AUD/USD

The AUD/USD continues its demise as it moves to another new low, this time touching just below 0.91 before rallying higher in recent hours. After all of its steady good work a couple of weeks ago which saw the AUD/USD steadily move higher from support at 0.93 back up to a one week high near 0.9450, the AUD/USD has since returned all of those gains and some moving down to the 2.5 month low. After settling around the 0.95 level for over a week earlier this month, the AUD/USD started to drift lower back towards the support at 0.93. Throughout most of October the AUD/USD enjoyed a solid and steady move higher from the support level at 0.93 up to the resistance level at 0.95 and beyond to a high around 0.9760. Throughout the first half of September the AUD/USD enjoyed a solid run which was punctuated by a strong surge higher sending it to a then three month high just above 0.95. A couple of months ago the AUD/USD had been trying valiantly to stay above the support level at 0.89 as all week it placed downward pressure but was unable to sustain any break lower. At the beginning of August it moved very well from three year lows to move back above the key level of 90 cents and beyond to a two week high just above 0.92 to finish out that week.

At the end of July the AUD/USD fell very strongly and appeared to resume the medium term down trend as it moved to a new three year low near 0.8850, but it reversed very well and looked poised to continue back towards the longer term resistance level at 0.93. For the most part of the last week, it moved very little and was quite subdued staying above the support level at 0.94. Throughout July the AUD/USD placed constant pressure on the 0.93 level again as it continued to place buying pressure on that level however the resistance there was able to stand firm. It was during this time it did very well to maintain its price level well above 0.92 as place upward buying pressure on the resistance level at 0.93. Throughout July, the AUD/USD spent most of its time trading between 0.90 and 0.93 threatening to break through either level at multiple stages. The 0.9150 level also became a key level during that time providing both some resistance and more recently support, and this was called upon again a few weeks ago providing some much needed support however it was completely ignored a couple of weeks ago as the AUD/USD fell heavily through it.

It was only a few months ago that many were waiting for the AUD/USD to break below the 90 cents level and then it would have been a matter of how far can it drop. It had continued to drift lower and move towards the 90 cents level, a level not seen for three years. Considering the speed of its decline throughout several months this year, the last couple of months has seen a significant slowing down and almost some consolidation as it has rested well on the support at 0.90 and now made its way back to 0.95. Throughout April to August, the AUD/USD established a strong medium term down trend with lower peaks and lower troughs, as it has moved from near 1.06 down to near 0.90 in that time. Up until mid April, the Australian dollar was enjoying its best move higher since October and November last year. After making a solid run higher in the middle of June back towards the key level of 0.97, the AUD/USD has since continued its strong and steady decline moving to below 0.90 and levels not seen since near the middle of 2010.

As the global economy continues to recover next year Australia will be left behind, according Goldman Sachs, which tips it as the only developed market likely to see lower growth. In a portfolio strategy research note published Monday, the global investment bank said they expect the world's 12th largest economy's to expand by 2 percent next year, slower than the consensus expectation of around 2.5 percent and down from 3.8 percent in 2012. "Relative to the acceleration forecast in the global economy, in Australia we expect economic growth to decelerate in 2014," the Goldman Sachs analysts said. With 22 years of consecutive growth Australia was the envy of the developed world, however many analysts have turned bearish on the economy amid a number of worrying headwinds. The most prominent concern has centered on the slowdown in the country's once booming mining sector, caused by declining demand from its major trading partner China. Many worry that Australia's non-mining sectors will not be able to pick up the slack. AUD/USD Daily Chart" title="AUD/USD Daily Chart" height="240" width="550">

AUD/USD Daily Chart" title="AUD/USD Daily Chart" height="240" width="550">

AUD/USD November 26 at 22:00 GMT 0.9126 H: 0.9204 L: 0.9088 AUD/USD Technical Chart" title="AUD/USD Technical Chart" height="240" width="550">

AUD/USD Technical Chart" title="AUD/USD Technical Chart" height="240" width="550">

During the early hours of the Asian trading session on Wednesday, the AUD/USD is trying to stay up after rallying higher from just below 0.91 in the last eight hours or so. Despite its strong recovery the last few months, the Australian dollar has been in a free-fall for a lot of this year. Current range: trading right around 0.9130.

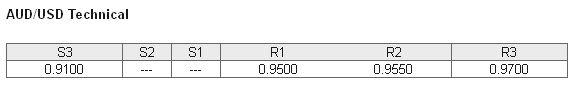

Further levels in both directions:

• Below: 0.9100.

• Above: 0.9500, 0.9550 and 0.9700. AUD/USD Position Ratios" title="AUD/USD Position Ratios" height="240" width="550">

AUD/USD Position Ratios" title="AUD/USD Position Ratios" height="240" width="550">

(Shows the ratio of long vs. short positions held for the AUD/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The long position ratio for the AUD/USD closes in on 70% as the Australian dollar continues to fall below the 0.92 level. The trader sentiment remains in favour of long positions.

Economic Releases

- 00:30 AU Construction Work Done (Q3)

- 09:30 UK GDP (2nd Est.) (Q3)

- 09:30 UK Index of Services (Sep)

- 13:30 US Core PCE Price Index (Oct)

- 13:30 US Durable goods orders (Oct)

- 13:30 US Durables ex defence (Oct)

- 13:30 US Durables ex transport (Oct)

- 13:30 US Personal income (Oct)

- 13:30 US Personal spending (Oct)

- 14:45 US Chicago PMI (Nov)

- 14:55 US Univ of Mich Sent. (Final) (Nov)

- 15:00 US Leading Indicator (Oct)