The Aussie/Kiwi cross is a bit of an exotic pair to many investors, but for the traders out there, it’s one to watch in the commodity currency pairings. Recently there has been a lot of talk about the Australian dollar finally pushing back up the charts against the kiwi dollar and reclaiming some ground back into the 1.10-1.20 level; where historically it has generally been.

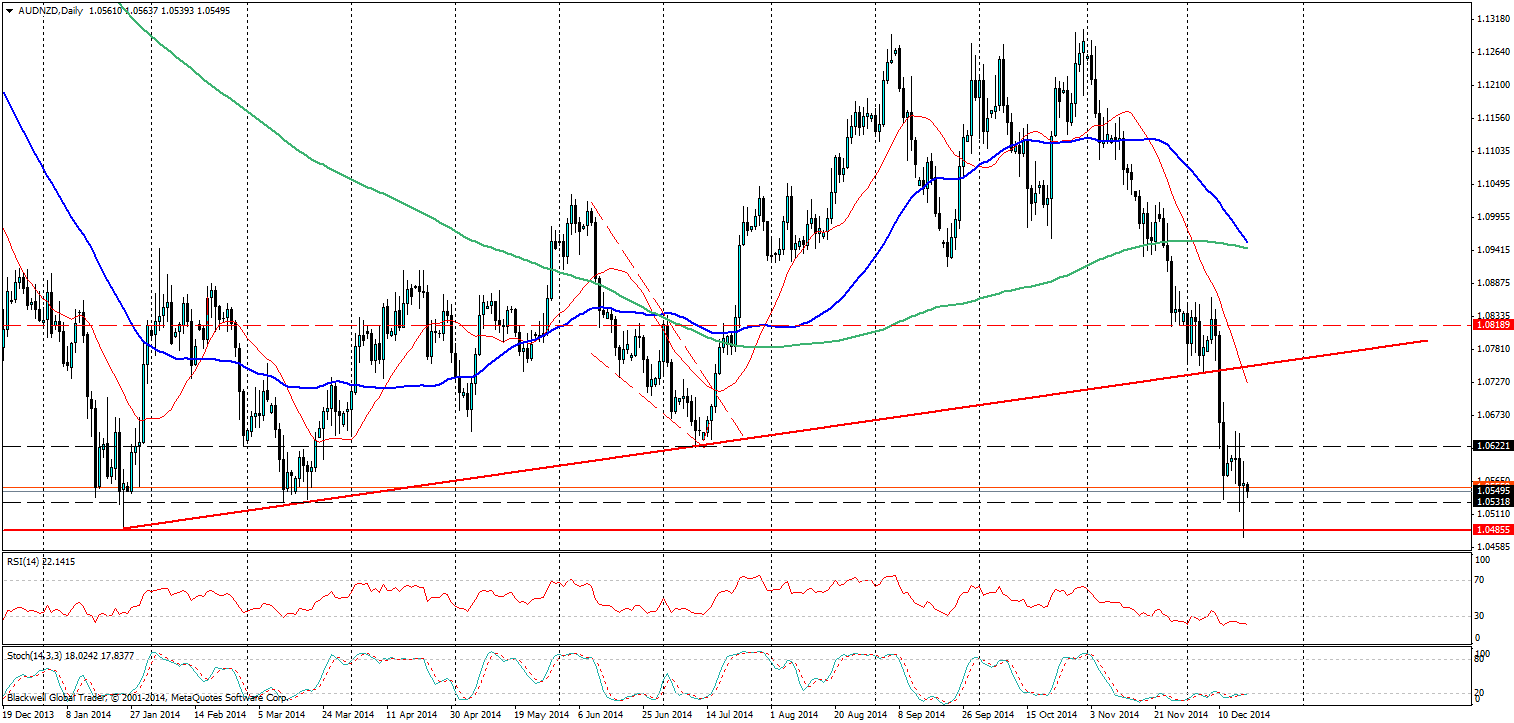

Source: Blackwell Trader (AUD/NZD, D1)

So if you’ve been watching today we saw a quick touch through the 1.048 level followed by a sharp pullback on the charts. This key level has always held and the pressure today was heavy due to New Zealand GDP data which came in at 1.0% q/q (exp 0.7%). This is a slight surprise for the market, but the RBNZ had mentioned that domestic demand was still very much strong going forward and expected the NZ economy to be staunch in the face of a global slowdown. Australia on the other hand keeps finding more and more disappointments with a large budget blow out affecting its fiscal outlook and weak economic data not doing it any favours.

