AUD/USD is trading in a narrow range, continuing the trend which started on Wednesday. The pair is trading in the low-89 range in Friday’s European session, as the Australian dollar continues to struggle. In economic news, Australian Private Sector Credit was steady and matched the forecast. In the US, US Preliminary GDP posted a strong gain and Unemployment Claims was very close to the estimate.

The markets reacted nervously this week as a US military strike against Syria appeared imminent. The US had declared that it would respond to a chemical attack, apparently by the Syrian government, which killed hundreds of civilians. The euro dropped sharply, losing about 150 points over the past two days. However, there is now a strong possibility that a strike by the US could be postponed until mid-September. On Thursday, the British parliament voted by a narrow margin not to join any US attack on Syria, and other US allies do not want to take any action before the UN has a chance to review data collected by UN inspectors in Syria. This complicates President Obama’s attempts to solidify a coalition before taking military action. On Friday, the markets have steadied and the euro has halted its recent slide against the dollar.

US releases have been in all direction this week. On Wednesday, US Pending Home Sales was a disappointment, but Thursday’s key releases looked solid. Preliminary GDP posted another strong gain of 2.5% in Q1, after a 2.4% rise in Q1. Unemployment Claims dropped slightly to 331 thousand, just shy of the estimate of 330 thousand. These strong numbers, especially the positive Unemployment Claims release, will likely fuel speculation in the markets that the Federal Reserve could taper QE in September rather than later in the year, so we could see the dollar post gains against the euro.

The Federal Reserve has kept mum as to when it plans to taper QE, but recent statement from Fed policymakers underscore the divisions regarding the timing of such a dramatic move. Dennis Lockhart, head of the Atlanta Fed, said that tapering could start in September, but only if US data justified such a move. There was a more hawkish statement from James Bullard, head of the St. Louis Fed. Bullard said that there was no need for the Fed to rush into QE tapering. Meanwhile, the uncertainty over QE tapering has boosted the US dollar, raised the yields on US treasury bonds and led nervous investors to pull billions of dollars out of emerging markets. With September just around the corner, we could see strong volatility in the markets as speculation over QE heats up. AUD/CAD" width="400" height="300">

AUD/CAD" width="400" height="300">

AUD/USD August 30 at 11:20 GMT

AUD/USD 0.8932 H: 0.8979 L: 0.8904

- AUD/USD is showing very little activity in Friday trading as it continues to trade in the low-89 range.

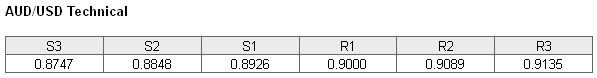

- AUD/USD continues to face resistance at the critical 0.90 line. This is followed by a resistance line at 0.9089.

- On the downside, the pair is testing support at 0.8926. This line could fall if the Aussie loses more ground. This is followed by strong support at 0.8848. This line has remained intact since January.

- Current range: 0.8926 to 0.9000

- Below: 0.8926, 0.8848, 0.8747 and 0.8578

- Above: 0.9000, 0.9089, 0.9135, 0.9221 and 0.9328

AUD/USD ratio is almost unchanged in Friday trading, continuing a trend we have seen since Wednesday. This is reflected in the pair’s movement, as the pair is showing very little movement. The makeup of the ratio shows a solid majority of long positions, indicating that trader sentiment is strongly biased towards the Australian dollar posting gains against the US currency.

The Aussie remains under pressure as it trades below the critical 0.90 line. With no key releases out of the US on Friday, we could see AUD/USD continue to trade quietly in the North American session

AUD/USD Fundamentals

- 1:30 Australian Private Sector Credit. Estimate 0.4%. Actual 0.4%.

- 12:30 US Core PCE Price Index. Exp. 0.2%.

- 12:30 US Personal Spending. Exp. 0.3%.

- 12:30 US Personal Income. Exp. 0.3%.

- 13:00 US FOMC Member James Bullard Speaks.

- 13:45 US Chicago PMI. Exp. 53.2 points.

- 13:55 US Revised UoM Consumer Sentiment. Exp. 81.2 points.

- 13:55 US Revised UoM Inflation Expectations.

.