Throughout last week the AUD/USD moved strongly from below 0.90 on its way to a three week high close to 0.92. To finish out last week it was able to continue on through the 0.92 level before easing back a little although in the early hours of the new week it is continuing to place pressure on this level. The AUD/USD had been trying valiantly to stay above the support level at 0.89 a couple of weeks ago as all week it placed downward pressure but was unable to sustain any break lower. A few weeks ago the AUD/USD experienced an ordinary few days which saw it fall strongly and move back down through the key 90 cents level to a two week low just above 0.8950. It rallied well to finish that week moving from below 0.91 back towards the short term resistance level at 0.92, however this was followed by a decline after being sold off quite heavily. Several weeks ago it moved very well from three year lows to move back above the key level of 90 cents and beyond to a two week high just above 0.92 to finish out that week.

About a month ago however, it fell very strongly and appeared to resume the medium term down trend as it moved to a new three year low near 0.8850 but it reversed very well and looked poised to continue back towards the longer term resistance level at 0.93 before its obstacle at 0.92. This level has emerged again to finish out last week as a level of significance. Throughout July the AUD/USD placed constant pressure on the 0.93 level again as it continued to place buying pressure on that level. It was during this time it did very well to maintain its price level well above 0.92 as place upward buying pressure on the resistance level at 0.93. Over the course of the last couple of months the 0.93 level has provided reasonable resistance to any movement higher and this level will likely play a role again should the AUD/USD continue its rally back up above 0.92. Throughout July, the AUD/USD spent most of its time trading between 0.90 and 0.93 threatening to break through either level at multiple stages. The 0.9150 level also became a key level during that time providing both some resistance and more recently support, and this was called upon again a few weeks ago providing some much needed support however it was completely ignored a couple of weeks ago as the AUD/USD fell heavily through it.

It was only a month or so ago that many were waiting for the AUD/USD to break below the 90 cents level and then it would have been a matter of how far can it drop. It had continued to drift lower and move towards the 90 cents level, a level not seen for three years. Considering the speed of its decline over the last few months, the last couple of months has seen a significant slowing down and almost some consolidation as it has rested well on the support at 0.90 and made its way back to 0.93 on a few occasions. The last few months have seen the AUD/USD establish a strong medium term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to near 0.90 in that time. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. After making a solid run higher in the middle of June back towards the key level of 0.97, the AUD/USD has since continued its strong and steady decline moving to below 0.90 and levels not seen since near the middle of 2010.

Australia’s conservative leader Tony Abbott has swept into office on Saturday in a landslide election as voters punished the outgoing Labor government for six years of turbulent rule and for failing to maximise the benefits of a now fading mining boom. Mr Abbott, a former boxer, Rhodes scholar and trainee priest, promised to restore political stability, cut taxes and crack down on asylum seekers arriving by boat. But it was frustration with Labor’s leadership turmoil that cost the government dearly at the polls. Labor dumped prime minister Kevin Rudd in 2010 for Australia’s first female prime minister Julia Gillard – only to reinstate Mr Rudd as leader this June in a desperate bid to stay in power. “This was an election that was lost by the government more than one that was won by the opposition,” former Labor prime minister Bob Hawke told Sky News. Election officials said with about 65 per cent of the vote counted, Mr Abbott’s Liberal-National Party coalition had won about 54 per cent of the national vote, and projected it would win at least 77 seats in the 150-seat parliament.

AUD/USD September 8 at 23:40 GMT 0.9197 H: 0.9213 L: 0.9186

During the early hours of the Asian trading session on Monday, the AUD/USD is pushing up against the resistance level at 0.92 after its surged higher to finish last week. Despite its slowing and slight recovery the last month or so, the Australian dollar has been in the middle of a free-fall, as the currency has lost around 15 cents since the beginning of May. In moving through to 1.0580 only a few months ago, it moved to its highest level since January. Current range: trading right around 0.9200.

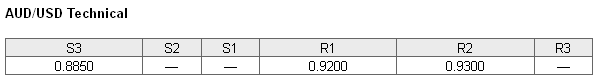

Further levels in both directions:

• Below: 0.8850

• Above: 0.9200 and 0.9300

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has eased back towards 60% as the Australian dollar has pushed back up towards 0.92. The trader sentiment remains in favour of long positions.

Economic Releases

- 23:50 (Sun) JP Bank Lending Data (Aug)

- 23:50 (Sun) JP Current Account (Jul)

- 23:50 (Sun) JP GDP (Final) (Q2)

- 01:30 AU ANZ Job Ads (Aug)

- 01:30 AU Housing Finance (Jul)

- 01:30 AU Lending Finance (Jul)

- 05:00 JP Consumer Confidence (Aug)

- 08:30 EU Sentix Indicator (Sep)

- 12:30 CA Building permits (Jul)

- 19:00 US Consumer Credit (Jul)