EUR/USD

The Euro averts immediate downside risk, on a bounce from 1.2360 lows, where double-bottom is under formation and offering solid support for now. Yesterday’s positive close signals possible stronger recovery attempts, however, bounce stays for now capped under initial barrier and first breakpoint at 1.2450, broken bull-channel support / Fibonacci 38.2% of 1.2597/1.2360. Break here to open 1.2480, 50% retracement / daily Tenkan-sen line and psychological / Fibonacci 61.8% barrier at 1.2500, above which to confirm recovery. Hourly indicators are struggling above the midlines, while negative tone prevails on a larger timeframes and sees limited upside action for now. Unless the price returns above 1.25 barrier, which would expose pivotal 1.26 barrier in the near-term, prolonged consolidative phase is expected to precede fresh attempts lower. Break below 1.2360 base to resume broader downtrend and look for key targets at 1.2100, trendline support and 1.2042, low of 24 July 2012.

Res: 1.2450; 1.2480; 1.2500; 1.2541

Sup: 1.2416; 1.2395; 1.2372; 1.2360

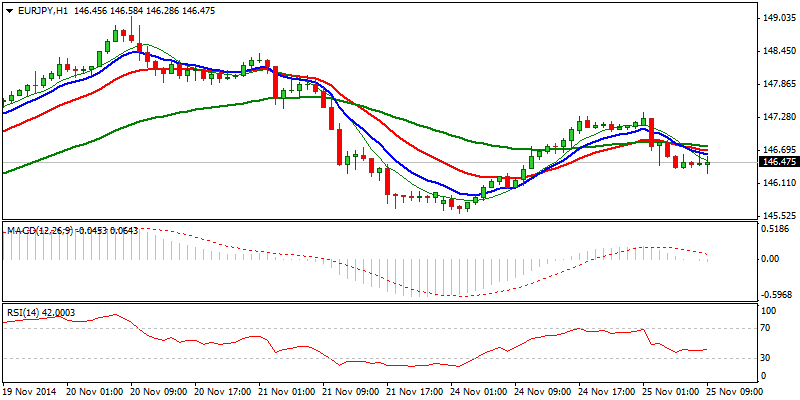

EUR/JPY

The cross ended yesterday’s trading in positive mode, closing above 147 handle, after pullback from 149.12, Shooting Star top, was contained by rising daily 10SMA at 145.67. Subsequent bounce failed for now to sustain gains above 147 barrier, stalling at 147.35, 50% retracement of 149.12/145.57 descend. Weak near-term studies still see downside at risk for stronger correction, signaled by overbought daily technicals. Further easing and violation of 146.25/00 supports, would increase risk of failure swing formation, which requires confirmation on a slide below 145.67 low. Otherwise, renewed strength above 147.35, to confirm low at 145.57 and signal further recovery, as overall picture remains bullish.

Res: 147.00; 147.35; 147.75; 148.00

Sup: 146.37; 146.00; 145.57; 145.28

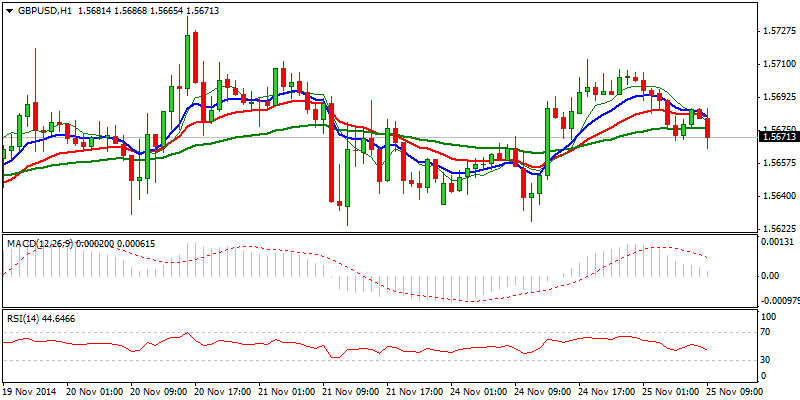

GBP/USD

Cable remains in extended consolidation above fresh lows at 1.5590, with current range tops being reinforced by descending 4-hour 55EMA. Yesterday’s Outside Day, along with crack of initial dynamic barriers of the daily chart, 10SMA and Tenkan-sen line, would mark near-term base and signal stronger recovery. Today’s close above congestion tops at 1.5735, is seen as minimum requirement to spark corrective action. Regain of the next significant barrier at 1.58, Fibonacci 61.8% of 1.5939/1.5588 downleg, to confirm and open pivotal 1.5939, lower top. However, caution is required as near-term studies show improvement but larger picture remains bearish, Repeated failure at range ceiling, to signal prolonged consolidation, with downside risk in play.

