AUD/USD took a break for the Queen’s Birthday on Monday, but the time off did little to change the downward direction of the pair. AUD/USD continues to slump, and is trading in the mid-93 level in Tuesday’s European session. In economic news, Australian Home Loans and NAB Business Confidence did not impress the markets. In the US, it is a very quiet day, with just two minor releases – NFIB Small Business Index and Wholesale Inventories.

About the only sure-proof method of stemming the Australian dollar’s slide is to close the financial markets. This worked on Monday, as a holiday in Australia resulted in thin trading and little movement by the Australian dollar. However, the markets were back in action on Tuesday, and the Aussie resumed its downward journey. The struggling currency has now dropped to its lowest levels since September 2010. How low can the Aussie drop?

Tuesday’s Australian releases did not look sharp. Home Loans posted a gain of just 0.8%, much weaker than the 5.2% in the previous release. The estimate stood at 2.1%. NAB Business Confidence was also a disappointment, registering its second straight reading below zero, which indicates worsening conditions.

Will the Fed pull the trigger on QE? A lot will depend on US employment numbers, which were a mix of good and less good last week. ADP Non-Farm Payrolls slipped badly, as the key employment indicator missed the estimate for the third consecutive month. The indicator posted a reading of 135 thousand, well off the forecast of 171 thousand. Unemployment Claims managed to meet the estimate, but the market reaction was lukewarm. Non-Farm Payrolls was strong, climbing from 165 thousand to 175 thousand. This was above the market forecast of 167 thousand. However, the Unemployment Rate rose edged higher to 7.6%, above the forecast of 7.5%. With speculation growing that the Fed could scale back QE in the next few months, employment figures have taken on added significance. However, the Fed may decide to hold a steady course if the employment picture remains cloudy.

AUD/USD June 11 at 12:10 GMT

AUD/USD 0.9344 H: 0.9442 L: 0.9326

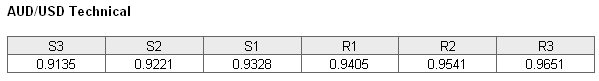

AUD/USD continues to struggle, and is trading in the mid-93 range. On the upside, the pair faces resistance at 0.9405. This is followed by resistance at 0.9541. This line has strengthened as the pair trades at lower levels. On the downside, the pair is receiving support at 0.9328. This line is under pressure and could break if the pair’s downward momentum continues. There is a stronger support line at 0.9221.

- Current range: 0.9328to 0.9405

Further levels in both directions:

- Below: 0.9328, 0.9221, 0.9135 and 0.9071

- Above: 0.9405, 0.9541, o.9651, 0.9727 and 0.9795

AUD/USD ratio continues to show no change, continuing the patter we saw on Monday, which was a holiday. Long positions make up most of the ratio, indicating that trader sentiment is strongly biased towards the pair undergoing a correction and moving higher.

The Australian dollar continues to drop, and is close to three-year lows. With no major US releases on Tuesday, we could see the pair settle down in the low or mid-93 range.

AUD/USD Fundamentals

- 1:30 Australian Home Loans. Estimate 2.1%. Actual 0.8%

- 1:30 Australian NAB Business Confidence. Actual -1 point

- 11:30 US NFIB Small Business Index. Estimate 93.4 points.

- 14:00 US Wholesale Inventories. Estimate 0.1%.