Heading into Aussie GDP, AUD/NZD is precariously poised at resistance.

The pair is very choppy and whipsawing price action is quite normal on these sorts of lower liquidity currency crosses, but most of all I just love that the big fundamental announcements seem to coincide with major technical levels like this.

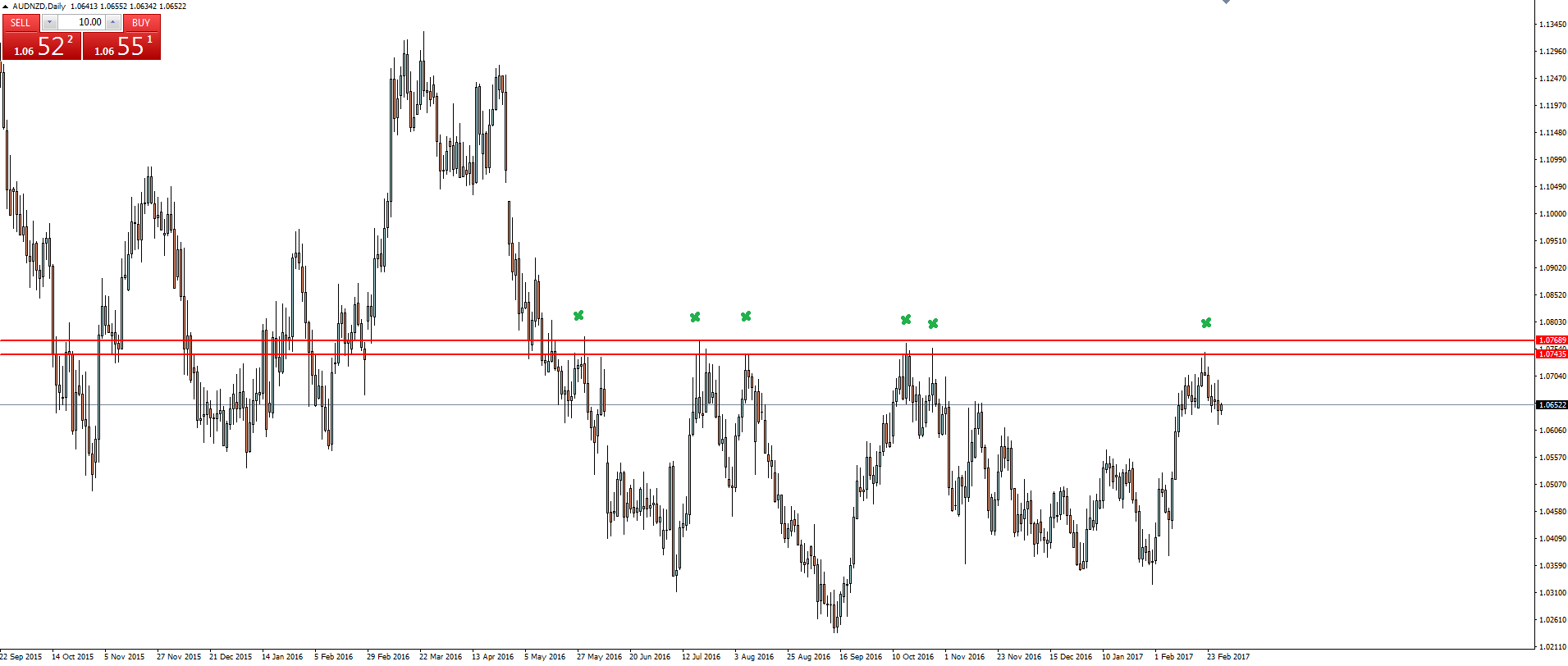

AUD/NZD Daily:

The daily chart shows an obvious higher time frame resistance level and as mentioned above, price action up into this zone looks very choppy. You can see the way that price has spiked in and out of the 25 pip zone that I’ve drawn.

Although the swift rejections out of a zone like this prove that the sellers are there and in charge at the moment, it also leaves you open to getting stopped out if you don’t leave yourself enough room. Especially so close to a big announcement like GDP.

