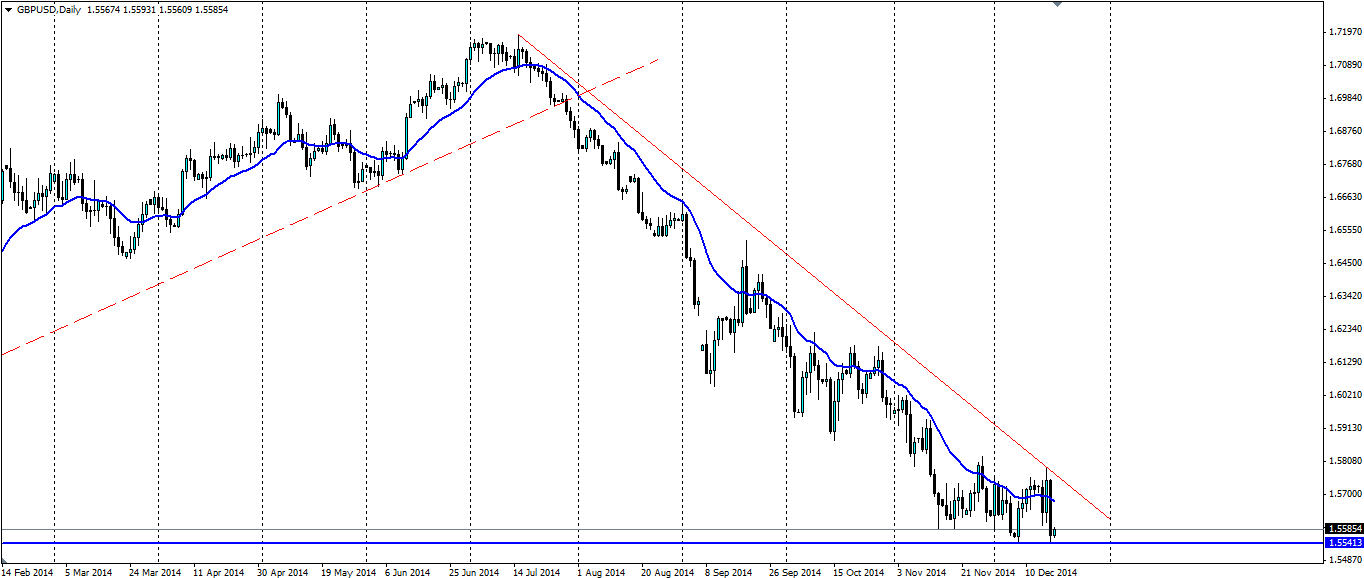

Pound Could Push Lower

The Pound had a rough ride last night and it briefly touched the support at the recent one year low. With little to get excited about in the UK, we could see a push through the support to fresh 15 month lows.

