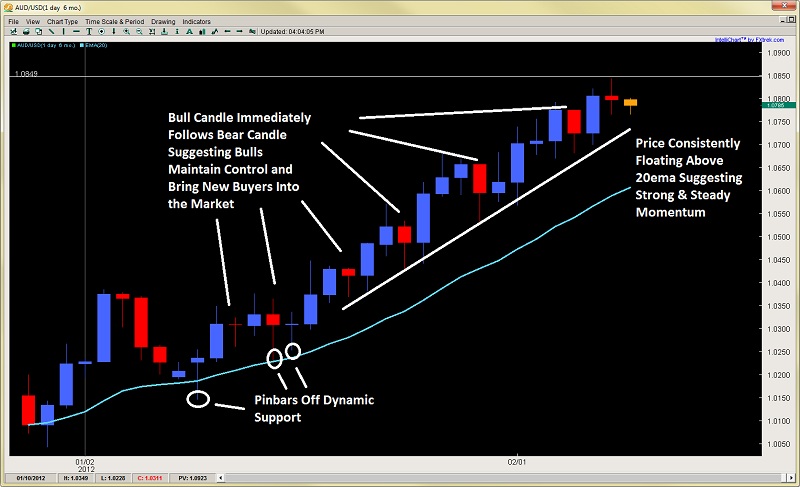

For the year, the AUD/USD has had an impressive run which shows in the numbers;

-19 Bullish Daily Closes (out of 29 or 65% Bullish Closing Ratio)

-Only 2x Were a Bearish Close Followed By Another Bearish Close (1st week of the year)

-Since then, every single Bearish Close has been followed by a Bullish Close

-Only 5 Out of Those 10 Bearish Close days took out the prior daily lows

All of these stats by themselves are impressive and communicate how consistently the bulls have been in control. From a price action perspective, it should be noted for the last month, anytime we get a daily bearish close, the next day is an up day. Also, when we get a bearish close on a daily basis, it only has a 50% chance of taking out the prior day’s low, suggesting the selling can 1 out of every 2x be somewhat tame and not take out many bulls in the process. Thus, all this communicates control and consistency on the part of the bulls. One statistics we’d like to point out is on the daily charts, over the last 10yrs, the AUDUSD has at a maximum floated above the 20ema (not touched it) for 34 consecutive candles. Currently, we are at 22, so we still have more to go before we hit our historical max. However, we are getting into the twilight of this move before we expect a pullback to the 20ema. So if we continue to see price float above the 20ema for another 7-10 candles, then we will expect a pullback shortly after.

One statistics we’d like to point out is on the daily charts, over the last 10yrs, the AUDUSD has at a maximum floated above the 20ema (not touched it) for 34 consecutive candles. Currently, we are at 22, so we still have more to go before we hit our historical max. However, we are getting into the twilight of this move before we expect a pullback to the 20ema. So if we continue to see price float above the 20ema for another 7-10 candles, then we will expect a pullback shortly after.

And rightfully so, taking a step back on daily charts below, we can see we are coming into some lofty levels for the pair. We have three key swing points above, such as;

1.0842 (today’s high)

1.1010 May 2nd, 2011 high

1.1082 All-Time High July 27th, last year So we are definitely coming into thinner air for the pair. Until we get a signal this trend is over, we will look for pullbacks to get back long on the pair, perhaps 1.0750/30 on an intraday level. Also close to the 20ema on the 4hr time frame may offer some good with-trend plays. As for targets, besides yesterdays high, you have the list above, but expect price action to saunter along at a casual pace. Why? We don’t expect too many bulls to be excited about piling on new positions, or new traders coming on board at this stage in the game, so watch for pullbacks and price action clues to get back into the trend. Any strong reversal bars will likely trigger profit taking for all who’ve been along for the ride, which could cause a sharp and fast drop in the pair. If we see back to back bear closes, or 1.0575 taken out, then we’d expect losses to accelerate and profit taking from a large portion of the stale longs still in play.

So we are definitely coming into thinner air for the pair. Until we get a signal this trend is over, we will look for pullbacks to get back long on the pair, perhaps 1.0750/30 on an intraday level. Also close to the 20ema on the 4hr time frame may offer some good with-trend plays. As for targets, besides yesterdays high, you have the list above, but expect price action to saunter along at a casual pace. Why? We don’t expect too many bulls to be excited about piling on new positions, or new traders coming on board at this stage in the game, so watch for pullbacks and price action clues to get back into the trend. Any strong reversal bars will likely trigger profit taking for all who’ve been along for the ride, which could cause a sharp and fast drop in the pair. If we see back to back bear closes, or 1.0575 taken out, then we’d expect losses to accelerate and profit taking from a large portion of the stale longs still in play.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

AUD/USD Coming Into Lofty Territory, But…

Published 02/09/2012, 12:41 AM

Updated 05/14/2017, 06:45 AM

AUD/USD Coming Into Lofty Territory, But…

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.