To finish off last week, the AUD/USD moved up towards the 0.93 level again as it recovered some of the lost ground from earlier in the week. However in the last few days it has fallen sharply and moved back below the long term support level at 0.90 to trade at a new three year low, close to 0.8900. Last week it did very well to maintain its price level well above 0.92 as upward buying pressure was placed on the resistance level at 0.93. However, earlier last week, it fell sharply to back under 0.92 and started to place pressure on the short term support level of 0.9150.

After finding solid support at 0.90 a couple of weeks ago, it did well to rally, moving up above 0.92 for the first time in nearly a week and getting to within a whisker of 0.93 again. The 0.93 level has provided reasonable resistance to any movement higher just like it did a few weeks ago and has done so again throughout last week. This level will likely play a role again should the AUD/USD rally up from below 0.90. To finish a few weeks ago, it dropped sharply again to resume its medium term downtrend as it moved down towards the key long term level of 90 cents. It surged higher to within a whisker of the 93 cents level before falling away to close out the week.

The 0.9150 level had become a key level over the short term providing both some resistance and more recently support, and this was called upon again last week providing some much needed support, however it was completely ignored the last day or so as the AUD/USD fell heavily through it. It was only a few weeks ago that many were waiting for the AUD/USD to break below the 90 cents level and then it would have been a matter of how far can it drop. It had continued to drift lower and move towards the 90 cents level, a level not seen for three years. Considering the speed of its decline over the last few months, the last month or so has seen a significant slowing down and almost some consolidation as it has rested well on the support at 0.90 and made its way back to 0.93 on a few occasions.

The last few months have seen the AUD/USD establish a strong medium term downtrend with lower peaks and lower troughs, as it has moved from near 1.06 down to near 0.90 in that time. In doing so, it has completely ignored any likely support at either 1.04 or 1.0360, and more recently the long term support level at 0.97. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. After making a solid run higher in the middle of June back towards the key level of 0.97, the AUD/USD has since continued its strong and steady decline moving to below 0.90 and levels not seen since near the middle of 2010. This has seen it experience a significant strong downtrend that would many people would have been caught on the wrong side of.

The Aussie has been in free-fall, shedding about 230 points so far this week. AUD/USD lost over a cent on Monday, courtesy of a dismal release from Australian Building Approvals. The key construction indicator posted a decline of -6.9%, its worst showing since December 2012. The weak release raises questions about the health of the construction and housing industries, both of which are important engines for economic growth. We’ll get a look at housing data later in the week, with the release of HIA New Home Sales.

There was further pressure on the Aussie as RBA Governor Glenn Stevens hinted that there was more room for an interest rate reduction next week. Stevens complained about low business confidence, the end of the mining boom and even criticized the government for not providing a specific date for the election. This is not the first time that Stevens has made comments which have had an impact on the currency markets. As far as the Australian dollar is concerned, it seems the less heard from Stevens, the better.

AUD/USD August 1 at 02:45 GMT 0.8957 H: 0.9047 L: 0.8926

AUD/USD August 1 at 02:45 GMT 0.8957 H: 0.9047 L: 0.8926

AUD/USD Technical

During the early hours of the Asian trading session on Thursday, the AUD/USD is trying to rally back to the key 0.90 but is continuing to meet stiff supply placing downward pressure on prices. Despite its slowing down the last few weeks, the Australian dollar has been in the middle of a free-fall, as the currency has lost around 13 cents since the beginning of May. In moving through to 1.0580 only a few months ago, it moved to its highest level since January. Current range: trading just below 0.8960.

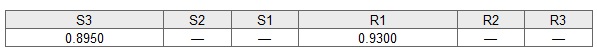

Further levels in both directions:

• Below: 0.8950

• Above: 0.9300

OANDA’s Open Position Ratios

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD has moved back above 70% as the Australian dollar has fallen heavily below 90 cents. The trader sentiment remains in favour of long positions.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

AUD/USD Moves Down Through 0.90 To Three Year Low

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.