Source: Blackwell Trader

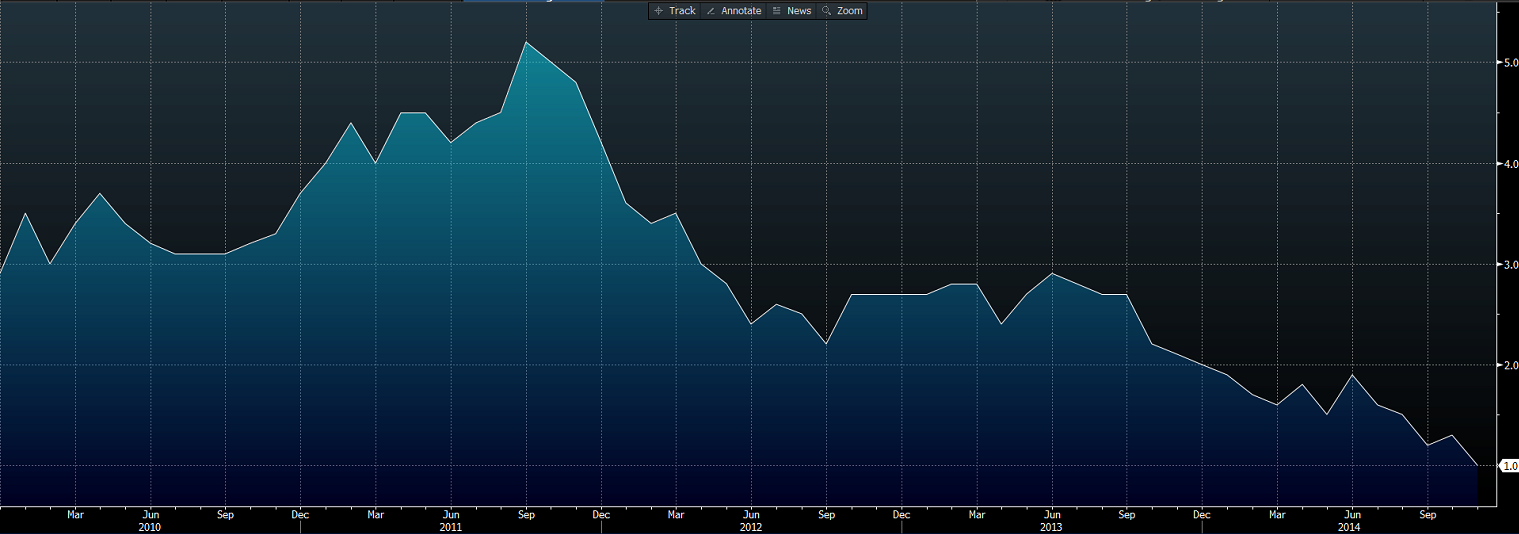

Earlier this week we saw UK inflation fall from 1.3% to 1.0%. This was a disappointment to the market, but not a real shock as inflation has been falling steadily throughout the year. This could eventually be reflected in the voting of the Monetary Policy Committee members. The latest voting put 7 at neutral and 2 in favour of a rate rise (no change from a month ago). Certainly the BoE will not consider raising interest rates when inflation is at its lowest in over 10 years.

UK 5 year Inflation

Source: Bloomberg

Yesterday saw the unemployment rate remain at 6.0% versus an expected fall to 5.9%. Again a disappointment for the market and the Fed coming across a little more hawkish than usual helped to push the pound down over 200 pips against the dollar. The differential in the two economies is likely to drive further lows in this pair.

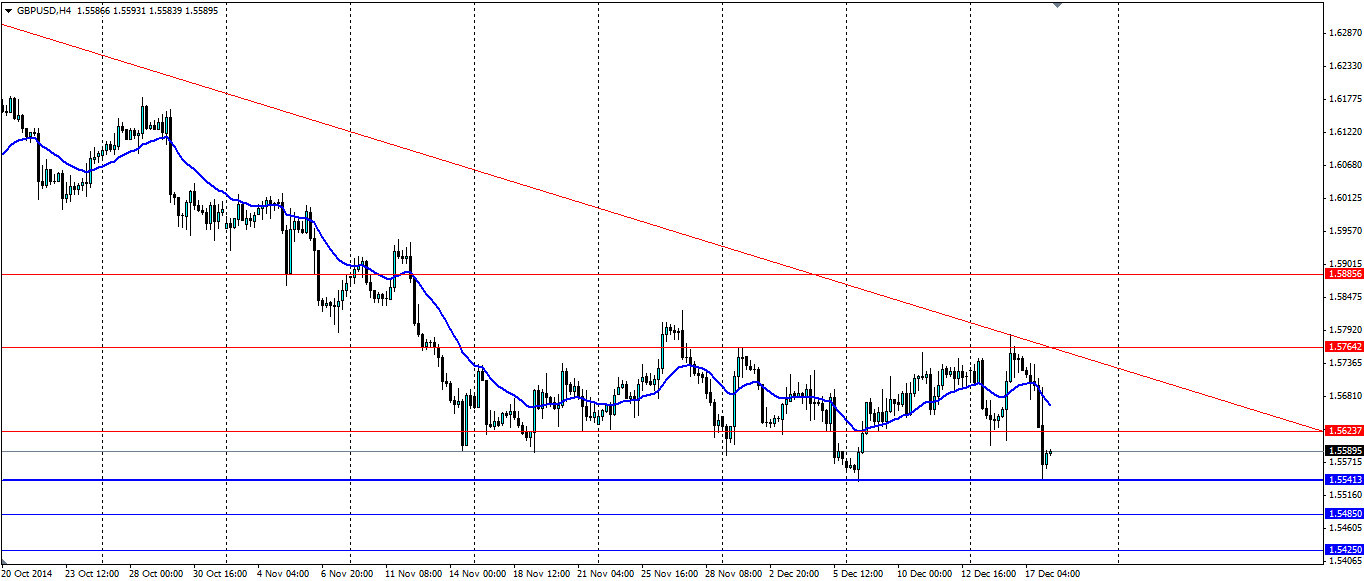

It now sits just above the low at 1.5541 and will likely give it another test, especially with UK retail sales later on today. Core retail sales have been a mixed bag recently and the market expects a drop this month from 0.8% to 0.4%.

If the results come in worse than expected we could see a breakout lower of the support. If this happens, look for the price to target 1.5485 and 1.5425 as support levels. Traders could look to take advantage of the momentum of a breakout with a stop entry under the current support.

If we see a resumption of the ranging patter, look for 1.5623, 1.5764 and the bearish trend to act as resistance. A rejection off the trend line could provide a short for traders to take.

Source: Blackwell Trader

The UK economy is not looking as rosy as it once did and the US is picking up pace, driving the GBPUSD pair lower. A breakout of the current range lower could provide traders an opportunity for a short on the pair.