The AUD/USD cross is looking still bullish despite today’s announcements and data releases.

After an extended period of time of hollow talk and neutral stances, the Reserve Bank of Australia (RBA) today took the next step and actually talked down the Australian dollar. His comments of a “significant fall” in regards to it being overvalued weighed heavily on markets. However, it was not enough to break current technical patterns.

The next set of data was a little more revealing for the Australian dollar, as retail sales fell to -0.5% in the previous month. While building approvals shot up sharply to 9.9% m/m. This is an interesting development for the Australian economy, a stuttering economy and an aggressive housing market. It is a bit of a conundrum for an economy that is trying to find a way to recover, but at the same time has a housing market looking very aggressive. The RBA were inclined to take a swipe at the housing market;Sydney in particular, as the governor was quick to point out that “people should not assume that prices always rise. They don’t; sometimes they fall.”

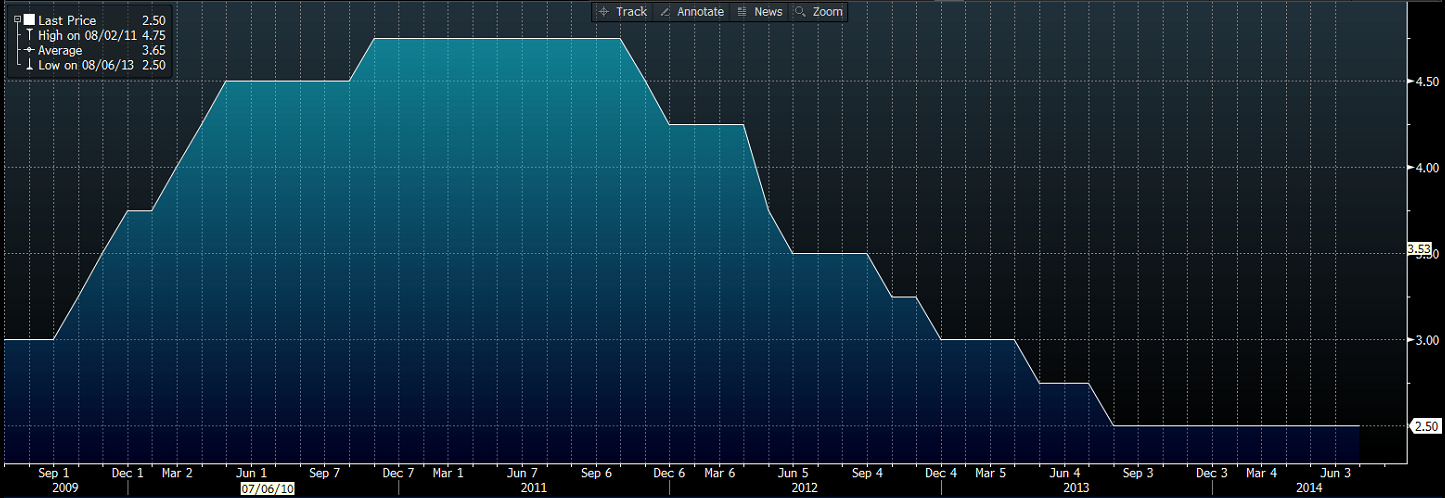

Despite all of this talk, it’s unlikely the RBA can slash rates heavily if at all as it sits at the record low of 2.50%, and any slashing of rates might stoke up the housing market further.

So with the currency higher, and the RBA wanting it to drop, there are not many options on the table. What is clear is that the RBA has spoken out against the Australian Dollar on a number of occasions and numerous times the markets have ignored it as hollow; especially given the RBA’s neutral stance in the marketplace.

The Australian dollar on the charts and using technical patterns is interesting to say the least. Let’s take away the fundamentals and we suddenly have a very strong bullish channel racing up the charts. The question is will it break; probably not in the present state. It’s more than likely that today’s touch is just a testing of dynamic support from the trend line and we will see moves to go higher when the market goes back to risk taking.

Tonight’s non-farm payroll will certainly test the trend line though, but momentum upwards might be an easy one to catch if it’s positive. Either way I expect the channel to hold in the long term until we see actual action from the RBA.