This is just a characteristic of trading a currency cross that you have to get used to and adjust your trading style around if it’s something you’re not normally familiar with.

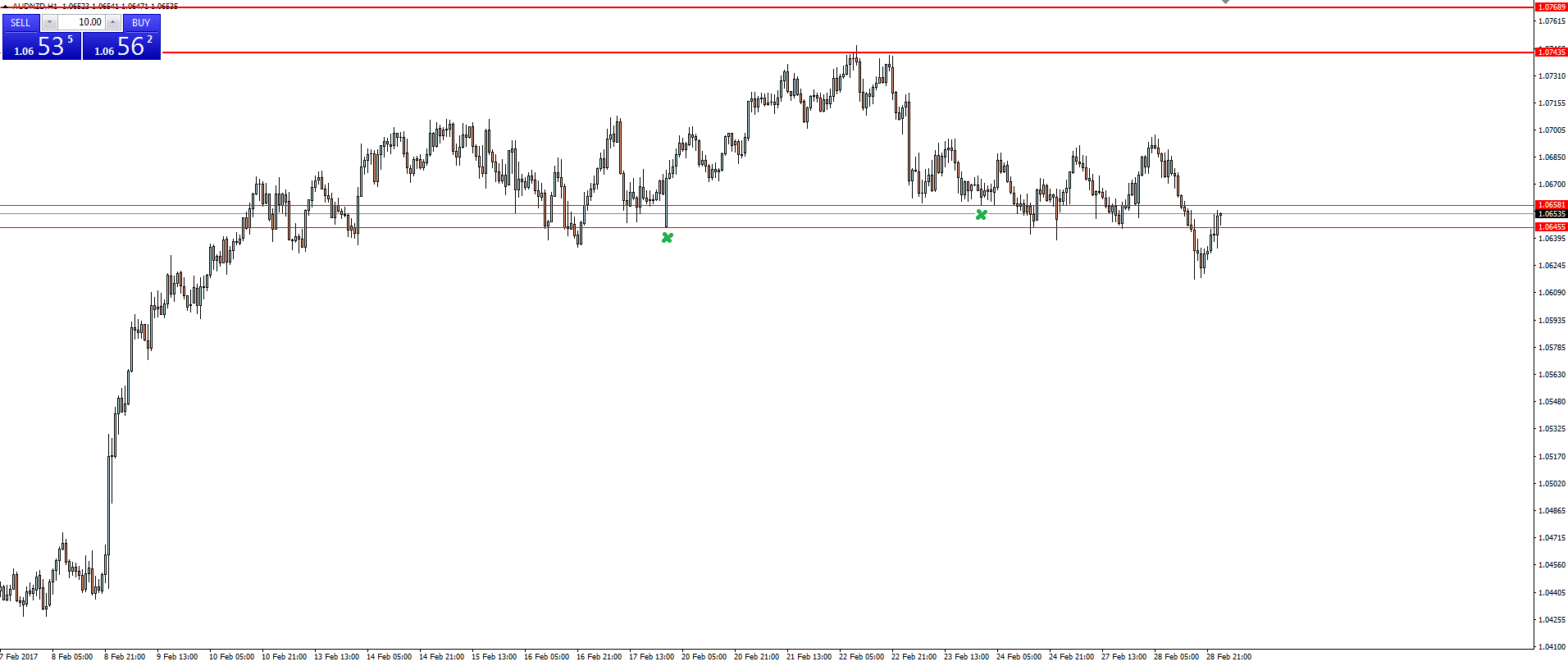

AUD/NZD Hourly:

Now that the higher time frame resistance zone looks like having held, we zoom into an hourly and we can start to see price printing that familiar stepping down pattern.

We will look for previous support to become resistance and this marked zone on the hourly looks like a good place to start if you’re happy taking on board the pre-news risk and playing for the repricing if expectations aren’t met.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by MT4 forex broker, Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.