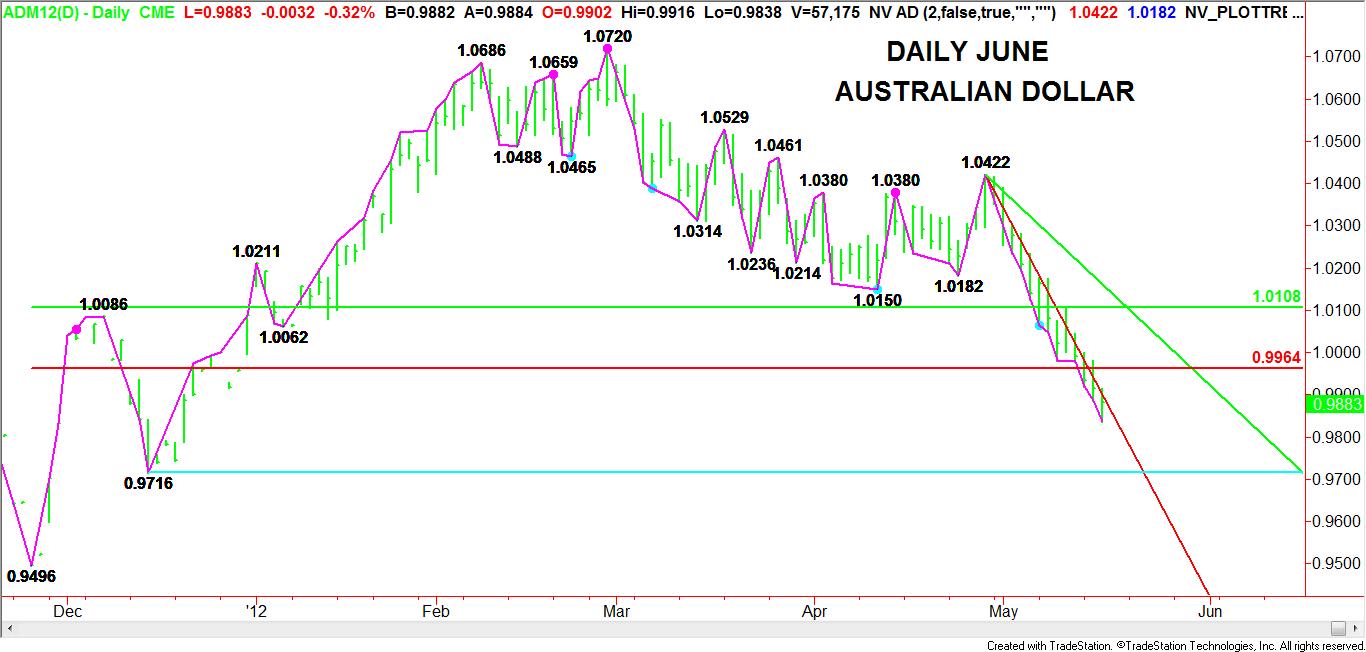

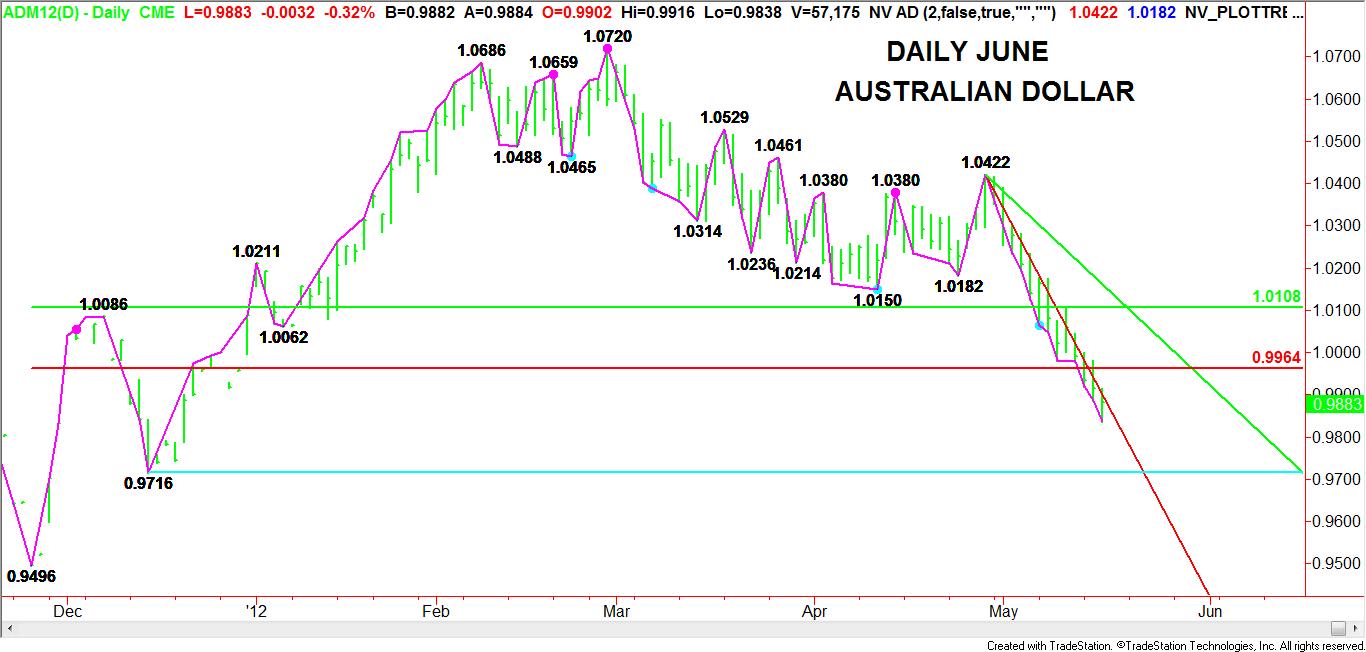

Early in the trading session on Tuesday, the June Australian Dollar was making an effort to form a bottom. Not only was it attempting to crossover to the bullish side of a downtrending Gann angle and regain a Fibonacci retracement level, but it was also attempting to form a closing price reversal bottom.

All of these scenarios were negated when the market turned south late in the trading session, falling below the angle and retracement level while erasing all possibilities of a closing price reversal bottom.

With the downtrend firmly intact, the June Australian Dollar is likely to continue to break until it reaches the main bottom from December 14, at .9716. The downtrending Gann angle that the market has been walking down since topping on April 27 at 1.0422 is at .9902 today. This angle, dropping .004 per day, should continue to be resistance as well as a guide to lower prices. Crossing to the bullish side of this angle will be a sign of a short-term bottom, but not a change in trend.

All of these scenarios were negated when the market turned south late in the trading session, falling below the angle and retracement level while erasing all possibilities of a closing price reversal bottom.

With the downtrend firmly intact, the June Australian Dollar is likely to continue to break until it reaches the main bottom from December 14, at .9716. The downtrending Gann angle that the market has been walking down since topping on April 27 at 1.0422 is at .9902 today. This angle, dropping .004 per day, should continue to be resistance as well as a guide to lower prices. Crossing to the bullish side of this angle will be a sign of a short-term bottom, but not a change in trend.