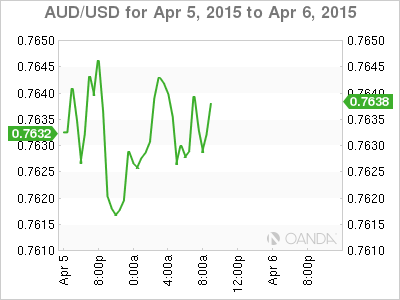

The AUD/USD appreciated after the U.S. employment shock on Good Friday. The move was contained as the Aussie is awaiting the interest rate decision from the Reserve Bank of Australia tomorrow. The pair is trading at 0.7620 to 0.7640 anticipating a rate cut that would leave the benchmark rate at 2.00 percent the lowest on record. The market has forecasted a rate cut either in tomorrow’s meeting or the next month. Surveyed analyst point to an unanimous 2.00 percent rate by May, but only 40 percent expect it to happen this week. The uncertainty regarding the timing will keep the AUD flat until after the decision from the RBA.

Tuesday at 12:30am EDT the central bank will announce its rate decision. Lower commodity prices have wreaked havoc on the Australian economy. A stronger USD had been a blessing as it had the double effect of rising commodity prices and making the AUD more competitive boosting exports. The latest NFP release reminded the market how fragile the U.S. recovery can be.

The USD was left reeling after the nonfarm payrolls report on Friday derail the rate hike optimistic timeline of June. The U.S. added 126,000 jobs missing expectations of 245,000. The latest jobs data is the lowest since December 2013.

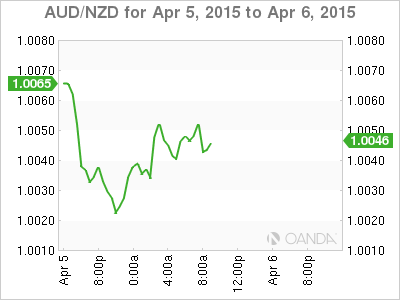

The AUD/NZD has been flirting with parity. The New Zealand economy has proven to be more resilient to the current global slowdown. Commodities are the country’s main exports, but the bulk of Kiwi exports are agricultural and less likely to be affected by economic shocks. Australia on the other hand exports minerals that are tied to manufacturing which has been the reason the Chinese slowdown has hit the Aussie economy particularly hard.

The price of iron ore, Australia’s biggest export, has been on the decline and had dragged the Aussie dollar lower before the U.S. NFP disappointment reversed that trend and might force the RBA’s hand to cut the Australian benchmark rate. Melting iron ore prices have fallen 47 percent since last year as China demand has shrunk and a supply glut is flooding the market pointing to a continued downward trend. Exports to China constitute a third of Aussie exports.

A frothy housing market is the main concern about lowering rates too soon. House prices in Australia have risen 35 percent since 2012.

The RBA faces a tough choice as the market knows that it needs to cut rate in order to boost economic growth. The timing could be somewhat of a surprise if it decides to hold which would boost the AUD beyond current levels and signal a May rate hike. Cutting rates this week could also backfire as the market has not fully absorbed the impact of the soft U.S. NFP which could reduce the impact made by a benchmark rate cut this week.