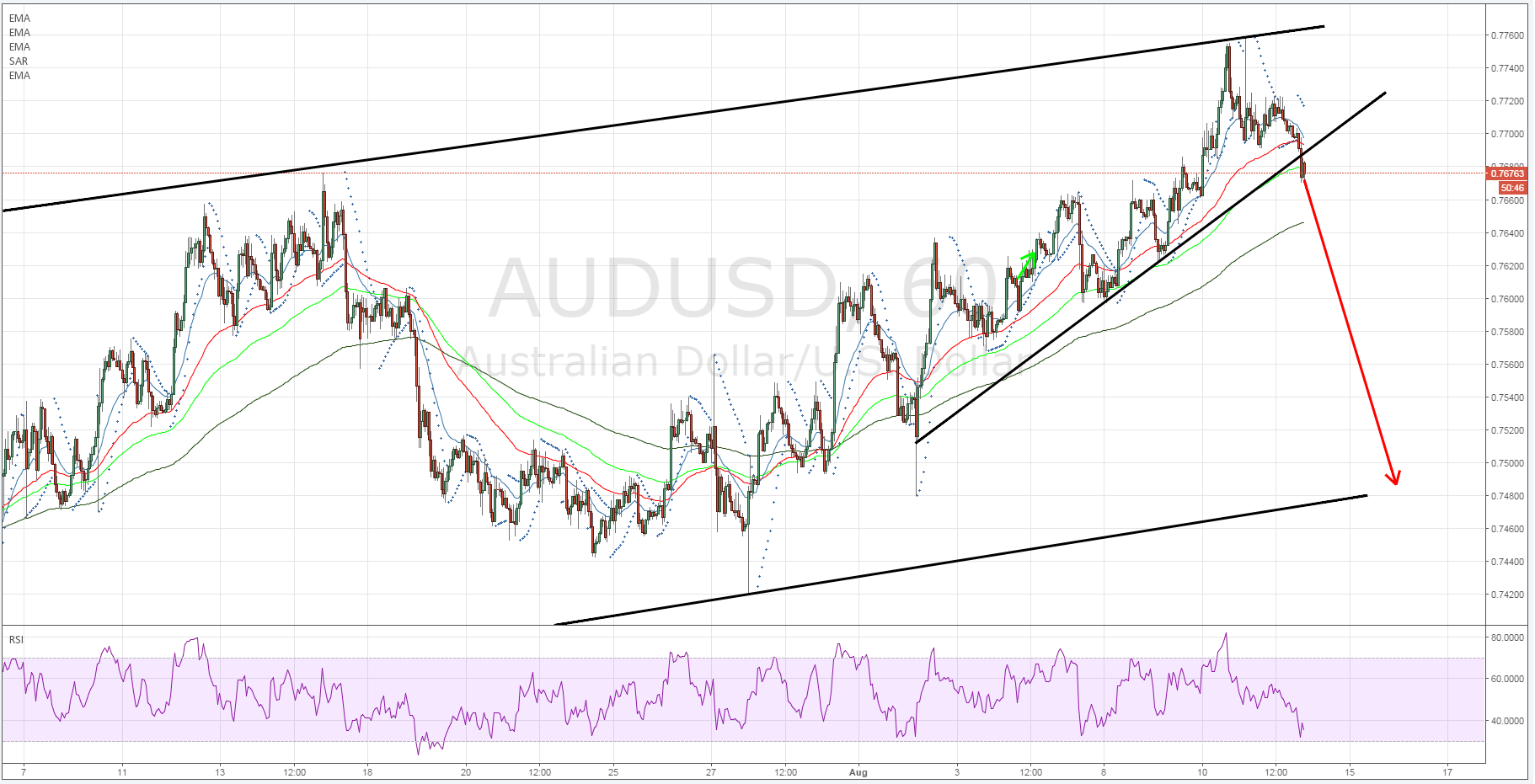

- AUD/USD breaches short run bullish trend line.

- ABCD pattern completes.

- 20 EMA trending lower towards 60 and 100 EMA’s

The Australian dollar has been one of the strong beneficiaries of the sentiment swing against the greenback over the past week. Subsequently, the AUD has been rampantly bullish which has seen its price action rallying within an ascending channel.

However, overnight the pair has pulled back relatively sharply from a weekly high and might just be setting up for a short squeeze back towards the lower channel constraint in the coming days.

A quick review of the pair’s charts demonstrate some interesting technical signals with the AUD/USD having breached the downside of the short run bullish trend line during the most recent pullback.

In addition, the 20EMA has turned and is now trending lower towards the 60 and 100 hour EMA’s. The Parabolic SAR reading is also in line with the turning moving averages and declining which also tallies with the completion of an ABCD pattern within the last day.

Subsequently, it’s likely that a bearish cross will occur in the upcoming session that could be a precursor to further declines. However, it should be noted that the RSI Oscillator is currently oversold on the hourly timeframe. This likely suggests that there may be a period of sideways moderation before the pair commences its retreat towards the bottom of the channel.

Fundamentally, the pair’s recent ascent is unlikely to be sustainable in the medium term despite the recent uptick in the Westpac Consumer Sentiment figures to 2.0% m/m.

The Australian economy is likely to continue to feel the pressures on their balance of payments whilst global commodity prices remain depressed. In addition, there is a relatively good probability of further easing from the Reserve Bank of Australia (RBA) within the next quarter which is likely to reverse any short term gains the Aussie dollar has made.

Ultimately, there are plenty of reasons both technical and fundamental to be bearish on the AUD. In particular, the current breach of the short run bullish trend line should be a cursory warning to those on the long side of the trade.

Subsequently, keep a close watch on the pair in the coming session and watch for a bearish EMA crossover which is likely to signal a good entry with targets down towards the bottom of the channel.