AUD/NZD 1" title="AUD/NZD 1" height="242" width="474">

AUD/NZD 1" title="AUD/NZD 1" height="242" width="474">

The AUDNZD is looking a little more resilient after clawing back its recent losses against the Kiwi dollar over the weekend. With a strong Monday opening, it seems as if some new life has certainly been found for the Aussie dollar and why not! With business confidence due out, it is likely we will see more action or at least a little more life in the Aussie dollar, which as of late has been heavily crushed.

However, the million (or billion) dollar question is, what’s the next move for the AUDNZD pair? I’m not going to say I know the actual direction of the pair, but what I can say is that Wednesday is a big day for the pair and we could see some serious movements.

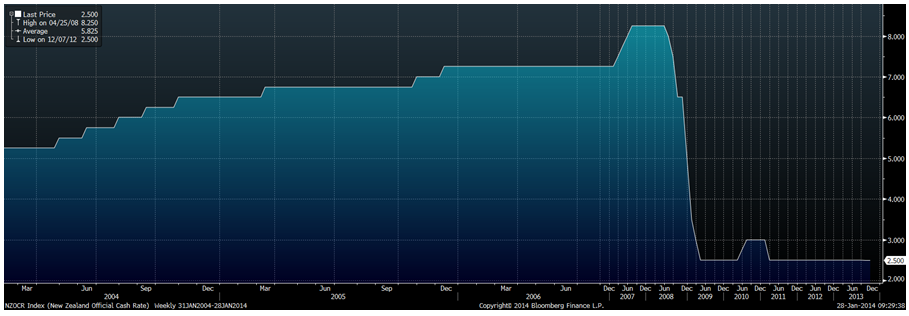

The Interest rate decision for the NZD is one of the most heavily watched at the moment, as the Reserve Bank of New Zealand (RBNZ) is set to raise rates, it's not a question of how much, but more a question of when, as the most likely move will be conservative at best to test the waters after holding out for some time.

AUD/NZD 2" title="AUD/NZD 2" height="242" width="474">

AUD/NZD 2" title="AUD/NZD 2" height="242" width="474">

With a possible rate increase of 0.25% points, it would make it the first developed economy to start raising rates after the Global Financial Crisis (GFC). It would also lead to a jump for the NZD as overseas investors looked to take action on the booming economy, especially when it comes to fixed interest rate investing.

When is a rate increase likely to happen?Well, some are saying the RBNZ needs to act now rather than later, as the economy is gaining momentum. The ANZ is tipping that a rate hike could be as soon as tomorrow. While many still point to March, but with the recent aggressive data that has been released, a rate rise before March certainly seems on the card, and Feburary is a strong case for a rate hike.

Even if there is no rate hike, I would imagine that the RBNZ would certainly talk up the Kiwi’s performance, however, it may also take a pot shot at the AUDNZD after recent comments from Bill English today showed that the government is taking notice of the exchange rate in its current state.

Whatever the decision, it looks certain the RBNZ will have to take action sooner rather than later, and a boost for the NZD is likely with a rate cut, I certainly am bearish for the AUDNZD pair until that trend line is breached. Current support levels are at 1.0546, 1.0572 and 1.0491 and are likely to be tested in the coming 24 hours. It’s likely that the trend line in place will act as dynamic resistance and should be used as such especially when it concerns stop losses.

Overall, the next 24 hours will certainly be exciting for the NZD and especially the AUDNZD pair which hit a 35 year low only a few days ago. I will be watching to see the effects the rate decision has, and if the expected jump lower does indeed happen.