The Australian dollar has been strongly bullish of late as the pair has benefitted from sentiment swings from the relatively uncertain FOMC outlook. However, despite the rally over the past month, price action has broken lower indicating that the pair could be preparing for a short side push.

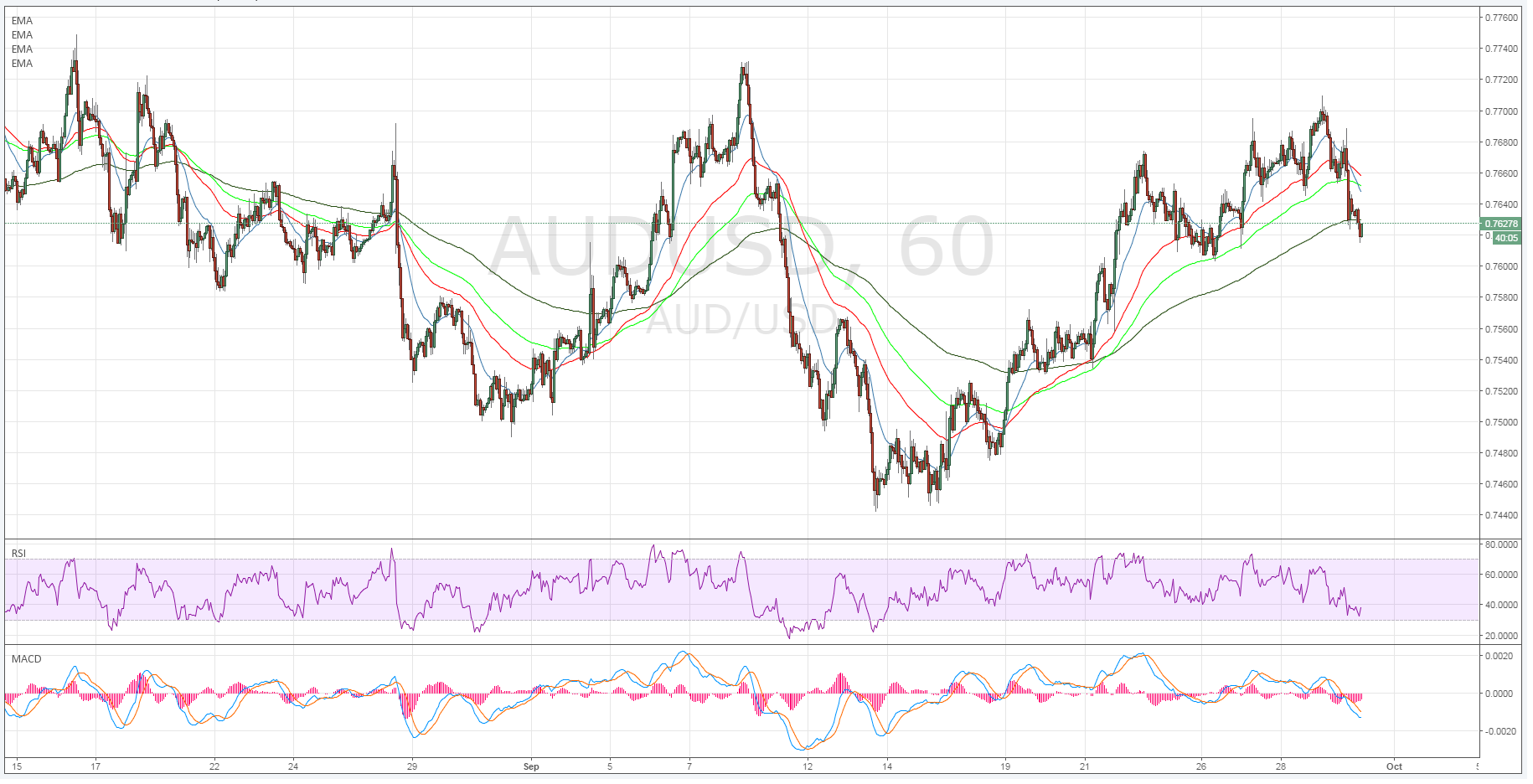

Taking a look at the technical indicators shows price action having recently broken down and tumbled below the 200-Hour MA. In addition, the RSI Oscillator has continued to trend lower within neutral territory. MACD has also been relatively depressed in recent days as the signal line remains bearishly depressed. However, the pair is now nearing a key support zone that is likely to be a critical line of defence for the Aussie dollar.

Subsequently, monitor the 0.7600 reversal zone closely as a move below this level is likely to signal further falls ahead. In fact, the probable downside target is the 0.7530 mark and 0.7480 if the bearish move gathers momentum. However, the pair will need to make a concerted break of the current support zone as there are plenty of bids around this area.

Subsequently, keep a close watch on the pair in the coming days for any signs that a pullback is in progress. In fact, there is a real chance for a short play to materialise given some of the fundamental factors also impacting the pair.

It’s unlikely that the US Fed’s rhetoric on rate hikes is about to end anytime soon which will continue to keep the AUD under pressure in the near term. However, keep a close watch on the US Chicago PMI and Final Michigan Consumer Sentiment data due out shortly as the market is looking for hints as to future Fed policy and is therefore likely to grasp at any potentially bullish economic results.

Ultimately, the AUD is likely facing further short side moves given the confluence of technical and fundamental indicators present. In fact, the RBA has said they believe the Aussie dollar is overvalued which is likely to further spark a sentiment move away from the AUD. Subsequently, watch the next 24 hours closely as it’s likely to determine the near term trend.