The Australian Dollar found concerted selling today as a highly negative CAPEX report crushed the currency. However, the move wasn’t a surprise to technical traders given that the AUD had entered a reversal zone and the pair now faces further selling that could see it falling back towards the lows of early November.

Fundamentally, the Australian economy is facing some significant headwinds as Capital Expenditure has apparently diminished significantly by 9.2% q/q and nearly 20% y/y. Given the severity of the contraction, it is almost assured that GDP growth for the embattled commodity exporter will be revised into 2016. Subsequently, there is plenty of negative fundamental information hitting the wires for bearish traders to smile at.

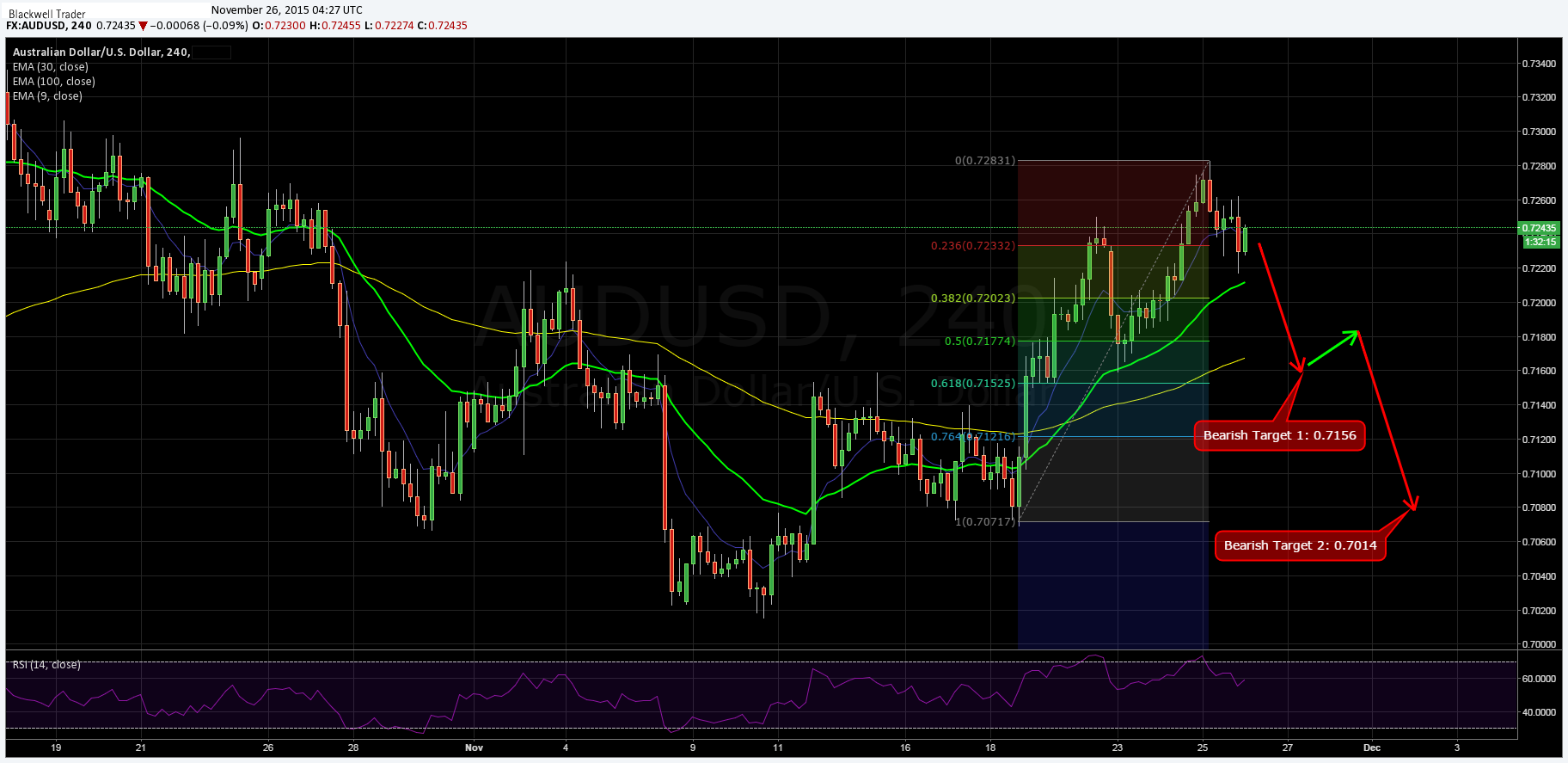

From a technical perspective, the move wasn’t surprising given the fact that traders were keenly watching the 73 cent handle for signs of a reversal. Currently, the pair has declined to trade around 0.7240 but there are some concerning signs looming that point to a short move in play.

RSI(7) has started to trend strongly lower, out of overbought territory, and looks to confirm the view that the pair is under the grips of the bears. Price action has also just broken below the 12 EMA and is subsequently eyeing the bearish trend line back around the 0.7138 level which also happens to coincide with the 38.2% Fibonacci level.

Subsequently, given the increased selling activity, an additional bearish leg to complete the ABCD setup is likely. Any additional bearish leg would likely focus upon 0.7156 and 0.7014 as potential target points for a reversal and completion of the trend. However, watch out for any correction given that there appear to be plenty of buyers on the order book between 0.7150 and 0.7170