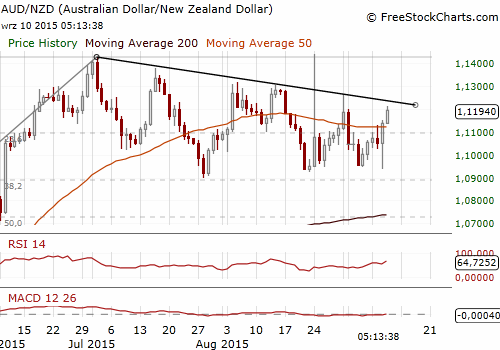

AUD/NZD: Profit Locked In At 1.1115

(long for 1.1300)

- The Reserve Bank of New Zealand (RBNZ) cut its official cash rate by 25 basis points to 2.75% as widely expected.

- RBNZ governor Graeme Wheeler was much more dovish than expected. He said: “Some further easing in the official cash rate seems likely (…) This will depend on the emerging flow of economic data.” He added that weak dairy prices and plummeting business and consumer confidence were weighing on growth. The RBNZ cut its outlook for global growth in its quarterly policy statement, and outlined a scenario where a sluggish Chinese economy might push New Zealand's OCR towards 2.0% in the next year - which would be a record low. The RBNZ said falls in the NZD helped support some growth, but it needed to fall further to offset to lower commodity prices, particularly for dairy exports.

- The kiwi was rising ahead of the RBNZ decision, as there was a slight risk of keeping interest rates unchanged. We used lower AUD/NZD levels to get long at 1.0985, in line with our trading strategy. The RBNZ statement was much more dovish than expected and the kiwi fell substantially soon after the bank’s decision.

- On the other hand, Australian macroeconomic data supported the AUD, as we expected. The Australian economy created more jobs than expected in August. Employment rose by 17.4k in August, well ahead of the median economists' forecast for a rise of 5k. The reading was even better than our forecast of 9k. Crucially, most of the increase came from full-time positions, which climbed 11.5k.

- Australian unemployment rate edged down to 6.2% in August, as expected, off a 13-year high of 6.3% in July. Thursday's data showed the participation rate edged down to 65.0%, from 65.1%. The employment-to-population ratio, which expresses the number of employed persons as a percentage of the population aged 15 years and over, held steady at 61.0 percent in August.

- The central bank of Australia kept interest rates unchanged at its recent meeting and no changes in its monetary policy are expected in the near future. Employment report is consistent with recent Reserve Bank of Australia rhetoric.

- As a result of dovish RBNZ statement and strong Australian jobs report, the AUD/NZD jumped above 1.1200. We have locked in our profit at 1.1115, just below the support level at 1.1129, high on September 8.

- Dovish comments from the RBNZ had initially short-term negative influence on the AUD. We used lower AUD/JPY levels to get long on this pair at 83.40, in line with our trading strategy. We have locked in profit on our AUD/JPY long at 84.45.

Significant technical analysis' levels:

Resistance: 1.1259 (high Aug 31), 1.1415 (high Aug 24), 1.1429 (high Jul 2)

Support: 1.1129 (high Sep 8), 1.1040 (session low Sep 10), 1.0943 (low Sep 9)