So how strong is the 1.048 level?

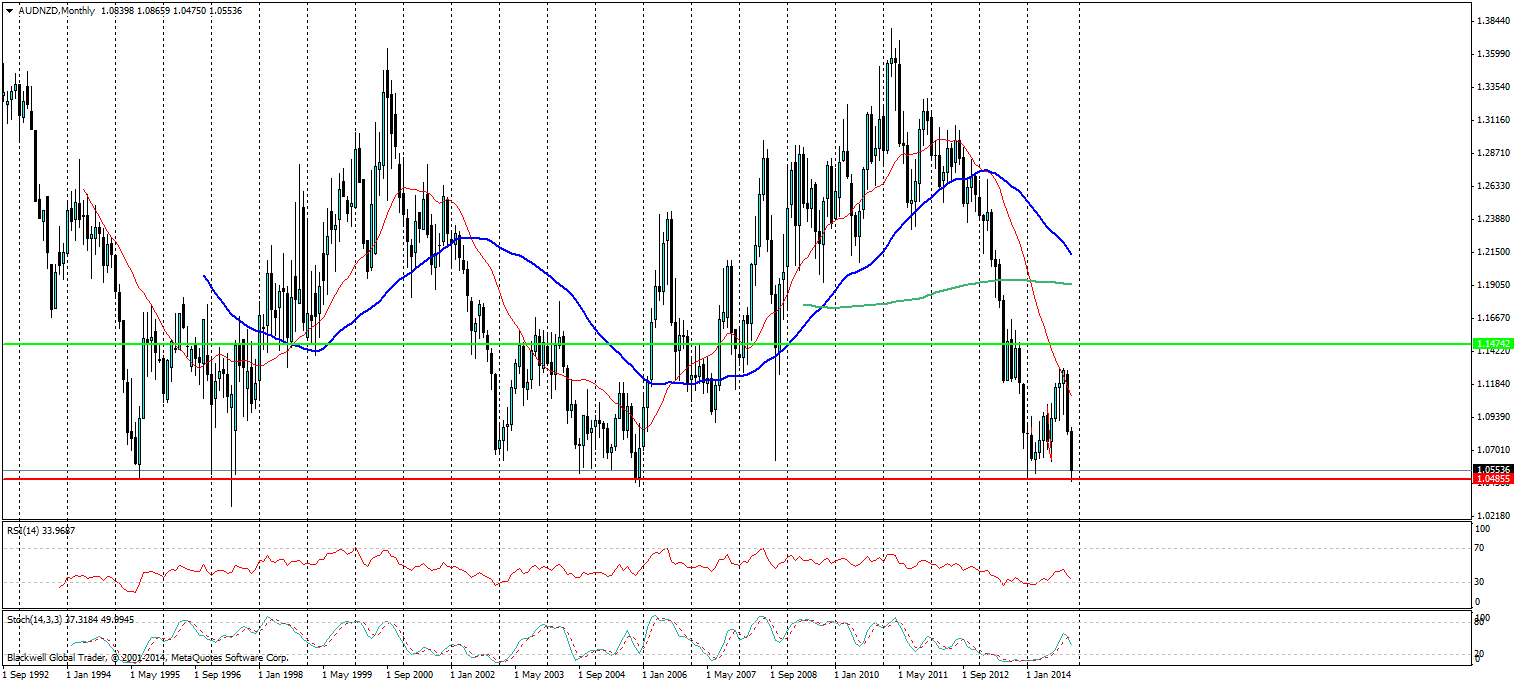

The level is actually very strong and no long term trade has managed to hold under it for a month, in fact, we have seen sharp pullbacks from this level on a number of occasions in the range of a few thousand pips. The market may well be looking at this level and seeing if it’s possible to push it further, but I feel that it may be slightly overextended and it does seem silly to have a major economy (Australia) at parity with the likes of the NZD (which is a smaller economy).

So long term I feel yes this is going to pull back and I would look for a little more bullish momentum, as I feel that markets will rush back into this one when given half a chance. The Australian economy is struggling at the moment, but its weakness against the US Dollar Index will help revive it in the face of falling commodity prices and we may just see some big rises on the AUD/NZD in the long run.