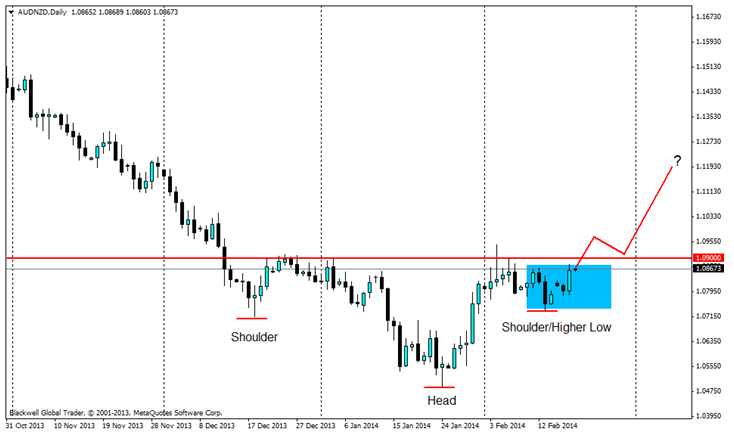

Let’s take a break from all the indicators and fancy stuff we put on our charts and look at price action on the AUD/NZD D1 chart.

AUD/NZD Daily" title="AUD/NZD Daily" height="242" width="474">

AUD/NZD Daily" title="AUD/NZD Daily" height="242" width="474">

It is quite plain that:

a) A reverse head and shoulders patterned has formed at the bottom of the downtrend

b) The 18/02 daily candle is a strong bullish one threatening the neckline of the price structure

c) The 2nd shoulder is higher than the previous one

d) This price action structure is not to be taken lightly as it has a range of 400 pips

I would start to take extra notice of price action within the highlighted area to watch for potential breakout setups on an intraday basis (to go long) as well as potential setups that reject the 1.09 level (to go short). I am, however, leaning toward a more bullish outlook for this pair as there has been a mid-term bullish trend since the beginning of Feb and I am a trend trader.

Technical Exam of AUD/USD and NZD/USD

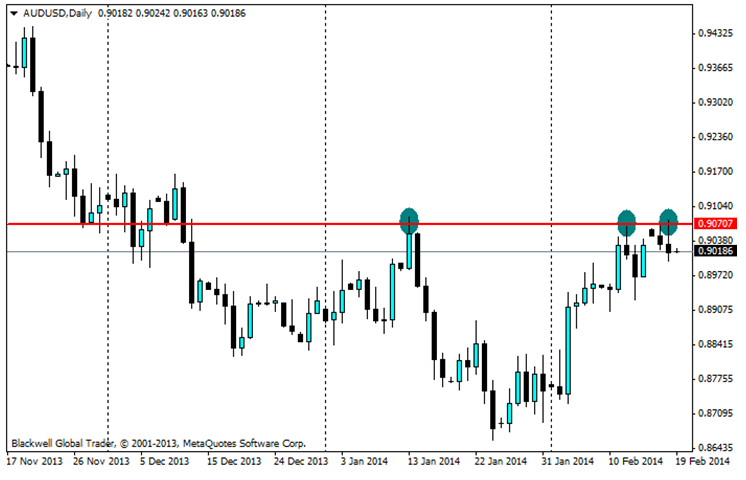

To try and understand the order flow behind the AUD/NZD, I turn to look for clues within the AUD/USD and NZD/USD. It is my opinion that both these pairs are technically supporting the AUD/NZD reversal pattern.

On one hand, we have the AUD/USD testing the 0.9070 resistance for the 3rd time with a weaker rejection off each successive test.

AUD/USD Daily" title="AUD/USD Daily" height="242" width="474">

AUD/USD Daily" title="AUD/USD Daily" height="242" width="474">

On the other hand, we have a NZD/USD that hates going above 0.8400 with a passion and has been trading in the 0.8080 – 0.8400 range for almost 3 months now.

NZD/USD Daily" title="NZD/USD Daily" height="242" width="474">

NZD/USD Daily" title="NZD/USD Daily" height="242" width="474">

A potential breakout to the upside on the AUD/USD, coupled with the recent rejection of the 0.8400 resistance of the NZD/USD, with some room to the downside, could spell a good long for the AUD/NZD in the coming days.

Fundamentals

The recent minutes by the Reserve Bank of Australia (RBA) emphasised a shift towards a “neutral” monetary policy stance. As such, there is a high likelihood that interest rates remain stable. Speculators might be hoping that the RBA’s shift from an easing bias to a more neutral one is a positive sign for the Australian economy, regardless of the bad job numbers.

In New Zealand, Retail sales data came out worse than expected, printing in 1.2% instead of the forecasted 1.7%. There has also been a softening in wholesale interest rates as Westpac brings itself in line with ASB’s and BNZ’s lower fixed home loan rates. Further, Finance Minister Bill English has been quoted in local news saying that the Kiwi may be 20% overvalued. All these factors certainly are doing no favours for the Kiwi.

Conclusion

Considering all the factors highlighted above, the AUD/NZD is something you might want to keep an eye of for opportunities. I for one, am looking really closely for intraday triggers. More particularly, a breakout pullback trade off the neckline of the reverse head and shoulders.