The Australian dollar has been doing stellar as of late, as it’s climbed strongly over the past few weeks as the Reserve Bank of Australia has held a neutral stance when it comes to monetary policy, and as many believe the Australian economy will recover. The reality is a little hard to see at this stage, and there are a fair few traders and economists who believe there is still a very rocky horizon for the AUD/USD.

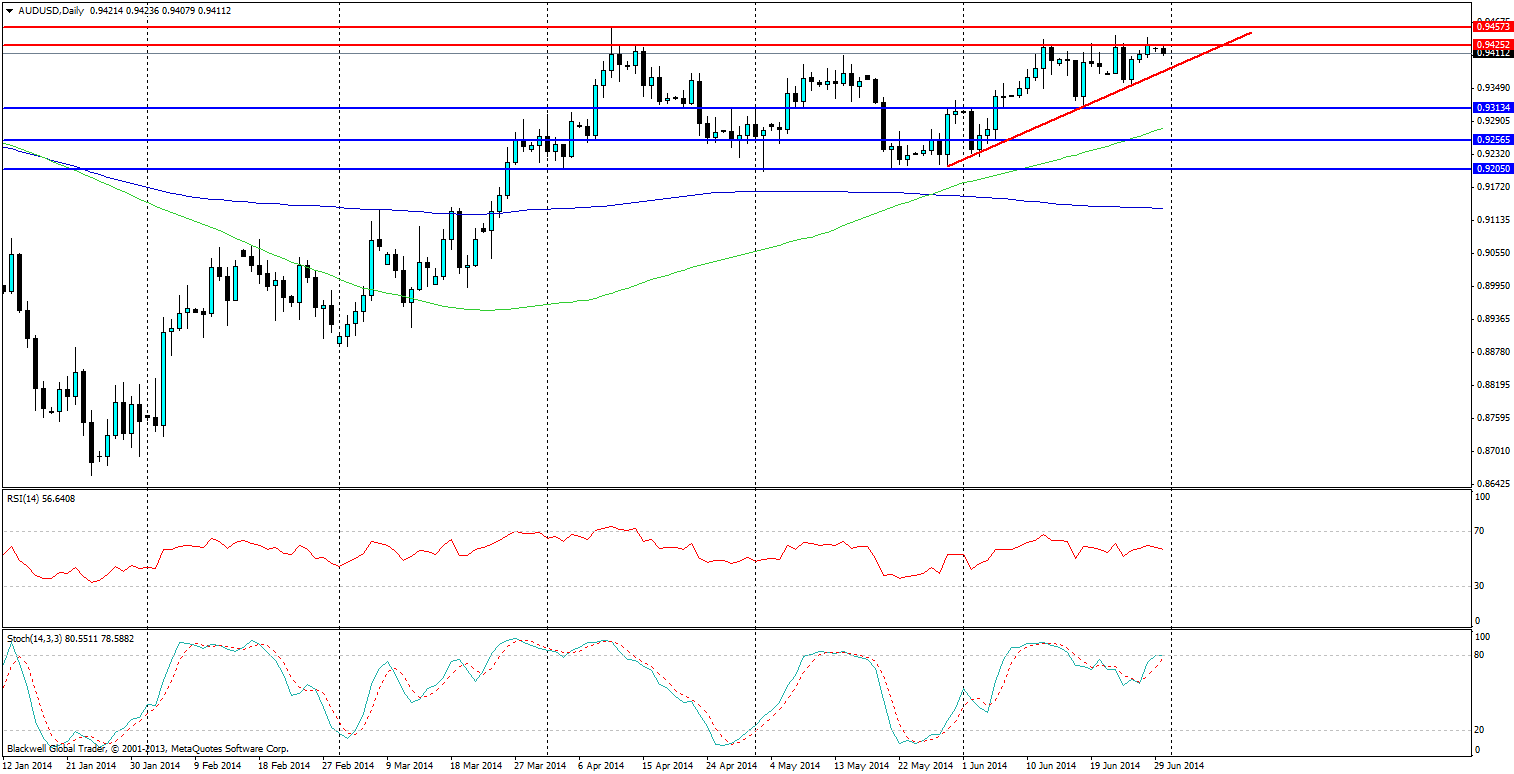

Source: Blackwell Trader (AUD/USD, D1)

The current resistance level is very strong at 0.9425 and is likely to hold in the near term as markets have truly found themselves a ceiling. What’s interesting though is the bullish trend line that accompanies the current movement higher. Many would look to follow this trend higher, but I believe that any push through would quickly get pushed back by traders.

