Market news has been pretty hectic early on in the morning as the market felt the pressure of the RBNZ and unemployment data out of Australia.

The RBNZ this morning managed to shoot itself in the foot after keeping interest rates neutral at 3.5% - this was no surprise to the market. What was a surprise for the market was the RBNZ talking up growth prospects and sounding hawkish for a change, and then at the same time trying to talk down the dollar; which the market almost totally ignored. If I were Graeme Wheeler I would be second guessing this morning as he seems to have a mandate to drive down the dollar if possible – the only problem is he seems to be lacking the ability after those comments.

Now the Aussie economy actually had a decent day for once, and markets were generally positive after the recent unemployment rate stayed flat at 6.3% and unemployment figures lifted to 42.7k. The only problem with this figure is that we saw 1.8k full time jobs created while the rest were part time jobs. Not exactly good stuff for a struggling economy, and even then I’m apprehensive when it comes to part time figures given the strange readings from Australian employment data in the past few months.

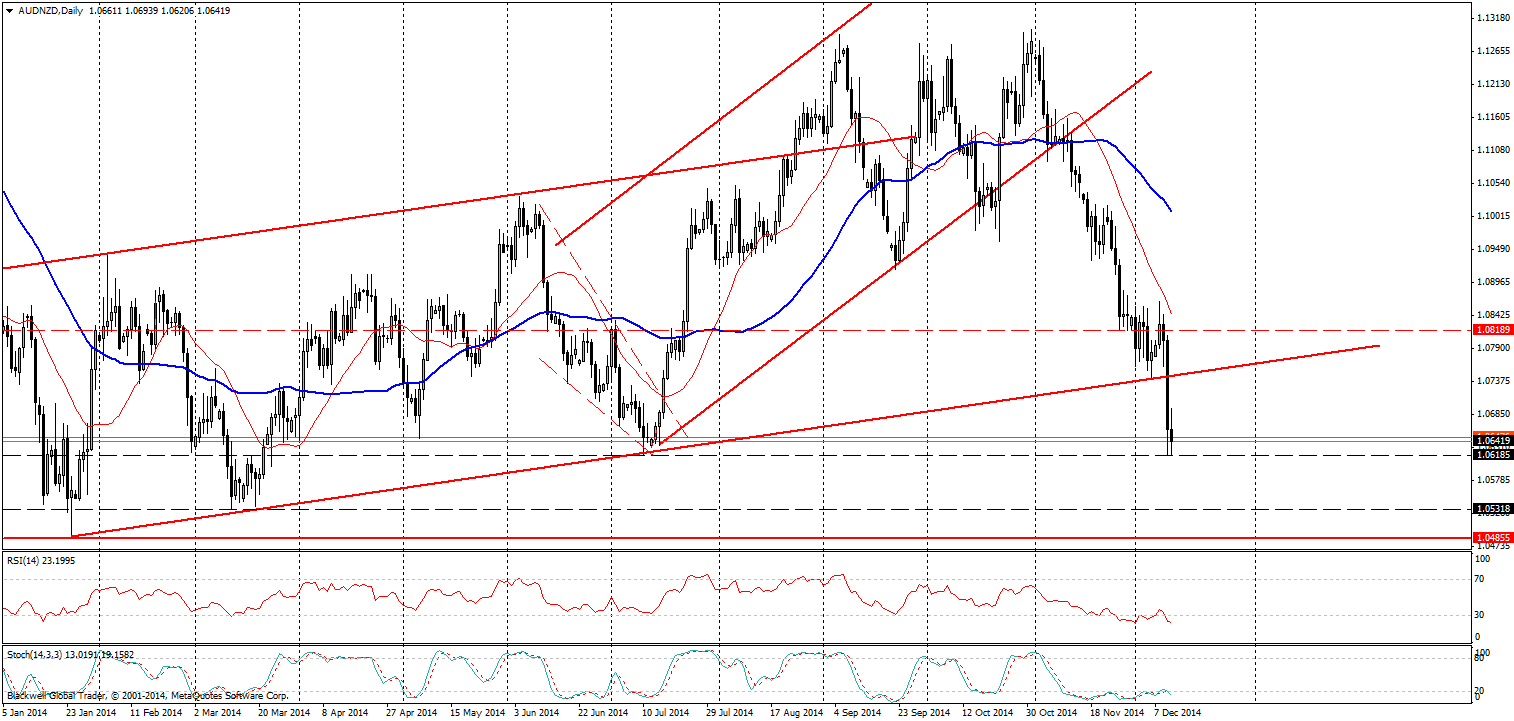

The charts for the AUDNZD tell the full story of one economy in more danger than the other. Many have predicted a strong recovery for the AUDNZD, but so far it has broken through trending channels on economic news. The level touched today at 1.0618 has seen strong support whenever the market has come close and markets tonight may be looking to pull back sharply on the charts.

If this does break through then we could see a very sharp touch at 1.0531, if this breaks down further we could see a fall to 1.0485. This would be the point of no return for a bit if we saw a push through here, there may be some support even lower at 1.0286 but even then it would be hard to stop that much momentum.

Overall, there is a lot to gain from the AUDNZD at the moment. Long term forecasts are predicting it picks up historically as it has always done and I believe it will as well after it finds support on the charts, its just more a matter of time in this case.