The Aussie dollar took a hit today as unemployment data was negative for the Australian economy, with the month of January coming in at -3.4K (15k expected) which was a little up from the last month’s unemployment data at -22.6k. However, the jobless rate has continued to climb in the short term and is now sitting at 6%. It’s certainly a blow to the Australian economy as of late.

The Australian unemployment data will evidently cast a shadow over the recent Reserve Bank of Australia’s (RBA) outlook, where it increased forecasts for growth. It may also encourage the RBA to act rather than remain on the sidelines as it is in the present moment. Either way, we may see some tough talking come the next RBA monetary policy meeting and traders will certainly be on the look out regarding it.

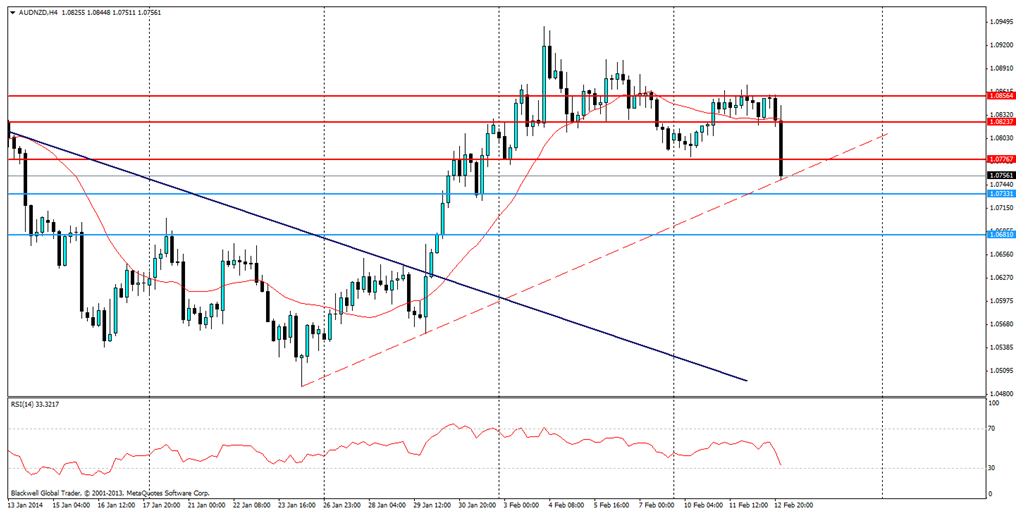

The AUD/USD plummeted heavily, breaking its 4H trend line and signalling lower movement. However, the AUD/NZD, which I think is a great opportunity, did not break its current trend line on the 4H chart.

AUD/NZD" title="AUD/NZD" height="242" width="474">

AUD/NZD" title="AUD/NZD" height="242" width="474">

The current bullish trend line has so far held out against attacks from the diving of the Aussie dollar against the Kiwi, as traders look to hold their ground against rapid rises. However, it may not hold only the next few hours and any close through the trend line should be a signal of the bears taking hold.

Current resistance levels can be found at 1.0776, 1.0823 and 1.0856. These levels look likely to offer stiff resistance as the AUD/NZD climbs back up off its current trend line. Support levels can be found at 1.0733 and 1.0681, though it's unlikely they will be tested unless we see a breakthrough of the trend line. It’s more than likely that the current trend line will act as dynamic support for the currency pair.

It’s also worth noting the current 20 day moving average is certainly acting as support and resistance for the AUD/NZD when we have periods of low volatility and markets are unable to find direction.

Overall, the AUD data is bad news for the Australian economy, and could lead to more aggressive action from the RBA, especially given how high the AUDUSD is. Despite this, the AUD/NZD still looks likely to be a great trading opportunity on the 4H and D1 chart, and traders should look to catch bullish movements of the trend line in the coming 24-48 hours.