The Australian dollar finally stemmed some of the bleeding on Tuesday, as the currency has moved up against the US dollar. Late in the European session, AUD/USD was trading at 0.9683. In economic news, the markets get their first look at key US data, with the release of CB Consumer Confidence. There are no Australian releases on Tuesday.

The Australian dollar flexed some muscle against the US dollar on Tuesday, which has become an increasingly rare site lately. The Aussie will want to forget about the month of May, which has seen the currency plunge about six cents against the US dollar. The greenback has taken advantage of the RBA interest rate cut, lukewarm Australian data and a budget which pointed to the high value of the Australian dollar as an impediment to economic growth. These factors have resulted in nervous investors shifting their funds to US assets, resulting in the Aussie plunging in value.

The Japanese government and BOJ have declared deflation to be enemy number one, and the BOJ has embarked on an aggressive monetary easing program, as it seeks to double the monetary base within two years. However, inflation indicators continue to point to deflation, despite these efforts. Corporate Services Price Index, which measures corporate inflation, actually worsened, as the indicator fell from -0.2% to -0.4%. Critics of the government’s agenda say economic growth cannot be created by monetary policy alone, and deflation continues to hobble the Japanese economy.

In the US, we continue to see ups and downs in US numbers, which has typified US releases in 2013. Last week saw mixed housing numbers, as Existing Home Sales missed the estimate, but New Home Sales looked very sharp. Unemployment Claims bounced back with a strong release, and the week ended with a rise in Core Durable Goods Orders. The mix of positive and weak releases churned out by the US has made it difficult to assess the extent of the economic recovery. The US Federal Reserve has hinted at scaling back QE, but has opted to stay the course with the current round of QE, which involves $85 billion in asset purchases each month.

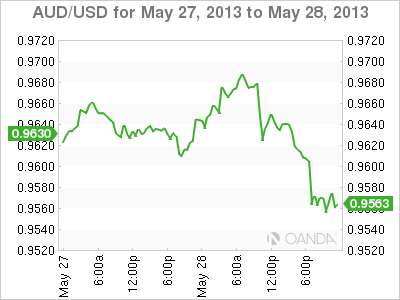

AUD/USD May 28 at 13:00 GMT

AUD/USD 0.9674 H: 0.9696 L: 0.9596 AUD/USD Technical" title="AUD/USD Technical" width="601" height="80">

AUD/USD Technical" title="AUD/USD Technical" width="601" height="80">

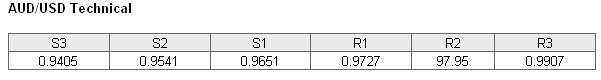

AUD/USD has moved higher, as the pair trades in the high-96 range. The pair is receiving support at 0.9651. This is a weak line, and could be tested if the US dollar shows any signs of recovery. This is followed by stronger support at 0.9541. On the upside, there is resistance at 0.9727. The next line of resistance is at 0.9795.

- Current range: 0.9651 to 0.9727

- Below: 0.9651, 0.9541, 0.9405, 93.28 and 92.21

- Above: 0.9727, 0.9795, 0.9907 and 1.00

AUD/USD ratio is showing very little movement in Tuesday trading. This is not reflected in what we are seeing from the pair, as the Aussie has posted gains against the US dollar. If the pair continues to show movement, we can expect the ratio to swing into action as well.

The Australian dollar has shown some improvement on Tuesday, as the Aussie tries to reverse the sharp losses it has sustained. We could see more activity from the pair, as the US releases key consumer confidence numbers later today.

AUD/USD Fundamentals

- 13:00 US S&P/CS Composite-20 HPI.

- 14:00 US CB Consumer Confidence. Estimate. 70.7 points.

- 14:00 US Richmond Manufacturing Index. Estimate 2 points.