Res: 1.5712; 1.5735; 1.5765; 1.5805

Sup: 1.5624; 1.5590; 1.5550; 1.5505

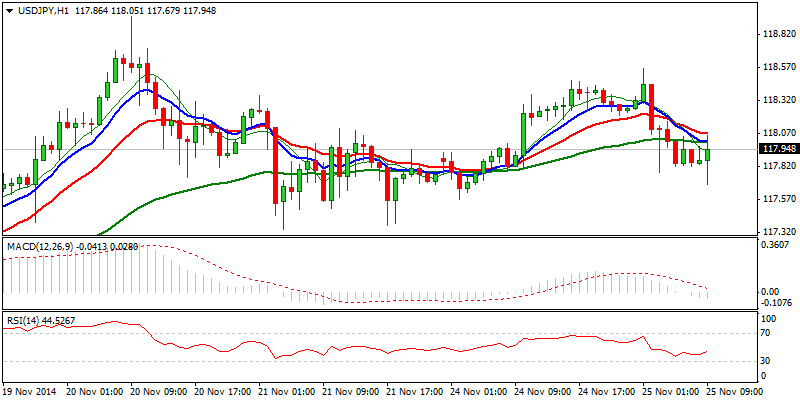

USD/JPY

Near-term structure weakens, as recovery attempts off 117.33 low, where the pair attempts higher base, failed to sustain gains above 118.35 lower tops and subsequent weakness increases risk of fresh attack at 117.33. The price probes below hourly cloud base at 117.75, the last significant support ahead of 117.33, below which to complete hourly failure swing for stronger pullback, as daily studies are overbought. Sustained break below 117.33 to open 117.10/00, daily Tenkan-sen line / psychological support, with 116.51, Fibonacci 38.2% of 112.56/118.96 ascend, in extension. Alternative scenario requires break above 118.56, overnight’s recovery rejection, to re-focus pivotal 118.96 top.

Res: 118.00; 118.20; 118.56; 118.71

Sup: 117.68; 117.33; 117.10; 117.00

AUD/USD

Near-term structure turned bearish after the pair completed 5-day corrective rally from 0.8564 to 0.8720. Return to 0.8564 low, also cracked near-term bull-trendline, connecting 0.8539/0.8564 lows, exposing pivotal 0.8539 support, 07 Nov low. Yesterday’s close in red confirms negative stance for eventual completion of 0.8539/0.8794 correction. Break lower to signal an end of near-term consolidative phase and resumption of larger downtrend, towards next targets at psychological 0.8500 level and 0.8460, bear-trendline, connecting 2008 peak at 0.9848 and Jan 2014 low at 0.8658.

Res: 0.8618; 0.8660;0.8700; 0.8720

Sup: 0.8564; 0.8539; 0.8500; 0.8460

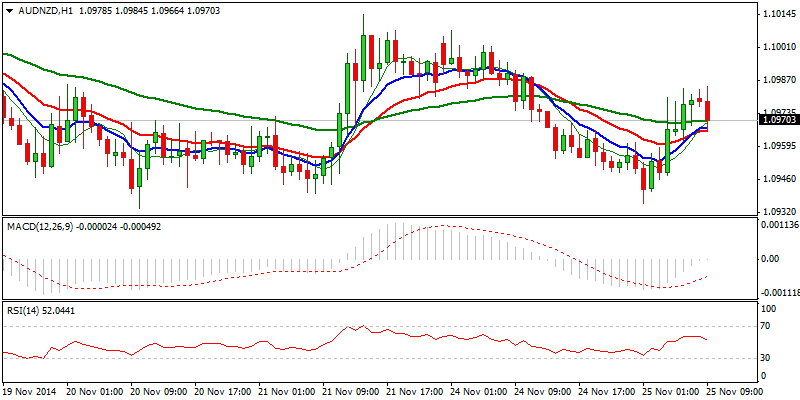

AUD/NZD

The pair trades in near-term consolidative mode, after extension of the downmove from 1.13 top, found support at 1.0931, ticks away from key 1.0914, low of 22 Sep and 1.0910, 200SMA. Consolidative action above 1.0931 low, stays for now capped 1.10 barrier, which signals limited consolidation before eventual attack at key supports. The notion is supported by yesterday’s long red candle and overall bearish structure.

Res: 1.0985; 1.1020; 1.1056; 1.1080

Sup: 1.0940; 1.0931; 1.0914; 1.0910

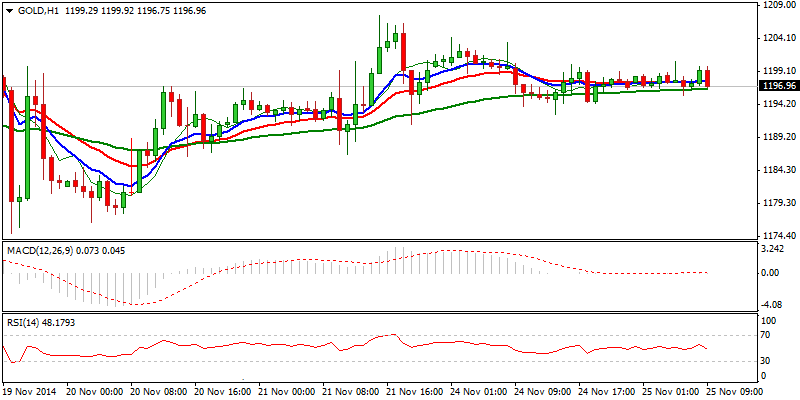

XAU/USD

Spot Gold consolidates just under 1200 barrier, following several unsuccessful attempts higher, which keep 1207 and 1207 barriers intact for now. Hourly studies are flat, with 4-hour indicators heading lower, which may trigger corrective action, signaled by yesterday’s bearish Inside Day. Break below initial 1192 support, to confirm pullback, which may extend to 1175 base, before fresh attempt higher. Conversely, sustained break above 1200 hurdle and 1207 high, reinforced by daily 55SMA, to signal bullish resumption.

Res: 1200; 1204; 1207; 1214

Sup: 1192; 1186; 1179; 1175

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

AUD/NZD Trading In Near-Term Consolidative Mode

Published 11/25/2014, 04:18 AM

Updated 02/21/2017, 08:25 AM

AUD/NZD Trading In Near-Term Consolidative Mode

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.