Markets may think that there is more momentum, but I see differently when it comes to economic data which is due out. As I have previously said, the RBA is likely to continue its neutral stance, and may even take a chance to try and talk down the dollar; maybe even a little more than the usual “dollar is at unsustainable levels”. The Trade Balance is expected to widen and be A$-0.16B, in fact, all forecasts this week are for the economy to worsen; the only reprieve may well be Chinese manufacturing data which is expected to rise.

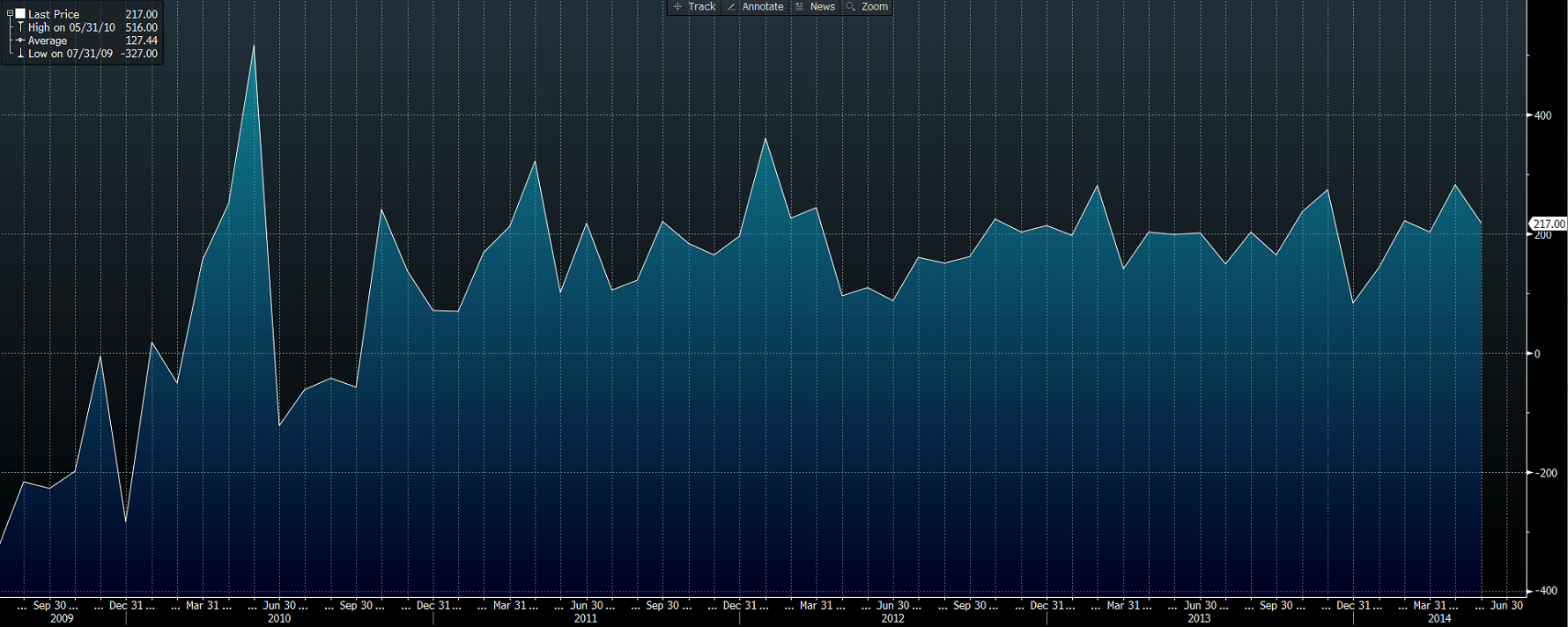

Additionally, the US dollar is set to make its mark, and many are expecting a bite back after the recent drop last week. Current forecasts for the USD show any expecting a slight rise in the manufacturing index (the darling child of the FED). Non-farm payroll is expected to post another 200k rise, which would be another great sign in the struggling economy. Despite the recent GDP figures showing weak growth, it’s silly to discount the U.S. economy at present as it's still churning along strongly.

Source: Bloomberg (US non-farm payroll)

So despite the AUD/USD continuing to climb, the ceiling at present is a sign that the market now believes that further momentum is likely to be on the downside as a result of the fundamental data at hand. If anything, market participants will be looking for further indication of a drift lower and that can be found on the RSI, which currently shows the buying pressure starting to move downwards as the market runs out of steam.

Overall, the AUD/USD is starting to look worth a watch and the prospect of it pushing its present trend line is certainly there. A push through the trend line would be advantageous for traders looking to test the support levels in play and would be a relatively easy play for most traders. I will be looking for that break through and probably a test of the 0.9205 level which is acting as the bottom of its present range, and hopefully a push through eventually.