The Australian dollar continues to struggle, as it moves lower against the US dollar. In Monday’s European session, AUD/USD was trading in the mid-0.94 range. On Friday, US Non-Farm Payrolls beat the estimate, but the Unemployment Rate edged higher. Monday is a quiet day, as the Australian markets are closed for a holiday. The sole US release is a speech by FOMC member James Bullard.

The Australian dollar continues to lose ground and has shed around nine cents against the US dollar since the beginning of May. Last week, Australian key releases faltered, as Retail Sales, GDP and Trade Balance all missed their estimates. There was more bleak news on Thursday, as BlackRock, the world’s largest issuer of exchange traded funds, said that a number of U.S. hedge funds are lining up to short the struggling Australian dollar. Meanwhile, the Aussie got no help from Chinese key data. Chinese Trade Balance rose to $20.4 billion, but this was short of the estimate of $20.8 billion. Chinese CPI, the most important inflation indicator, dropped to 2.1%. The estimate stood at 2.4%. These weak numbers from Australia’s most important trading partner are not good news for the Australian currency.

US employment numbers were a mix last week. ADP Non-Farm Payrolls slipped badly, as the key employment indicator missed the estimate for the third consecutive month. The indicator posted a reading of 135 thousand, well off the forecast of 171 thousand. Unemployment Claims managed to meet the estimate, but the market reaction was lukewarm. Non-Farm Payrolls was strong, climbing from 165 thousand to 175 thousand. This was above the market forecast of 167 thousand. The Unemployment Rate rose edged higher to 7.6%, above the forecast of 7.5%. With speculation growing that the Fed could scale back QE in the next few months, employment figures have taken on added significance. However, the Fed may decide to hold a steady course if the employment picture remains cloudy. AUD/USD" width="400" height="300">

AUD/USD" width="400" height="300">

AUD/USD June 10 at 12:50 GMT

AUD/USD 0.9436 H: 0.9454 L: 0.9399 AUD/USD Technical" title="AUD/USD Technical" width="597" height="80">

AUD/USD Technical" title="AUD/USD Technical" width="597" height="80">

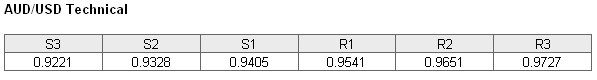

AUD/USD continues to struggle, and briefly dipped below the 94 line earlier on Monday. On the upside, the pair faces strong resistance at 0.9541. This is followed by resistance at 0.9641. On the downside, the pair is receiving support at 0.9405. This line is under pressure and could see more activity during the day. There is a stronger support line at 0.9328.

- Current range: 0.9405 to 0.9541

Further levels in both directions:

- Below: 0.9405, 93.28, 92.21 and 0.9071

- Above: 0.9541, o.9651, 0.9727, 0.9795 and 0.9907

AUD/USD ratio continues to show no change. The pair has shown little movement on Monday, but this is to be expected as the Australian markets are closed for a holiday. Long positions make up most of the ratio, indicating that trader sentiment is strongly biased towards the pair undergoing a correction and moving higher.

Weak US employment numbers on Friday did were of no help to the Aussie, which continues to struggle. We could see the pair remain subdued on Monday, with no data out of the US and the Australian markets closed.

AUD/USD Fundamentals

- 13:50 US FOMC Member James Bullard Speaks