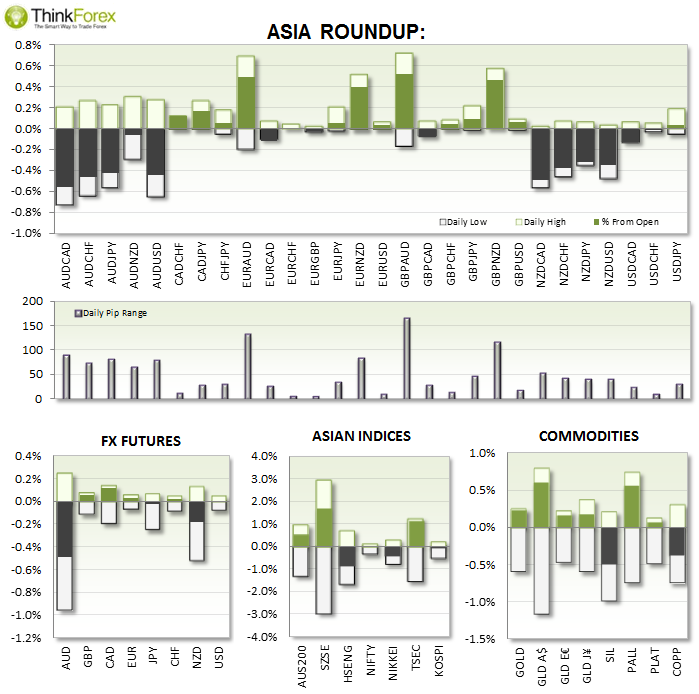

AUD: GDP figures put another nail on the Aussie coffin to see AUD/USD break to fresh 4-year lows. Eyes will be on employment data tomorrow to provide it even the slightest bit of hope.

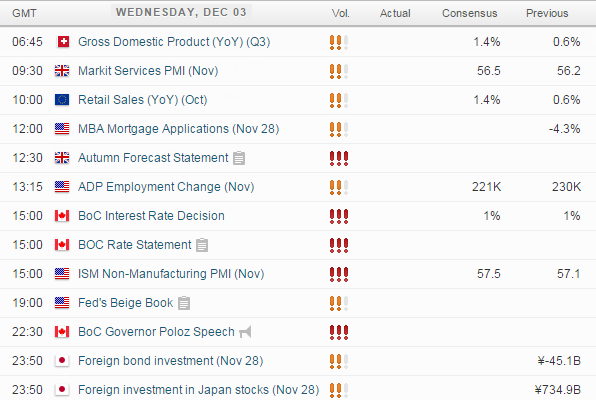

UP NEXT:

Lots of potential here for some good moves. EUR retail sales are expected to see a 1.4% increase on top of the previous 0.8% so this leaves room for the inevitable disappointment whilst EUR/USD meanders near multi-year lows.

Bank of Canada are likely to present us with a 'less Dovish' statement which should be CAD cross bullish. It is a shame Oil prices have plummeted because data from Canada has been strong recently.

ADP employment is the prequel to Friday's NFP but the headline figure from US will be manufacturing. US Dollar Index is still near the 4-year highs so there is room for a shock here if it comes in low enough, but I suspect we'll get a strong figure here to push USD to new highs.

Later on the US release the Beige Book. Whilst not a tradable release in its own right many analysts will be scouring through this report to decipher what state the economy is in.

TECHNICAL ANALYSIS:

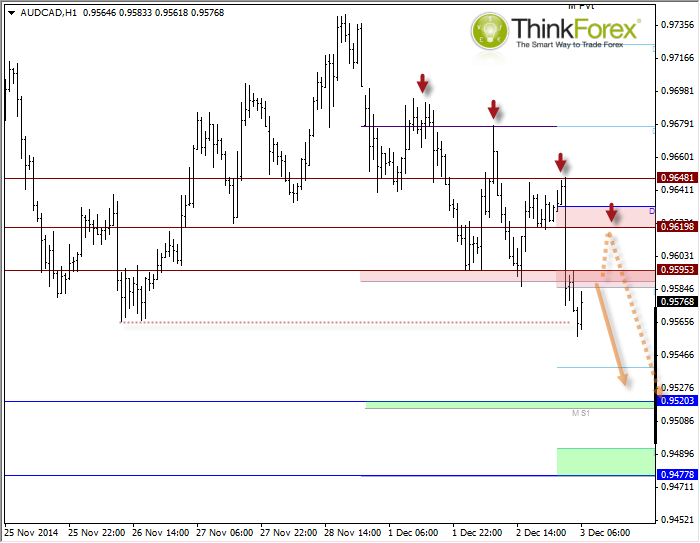

AUD/CAD: Just a question of how deep a retracment before losses resume

With Bank of Canada due to talk tonight and the overwhelmingly bearish sentiment for Aussie pairs, then AUD/CAD is a pair worth of watching for both fundamental and technical reasons.

Price has recently broken below the November lows and forming a series of lower highs and low. Even if price does rally I doubt it will muster up the strength to break above the 0.9648 high to threaten the trend.

So for me it is just a question of how deep the retracement will be.

If BoC provides a dovish speech then I would expect a deeper pullback and still seek to fade the move for a break to new lows.

If we see a less Dovish statement then we may see 0.960 hold as resistance and for the decline to continue.

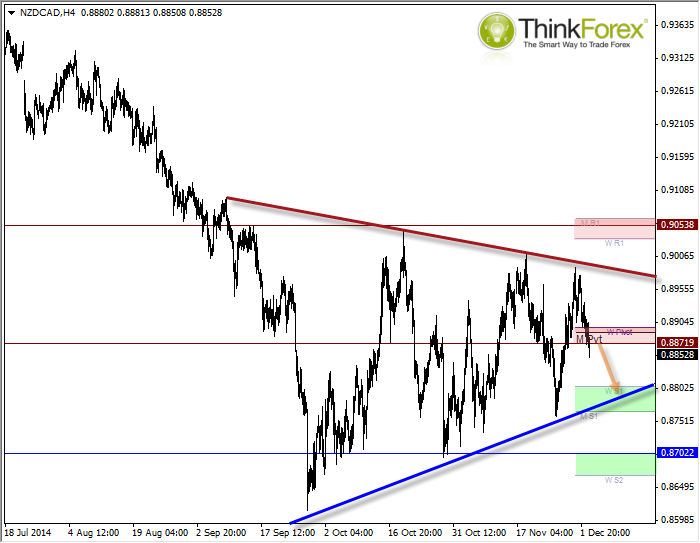

NZD/CAD

Now within the lower half of the suspected triangle we can use the confluece of resistance around 0.8870-90 to aid with entry and stop placement, to trade down to the lower end of the triangle.

That's pretty much it.

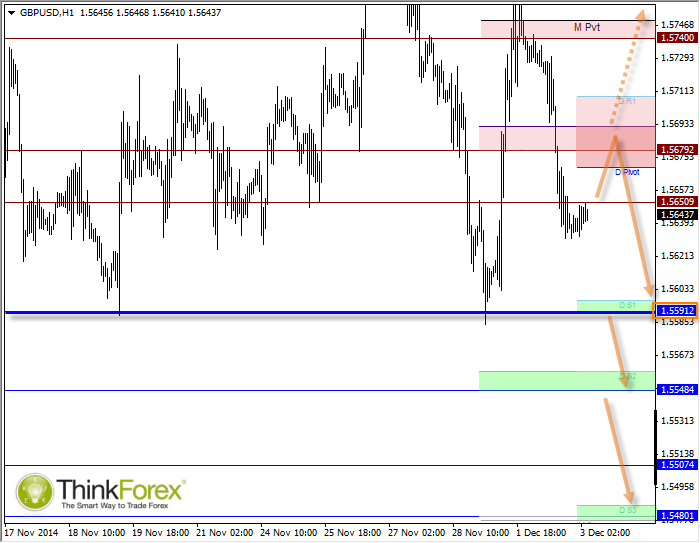

GBP/USD: Not pretty but still has potential

The logic behind this move is we are now en route to the multi-month lows and price is forming a suspected bear flag below the daily pivot.

If we see price rally there is a wide range I have highlighted that may act as resistance to consider sell-setups.

I would expect there to be plenty of stops below 1.5590 so if this area does break, it should continue south fairly quickly.